Both of the e-Invoice Guidelines (e-Invoice Guideline Version 4.5 and e-Invoice Specific Guideline Version 4.3) were updated in relation to the e-Invoice Specific Frequently Asked Questions (FAQs) for Donations or Contributions released by the Inland Revenue Board of Malaysia (IRBM) on 7 July 2025. The updated e-Invoice General Frequently Asked Questions (FAQs) was released on 9 July 2025.

A. The salient points of the FAQs for Donations or Contributions (7 July 2025)

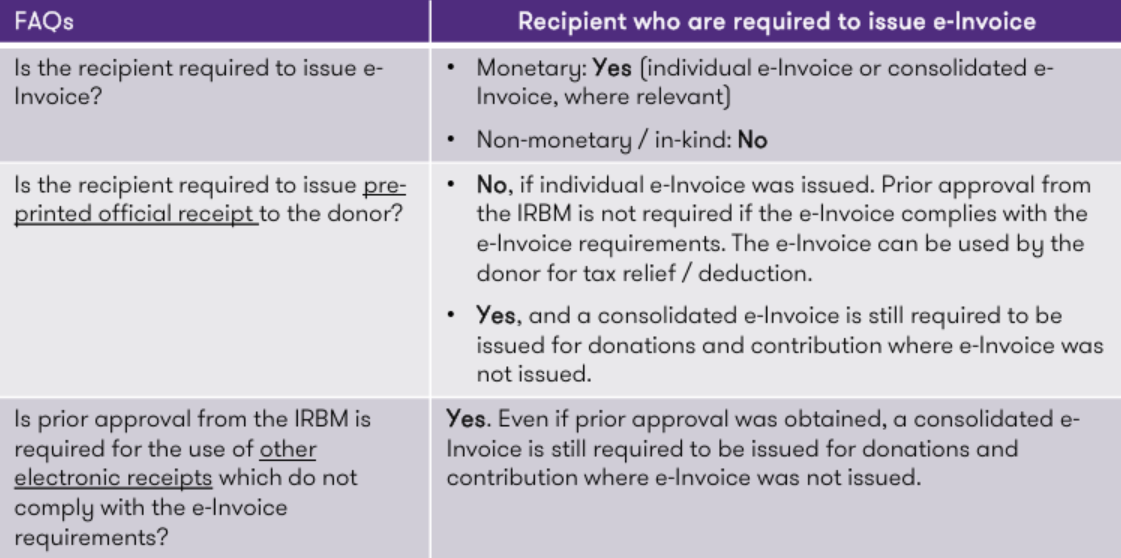

- Recipient of donations or contributions is required to issue individual e-Invoices or consolidated e-Invoices (where relevant) except for (a) and (b) below:

- a) Religious institutions or organisations established exclusively for the purpose of religious worship or the advancement of religion (RIOs).

- b) Any person (excluding (a) above) receiving donations or contributions that are not tax-exempt under the Income Tax Act 1967 [ITA].

However, if the RIOs under (a) are:

-

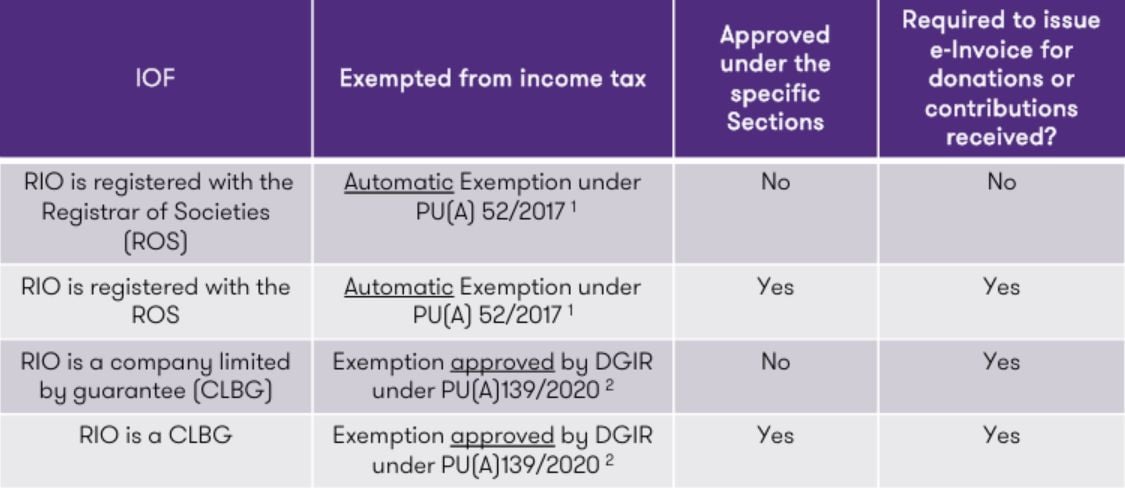

- i. Institutions, organisations or funds (IOFs) approved under the ITA [including approvals under Sections 44(6), 44(6B), 44(11B), 44(11C) and 44(11D) hereinafter referred to as “the specific Sections”].

- ii. Managing a charity or community project approved under paragraph 34(6)(h) of the ITA pertaining to education, health, housing, conservation or preservation of environment, enhancement of income of the poor, infrastructure, information and communication technology or maintenance of a building designated as a heritage site by the Commissioner of Heritage under the National Heritage Act 2005.

The exception would not be applicable to the said RIOs (i.e. the said RIOs are on the donations or contributions received). required to issue e-Invoices

Please note that the exemption will be reviewed and updated from time to time.

- IOFs approved under ITA (including approvals under the specific Sections) are summarized below:

- The obligations and e-Invoice requirements for donations or contributions received are as follows:

- Donors are not required to issue self-billed e-Invoices for donations or contributions made to charitable organisations which are not approved for tax exemption under the ITA.

- All persons including (a) and (b) are still required to:

- Issue e-Invoice for sale of goods and services .

- Issue self-billed e-Invoice for transactions where self-billed e-Invoice is required (e.g. imported goods and imported services)

- Provide their information to suppliers (including those who are engaged in activities where consolidated e-Invoice is not allowed) to allow the suppliers to comply with e-Invoice requirements.

- Business Registration Number (BRN) used for Tax Identification Number (TIN) registration and eInvoice purposes

- 1) Registered bodies may use the registration number obtained from ROS, Companies Commission of Malaysia (SSM), Legal Affairs Division of Prime Minister’s Department (BHEUU) or other recognized body in Malaysia.

- 2) Non-registered bodies should use the stamp certificate number (not the adjudication number) of the governing document (e.g. constitution, charter, etc.) stamped with the IRBM.

B. The salient clarifications to the e-Invoice General FAQs (updated 9 July 2025)

-

- The general TIN “EI00000000040” and BRN “NA” can be used for the issuance of e-Invoice / self-billed e-Invoice to government, state government, state authority, government entity, local authority, statutory authority and statutory body.

- The definition of “related company” for e-Invoice purposes has the meaning assigned to it in Section 2 of the Promotion of Investments Act 1986.

Tax Alert publication

Updated e-Invoice Guidelines, General FAQs and Specific FAQs for Donations or Contributions: 7 and 9 July 2025

We would like to highlight that the e-Invoice Guidelines, General FAQs, FAQs for Donations or Contributions and the said Income Tax (Exemption) Orders may be subject to changes. For further details, please click on the links above or please contact your respective Grant Thornton tax adviser should you require further guidance.