-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

At Grant Thornton we use a single audit methodology (LEAP) across our global network. This means that our clients get a consistent, high-quality approach wherever they are.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Reporting Accountants

Reporting Accountants

-

Our local experts

Our local experts

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business consulting

Our business consulting services help organisations improve operational performance and productivity throughout the growth life cycle.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Forensic and investigation

We take a 360-degree view of your situation using our deep experience, industry specialization and global reach to help you get to the core of the issue with a full service portfolio of capabilities.

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your potential for growth, allowing you to be at your best every day. And when you are at your best, we are the best at serving our clients

-

In the community

Many Grant Thornton member firms provide a range of inspirational and generous services to the communities they serve.

-

Internship

Internship

A recent research from the Grant Thornton International Business Report (IBR) reveals that business optimism in Malaysia fell to net -36% in Q4 2016, the lowest quarterly figure since 2010.

KUALA LUMPUR, 9 January 2017 – A recent research from the Grant Thornton International Business Report (IBR) reveals that business optimism in Malaysia fell to net -36% in Q4 2016, the lowest quarterly figure since 2010. This is a decrease of 24pp from -12% in Q3 2016 and this puts Malaysia’s business optimism level as the lowest in the ASEAN region at the end of Q4 2016.

The findings, from Grant Thornton’s most recent quarterly global survey of 2,600 businesses in 37 economies, reveal that business optimism among ASEAN economies has fallen 10pp in Q4 2016 to net 39%.

Indonesia has fallen 10pp from 98% in Q3 2016 to 88% in Q4 2016. Philippines has fallen 4pp from 84% in Q3 2016 to 80% in Q4 2016. Thailand has fallen 2pp from 18% in Q3 2016 to 16% in Q4 2016 and Singapore remains at -28% in Q3 and Q4 of 2016.

Globally, business optimism at the end of Q4 2016 stands at net 38%. This is an increase of 5pp from Q3 and the highest level since Q3 2015.

Dato’ NK Jasani, Country Managing Partner at Grant Thornton Malaysia commented:

“Globally, the increase in optimism reflects a view among the business community that uncertainty over the outcome of major events like the EU referendum and the US presidential election is now behind them. Knowing the results will allow businesses to have a clearer steer on key issues such as taxes, jobs and trade policy.

“In Malaysia however, business optimism level suffered a huge decline due to our weak Ringgit performance and this links to our country’s economic uncertainty.

“Exchange-rate fluctuations topped the list as Malaysia’s biggest constraint to business expansion, with 76% of business executives highlighting this as a challenge. This is an increase of 34pp from 42% in Q3 2016 and is the highest in the ASEAN region.

“Meanwhile, business executives highlighted economic uncertainty as the second-biggest constraint to business growth and expansion in Malaysia, with 60% from 46% in Q3 2016 highlighting this challenge as hindering growth opportunities for business. This is also the highest in ASEAN region.

“Lack of skilled workers is the third-biggest challenge facing business expansion in Malaysia, with 36% from 24% in Q3 2016 of business executives concerned about this matter.”

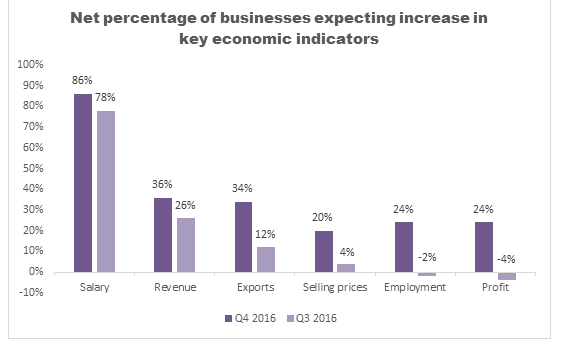

Positive economic indicators in Malaysia

Findings from Grant Thornton’s IBR do reveal a glimmer of hope as the outlook on key indicators in Malaysia is strong heading into 2017. According to the survey, despite low optimism outlook for the year ahead, businesses are planning an increase in employee salary, revenue, exports, selling prices, employment and also profit to gear up over the next 12 months.

Malaysia has the most proportion of businesses in the ASEAN region that are expecting to offer employees a pay rise in next 12 months. 86% of businesses are expecting to offer salary increment for their employees for the year ahead.

Malaysia also has the most proportion of businesses in the ASEAN region at 34% that are expecting an increase in exports for the year ahead. This is an increase of 22pp from Q3 2016.

The findings also reveal that businesses in Malaysia are also expecting revenue to increase for the year ahead. The proportion of businesses expecting an increase in revenue has gone up to 36% from 26% in Q3 2016.

Selling prices and profitability are also expected to increase over the next 12 months. The proportion of businesses expecting an increase in selling prices has gone up to 20% from 4% in Q3 2016. More businesses are expecting an increase in profit, from -4% in Q3 2016 to 24%.

Besides that, businesses are planning to increase hiring over the next 12 months. 24% of businesses have expressed that they will be hiring as compared to -2% of businesses in Q3 2016.

Dato NK Jasani added:

“There is a striking split in the direction of travel between business leaders in emerging and developed Asia Pacific countries. Part of the reason for this could be the likely scrapping of the Trans-Pacific Partnership (TPP), out of which developed economies – like those of Australia and New Zealand – stood to gain the most. However, China is looking to implement its own regional economic partnership, which could fill some of that gap. The high levels of optimism in emerging economies reflect what can happen when closer economic ties are in place, with the ASEAN Economic Community agreed in 2015.

“There will be challenges in 2017, including the impact of further rate rises from the US Federal Reserve. But these shouldn’t mean that growth plans across Asia Pacific should be abandoned. They may be focused on investing for greater efficiency, hiring new skilled workers, or researching new markets and services. Dynamic firms with the ability to think long-term and pay attention to their operations will be the big winners.”

In concluding, Dato’ Jasani said that the relevant Malaysian Ministries like for Finance and Trade as well as authorities like MIDA, Inland Revenue, and Customs should be dynamic in helping Malaysian businesses grow and prosper. This will create much needed employment and additional tax revenue.

Eliminating red flag and promoting efficiency should be the aim in order to have a holistic environment that would stimulate business growth.

In this context therefore no new taxes, foreign workers’ levies or new form filling requirements should be introduced for the next one year. As a nation, we must be pro-business and pro-growth.

-end-

For more information please contact:

Sharon Sung

Partner, Technical & Corporate Affairs

Grant Thornton Malaysia

T +603 2692 4022

F +603 2732 1010