-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

At Grant Thornton we use a single audit methodology (LEAP) across our global network. This means that our clients get a consistent, high-quality approach wherever they are.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Our local experts

Our local experts

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business consulting

Our business consulting services help organisations improve operational performance and productivity throughout the growth life cycle.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Forensic and investigation

We take a 360-degree view of your situation using our deep experience, industry specialization and global reach to help you get to the core of the issue with a full service portfolio of capabilities.

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your potential for growth, allowing you to be at your best every day. And when you are at your best, we are the best at serving our clients

-

In the community

Many Grant Thornton member firms provide a range of inspirational and generous services to the communities they serve.

-

Internship

Internship

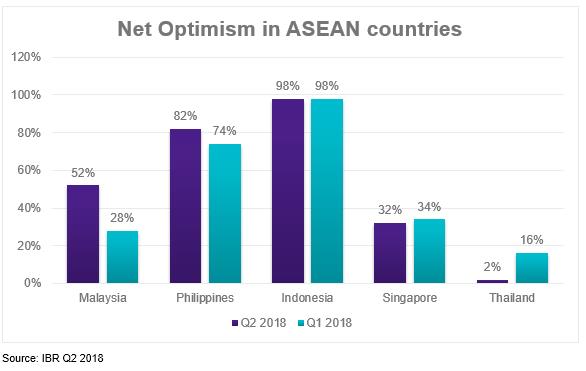

Grant Thornton International Business Report (IBR) reveals that the business optimism in Malaysia has leapt 24pp to net 52% at the end of Q2 2018, as compared to 28% in Q1. This near doubling in business optimism is the highest recorded among ASEAN countries.

KUALA LUMPUR, 19 July 2018 - Grant Thornton International Business Report (IBR) reveals that the business optimism in Malaysia has leapt 24pp to net 52% at the end of Q2 2018, as compared to 28% in Q1. This near doubling in business optimism is the highest recorded among ASEAN countries.

Business owners are confident about their business performances over the next year, with many having positive outlooks for revenue, employment and also investments. A net 56% of businesses are expecting an increase in revenue over the next 12 months, an increase of 22pp from Q1.

The report finds that a net 26% of businesses owners are expecting to hire more employees, an increase of 12pp from Q1.

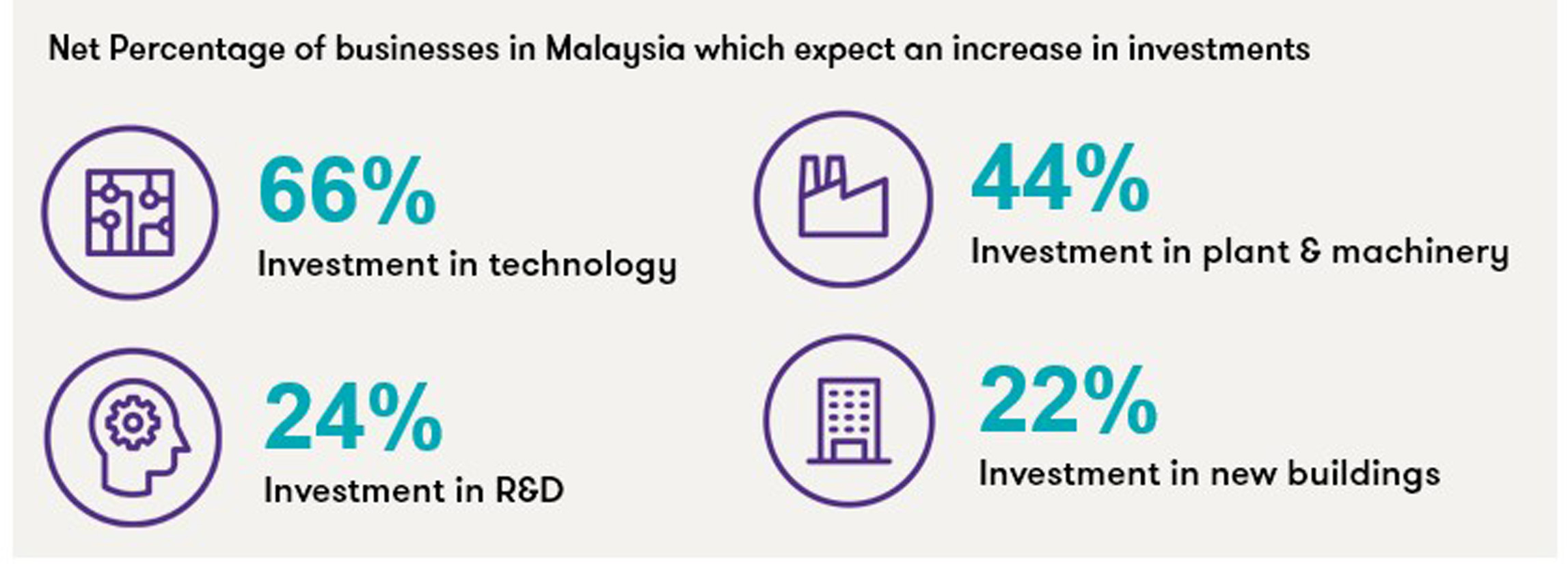

Businesses owners have also expressed that they are expecting to increase their level of investments. 66% of businesses, the highest in number ASEAN are expecting to increase their investment in technology, up 16pp from Q1. Besides that, businesses are planning to invest in plant & machinery, 44% up 16pp from Q1, followed by investment in increase research and development, 24%, up 10pp from Q1 and also investment in new buildings, 22%, up 14pp from Q1.

The IBR reveals that there are lesser business owners who have cited the economic uncertainty as a constraint to their business growth, a decrease from 44% in Q1 to 32% in Q2.

The IBR finds that in Malaysia behind the confidence there is a growing concern on the lack of skilled workers, energy costs and exchange rate fluctuations.

Access to skilled workers is seen as the biggest constraint to growth by Malaysian businesses at 46%. This is an increase of 14pp from Q1, making it the highest number in ASEAN. Concerns have increased for exchange rate fluctuations, driven by the prospect of further US Federal Reserve rate rises this year. The proportion of Malaysian business leaders citing exchange rate fluctuations as a constraint on their ability to grow sits at 48%. This is an increase from 30% in Q1.

The IBR data reveals that despite the overall increase in ASEAN business optimism, in Singapore it decreased slightly from net 34% to net 32% and in Thailand from net 16% to net 2%. Furthermore, exchanges rates are not the only potential drag on confidence. Expectations for increased employment across the region have fallen from net 37% to net 31% – the lowest since the end of 2016.

Dato’ NK Jasani added:

“It’s unfortunate that exchange rate concerns have recently emerged. With many businesses across ASEAN still borrowing in US dollars, fears over rate rises could easily blow business confidence off course. US interest rates have gone up once this year and more increases look likely.

“For the Emerging economies, including ASEAN, it is not an easy situation for businesses. However, action can be taken to reduce the risks associated with a reliance on US dollars. One option is to hedge and lock in a more predictable exchange rate for a period of time.

In concluding Dato’ Jasani said, the survey shows that business confidence when comparing Q1 to Q2 of 2018 has significantly increased in Malaysia mainly due to the election of the new Pakatan Harapan government. The new emphasis on accountability and transparency has contributed to the new found business confidence. Dato’ Jasani added that the Government should now emphasize on business transparency and have business-friendly Budget to continue this positive momentum.

-end-

Further enquiries, please contact:

Charmane Koh

Senior Manager, Corporate Affairs

T +603 2692 4022