The Budget reaffirms the three pillars of Ekonomi MADANI - Raising the Ceiling of National Growth, Raising the Floor of Living Standards, and Driving Reform and Good Governance.

Amid global uncertainties and growing competition, Budget 2026 has remained focused on advancing Malaysia’s long-term economic reform agenda, while also addressing near-term challenges to sustain growth and safeguard economic resilience. At the same time, it has prioritised the well-being of the rakyat through targeted, outcome-driven measures aimed at improving the overall quality of life.

This Budget Adviser outlines numerous updates on the various existing tax measures, as well as new tax initiatives as announced in Budget 2026.

Individual Tax

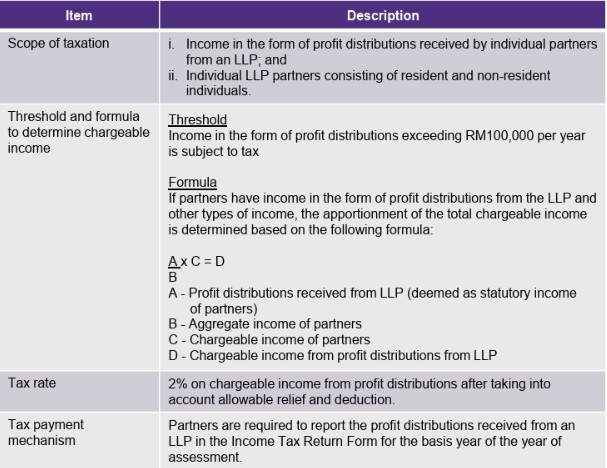

INCOME TAX ON PROFIT DISTRIBUTIONS RECEIVED BY PARTNERS IN A LIMITED LIABILITY PARTNERSHIP

Currently, the income tax treatment for Limited Liability Partnerships (LLP) are as follows:

i. Income received by an LLP is taxed at the corporate tax rate at 15%, 17% and 24%; and

ii. Profit distributions received by partners from an LLP are exempt from tax under Paragraph 12C, Schedule 6, Income Tax Act 1967.

Partners receiving income other than profit distributions from an LLP such as employment income are subject to individual income tax based on progressive rates.

To enhance the individual income tax structure to be more progressive and broaden the tax base, it is proposed that profit distributions received by partners from an LLP be taxed as follows:

Effective date : From year of assessment 2026

Corporate Tax

1. TAX DEDUCTION ON RENOVATION AND REFURBISHMENT FOR TOURISM PROJECTS

Currently, renovation and refurbishment expenses incurred for business premises are not allowable for tax deductions under Section 33(1) of the Income Tax Act 1967.

To encourage tourism project operators to upgrade and refurbish their business premises in order to enhance the quality of domestic tourism products in line with Visit Malaysia Year 2026, it is proposed that tourism project operators registered with the Ministry of Tourism, Arts and Culture (MOTAC) undertaking renovation and refurbishment works for business purposes be allowed a tax deduction on qualifying expenditure incurred, up to a maximum of RM500,000.

Effective date : For qualifying expenditure incurred from 11 October 2025 to 31 December 2027.

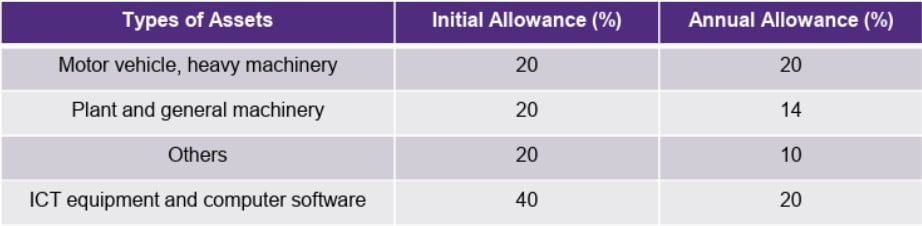

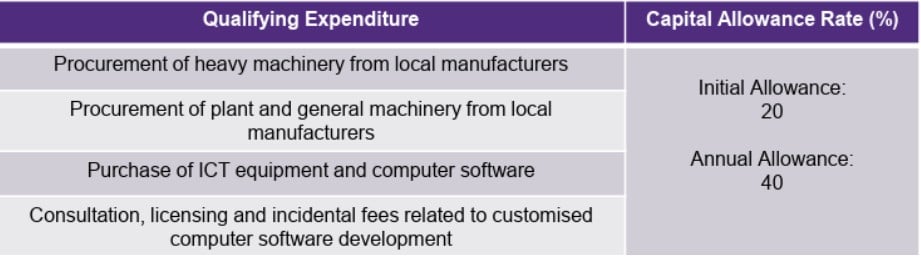

2. ACCELERATED CAPITAL ALLOWANCE FOR PLANT, MACHINERY AND ICT EQUIPMENT

Currently, companies are allowed to claim capital allowance on qualifying capital expenditure incurred for business purposes under Schedule 3 of the Income Tax Act 1967 as follows:

To further promote domestic direct investment and accelerate the adoption of digital technology among businesses, it is proposed that qualifying capital expenditure be given Accelerated Capital Allowance (ACA) which can be fully claimed by companies within 2 years as follows:

Effective date : For qualifying capital expenditure incurred from 11 October 2025 to 31 December 2026

3. TAX TREATMENT FOR PUBLIC UNIVERSITY TEACHING HOSPITALS ENDOWMENT FUNDS

Currently, endowment funds established by public universities are eligible for tax treatment under Section 44(11D) Income Tax Act (ITA) 1967. The eligible public universities are as follows:

i. Public universities established under the Universities and University Colleges Act 1971; and

ii. Universiti Teknologi MARA established under the Universiti Teknologi MARA Act 1976.

The establishment of public university endowment funds is subject to the following conditions:

i. contributions must be in the form of cash;

ii. the total contribution sum shall be preserved; and

iii. only the income or returns generated from the fund can be expended in line with the fund’s objectives.

The tax treatment accorded to endowment funds is as follows:

i. donors are eligible for tax deduction equivalent to the amount of the contribution, subject to a maximum of 10% of aggregate income; and

ii. contributions received including the income generated from the endowment fund are exempt from income tax.

To ensure the financial sustainability of public university teaching hospitals in providing quality healthcare services, it is proposed that such public university teaching hospitals be allowed to establish endowment funds in which the cash contributions made to these funds to be given tax deduction under Section 44(11D) ITA 1967, provided that the endowment funds are governed and managed solely by the public university teaching hospitals, in line with the prescribed guidelines.

Effective date : From year of assessment 2026

4. ACCELERATED CAPITAL ALLOWANCE ON SPEED LIMITATION DEVICES FOR HEAVY VEHICLES

The Government has announced the compulsory use of Speed Limitation Devices (SLD) on commercial vehicles as part of efforts to enhance road safety and reduce the risk of fatalities involving heavy vehicles.

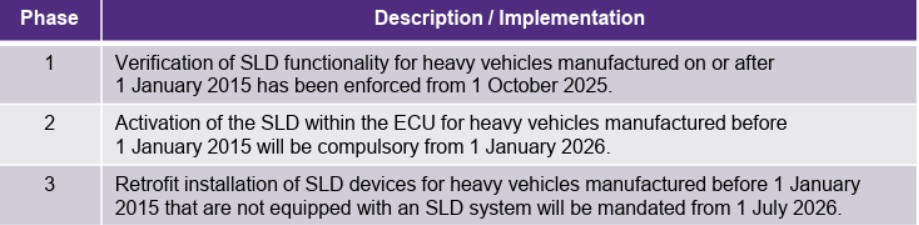

The enforcement of SLD installation on heavy vehicles will be implemented in phases as follows:

The purchase of SLD devices qualifies for capital allowance under Schedule 3 of the Income Tax Act 1967, classified under the “Other Assets” category, with an Initial Allowance of 20% and an Annual Allowance of 10%.

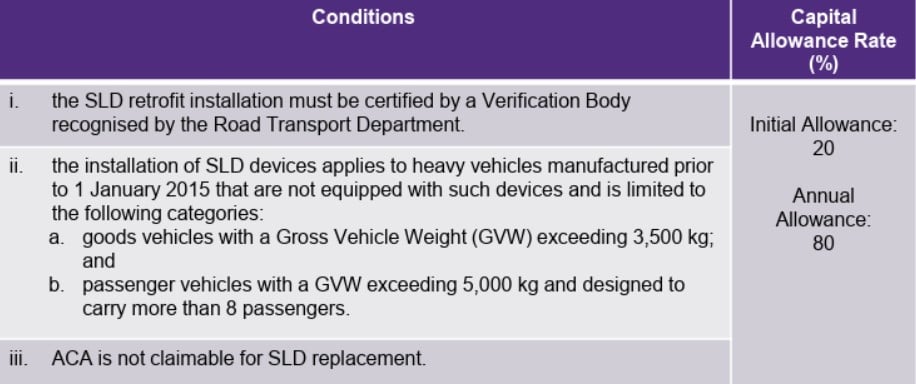

To support efforts in reducing road accidents through the installation of SLD devices on heavy vehicles, it is proposed that Accelerated Capital Allowance (ACA) be given on expenditure for the purchase of SLD devices, up to RM4,000 per unit, subject to the following conditions:

Effective date : This ACA applies to SLD installations carried out from 1 January 2026 to 31 December 2026

Tax Incentive

1. TAX INCENTIVES FOR TOUR OPERATORS

From year of assessment 2007 to year of assessment 2020, companies operating tourism packages were given 100% tax exemption on statutory income derived from the following tourism business activities:

i. Domestic tourism packages participated by at least 1,500 local tourists annually in a basis period for a year of assessment; and

ii. Inbound tourism packages participated by at least 750 foreign tourists annually in a basis period for a year of assessment.

To minimize the impact of COVID-19 to tourism sector, from year of assessment 2021 to year of assessment 2022, the incentive was reviewed and extended as follows:

- The threshold for domestic tourism packages was reduced to 200 local tourists annually, with no minimum requirement for foreign tourists for inbound tourism packages in a basis period for a year of assessment.

To further encourage tourism operator for Visit Malaysia Year 2026, it is proposed that tour operators be given 100% tax exemption on the incremental income derived from inbound tourism packages, subject to the following conditions:

i. The operator must bring in at least 1,000 foreign tourists annually; and

ii. The incremental income refers to the difference between the qualifying income derived from the business of operating inbound tourism packages to Malaysia during the basis period and the income from the preceding basis period.

Effective date : From year of assessment 2026 to year of assessment 2027

2. TAX DEDUCTION FOR RENOVATION AND CONVERSION OF COMMERCIAL BUILDING TO RESIDENTIAL

To encourage the repurposing of commercial buildings for residential use, it is proposed that a special tax deduction of up to 10% be granted on qualifying renovation and conversion expenditure, up to a maximum of RM10,000,000.

Further details are expected to be released in due course.

3. TAX INCENTIVES FOR ORGANISING INTERNATIONAL INCENTIVE TRIPS, CONFERENCES AND TRADE EXHIBITIONS

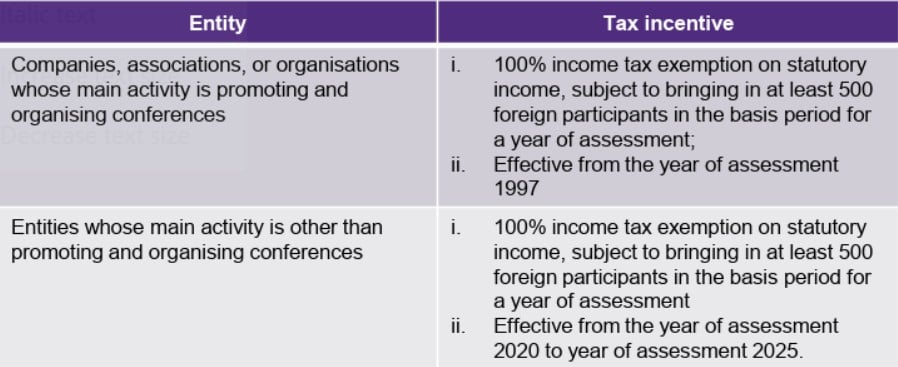

Currently, companies promoting and organising conferences are given tax incentives as follows:

To promote international incentive trips, conferences and trade exhibitions (MICE) in conjunction with Visit Malaysia Year 2026, it is proposed that the above tax incentives be reviewed as follows:

i. 100% income tax exemption on statutory income for organisers verified by Ministry of Tourism, Arts and Culture (MOTAC), subject to bringing in:

a. at least 1,500 foreign participants for incentive trips annually; or

b. at least 2,000 foreign participants for conferences annually; or

c. at least 3,000 foreign participants for trade exhibitions annually.

ii. The incentive be extended for 2 years.

Effective date : From year of assessment 2026 to year of assessment 2027

4. TAX DEDUCTION FOR CONDUCTING SPORTS DEVELOPMENT PROGRAMMES

To promote sports development programmes, the government shall allow organisations approved by the Inland Revenue Board of Malaysia to utilise a portion of its income received to conduct sports activities.

Further details are expected to be released in due course.

5. TAX INCENTIVES FOR SCHOLARSHIPS

Currently, double deduction is granted to companies that provides scholarships to Malaysian student pursuing studies at Technical and Vocational Certificate, Diploma, Bachelor’s Degree, Master’s Degree or Doctor of Philosophy Levels.

The criteria are as follows :

- Malaysian citizen and resident in Malaysia;

- pursue full-time studies;

- has no source of income; and

- the total household income of the parents or guardians does not exceed RM10,000 per month.

To encourage greater participation from private sector in sponsoring students by providing scholarships to meet the demand of the employment market, it is proposed that the double deduction be reviewed as follows:

i. the scope of qualifying studies be expanded to include Sijil Teknik Vokasional/Diploma/Degree and qualified professional certification courses such as information and communication technology (ICT), engineering, accounting and finance;

ii. the total household income of the parents or guardians does not exceed RM15,000 per month; and

iii. the tax incentive period be extended for 5 years from the year of assessment 2026 to the year of assessment 2030.

Effective date : From year of assessment 2026 to year of assessment 2030

6. TAX INCENTIVE FOR FOOD SECURITY PROJECTS

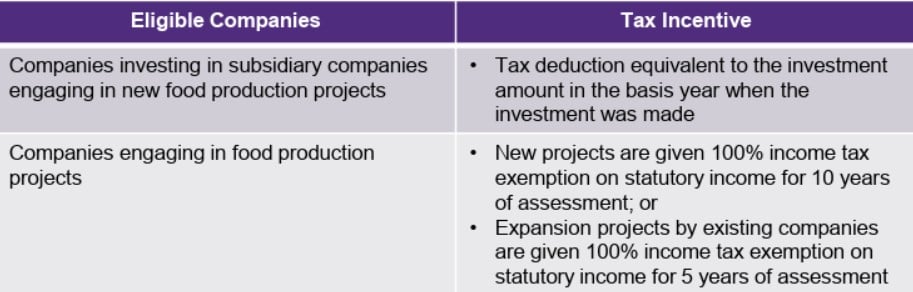

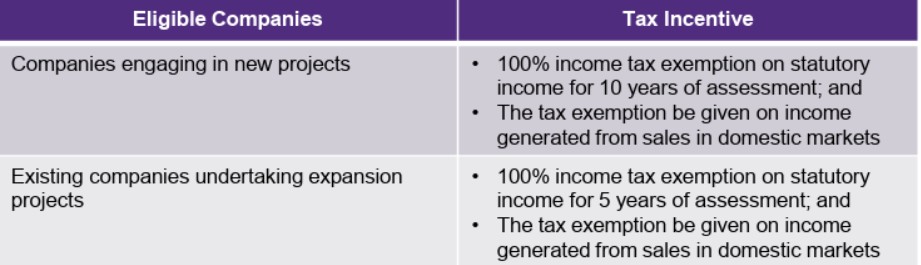

Currently, the following tax incentives are available for food production projects:

The above incentives are for application received by Ministry of Agriculture and Food Security (MAFS) from 1 January 2023 to 31 December 2025.

It is proposed that the Tax Incentive for Food Production Projects be rebranded as the Tax Incentive for Food Security Projects. To ensure the sustainability of national food security and to encourage greater participation of industry players in the agriculture sector, it is further proposed that tax incentive be granted to companies undertaking food security projects as follows:

Effective date : Application received by the Ministry of Agriculture and Food Security (MAFS) from 1 January 2026 to 31 December 2030

7. INCOME TAX DEDUCTION ON CONTRIBUTIONS FOR INTEGRITY AND ANTI-CORRUPTION PROGRAMMES / ACTIVITIES

Currently, any person with business income is eligible for tax deduction under Section 34(6)(h) of the Income Tax Act 1967 in respect of expenses incurred in organising integrity and anti-corruption programmes, subject to the following conditions:

- organised in collaboration with the Malaysian Anti-Corruption Commission (MACC);

- benefits the public and is apolitical;

- not profit-oriented and no participation fee is imposed; and

- not related to the company’s core business activities and is undertaken on a voluntary basis.

To support the objectives of the National Anti-Corruption Strategy (NACS) 2024 - 2028 which aims to strengthen organisational integrity and encourage wider public participation in anti-corruption initiatives, it is proposed that :

i. anti-corruption education programmes organised by the Civil Society Organisations (CSOs) be approved as national interest projects under Section 44(11C) of the Income Tax Act 1967, subject to the following conditions:

a. The programmes or activities are recognised by the MACC;

b. The initiatives serve the interest of the public and do not involve or promote sensitive issues relating to politics, race and religion;

c. The programmes are not profit-oriented and no participation fees are levied; and

d. The programmes are implemented within the period from 1 January 2026 to 31 December 2028.

ii. income tax deduction up to 10% of aggregate income shall be granted in respect of cash contribution to approved anti-corruption education programmes organised by CSOs.

Effective date : Application received by the Ministry of Finance from 1 January 2026 to 31 December 2028

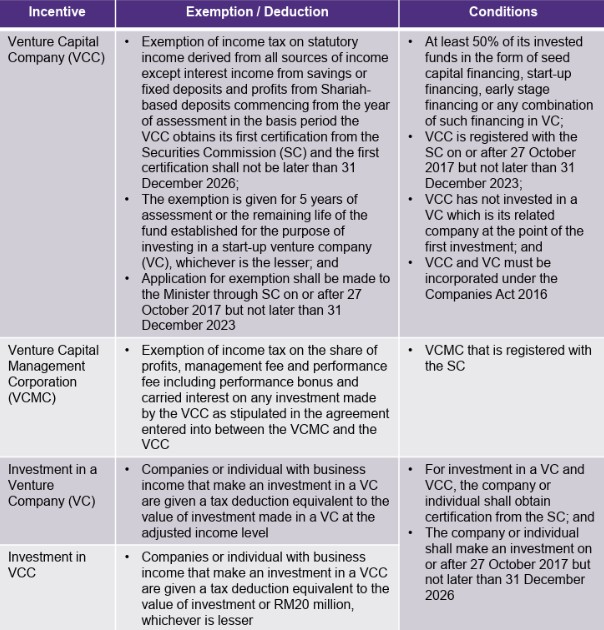

8. REVIEW OF TAX INCENTIVE FOR VENTURE CAPITAL

Currently, tax incentives for venture capital are as follows:

To further encourage investment by VCC, the following tax treatment is proposed:

i. Venture Capital Company

a. A corporate tax rate of 5% is proposed to be imposed on all income of the VCC, except for interest or profit income derived from savings, fixed deposits, or deposits. The VCC is required to invest a minimum of 20% of its funds in local venture companies.

b. The tax incentive is given for 10 years or for the remaining life of the fund starting from the year the VCC obtains its first certification from SC. The first certification by SC must be obtained no later than 31 December 2035; and

c. The tax incentive is expanded to entities incorporated under the Limited Liability Partnerships Act 2012 and the Labuan Limited Partnerships and Limited Liability Partnerships Act 2010 which elect to be taxed under the Income Tax Act 1967.

ii. Venture Capital Management Company

A tax rate of 10% is imposed on income derived from the share of profits, management fees and performance fees from the year of assessment 2025 to year of assessment 2035.

iii. Individual Shareholders of VCC

Exemption of income tax on dividends paid, credited or distributed to individual shareholders at the first level from the year of assessment 2025 to year of assessment 2035.

Effective date : From year of assessment 2025

Note: In addition, the Budget Speech also mentioned that dividend from VCC will be granted dividend tax exemption.

Indirect Tax

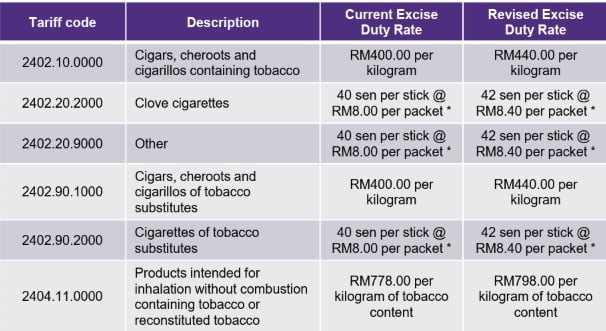

1. REVIEW OF EXCISE DUTY RATE ON CIGARETTES, CIGARS, CHEROOTS, CIGARILLOS AND HEATED TOBACCO PRODUCTS

The following is subject to excise duty (current and revised) as follows:

Note: One cigarette packet contains 20 cigarette sticks.

The proposed revision is to be in line with Malaysia’s commitment as a party to the World Health Organisation (WHO) Framework Convention on Tobacco Control and as part of efforts to reduce the consumption of smoking products for the well-being of the people:

i. Excise duty rate on cigarettes be increased in phases, starting with a rise of 2 sen per stick or 40 sen per packet;

ii. Excise duty rate on cigars, cheroots and cigarillos be increased in phases, starting with a rise of RM40 per kilogram; and

iii. Excise duty rate on heated tobacco products be increased in phases, starting with a rise of RM20 per kilogram of tobacco content.

Effective date : From 1 November 2025

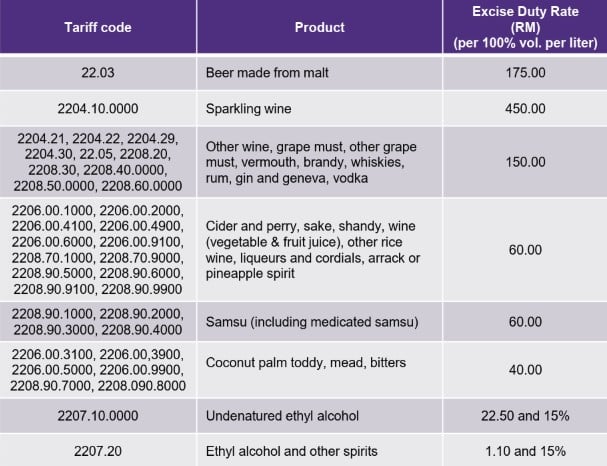

2. REVIEW OF EXCISE DUTY RATE ON ALCOHOLIC BEVERAGE PRODUCTS

Currently, alcoholic beverage products are subject to excise duty as follows:

It is proposed that excise duty rate on alcoholic beverage products be increased by 10%. This is to reduce access to alcoholic beverage products and promote a healthier lifestyle.

Effective date : From 1 November 2025

Stamp Duty

1. REVIEW OF WAGE THRESHOLD FOR STAMP DUTY EXEMPTION ON EMPLOYMENT CONTRACTS

Currently, stamp duty is exempted for employment contracts involving monthly wages not exceeding RM300 pursuant to Item 4 of the First Schedule, Stamp Act 1949. In order to reduce the cost of doing business, it is proposed the wage threshold for stamp duty exemption on employment contracts be increased from RM300 to RM3,000 per month.

Effective date : Employment contracts executed from 1 January 2026

2. STAMP DUTY EXEMPTION ON CONTRACT NOTES FOR BUY-SIDE TRANSACTION OF STRUCTURED WARRANTS

Currently, stamp duty at a rate of 0.1% is chargeable on contract notes for the sale and purchase transactions of structured warrants pursuant to Item 31(b) of the First Schedule, Stamp Act 1949.

In order to promote the growth of the capital market and enhance Malaysia’s competitiveness at the regional level, it is proposed the stamp duty on the contract notes for buy-side structured warrant transaction be exempted for 3 years.

Effective date : Buy-side structured warrant transactions executed from 1 January 2026 to 31 December 2028

Others

1. VEHICLE EXEMPTION IN LANGKAWI AND LABUAN

Currently, vehicles imported and registered in Langkawi and Labuan are exempted from taxes.

In order to prevent the abuse of vehicle tax exemptions in these locations, it is proposed that effective from 1 January 2026, no exemption will be granted for luxury vehicles valued at over RM300,000.

Base on the Budget Speech, it is unclear whether the removal of exemption applies to import duty, excise duty as well as sales tax.

Further details are expected to be released in due course.

2. TAX DEDUCTION FOR CONTRIBUTIONS MADE TO CHARITY PROGRAMMES OR WELFARE FUNDS

In the Budget Speech, it is proposed that companies and individuals who contribute to the following are eligible for income tax deduction:

i. Kampung Angkat dan Sekolah Angkat MADANI, Sejahtera MADANI programme; and

ii. Akaun Amanah Jabatan Muzium Malaysia.

In addition, the speech also mentioned that private hospitals are allowed to establish a Hospital Welfare Fund and to be managed by a Company Limited By Guarantee. It is proposed that the income received by the fund be exempted from tax, and the donor will be eligible for income tax deduction.

Further clarifications required on the conditions for the tax deduction.

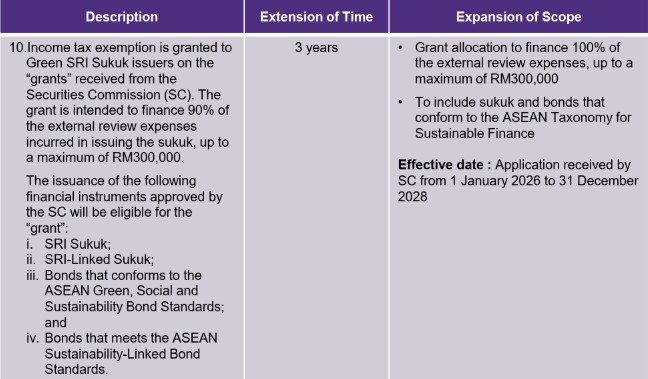

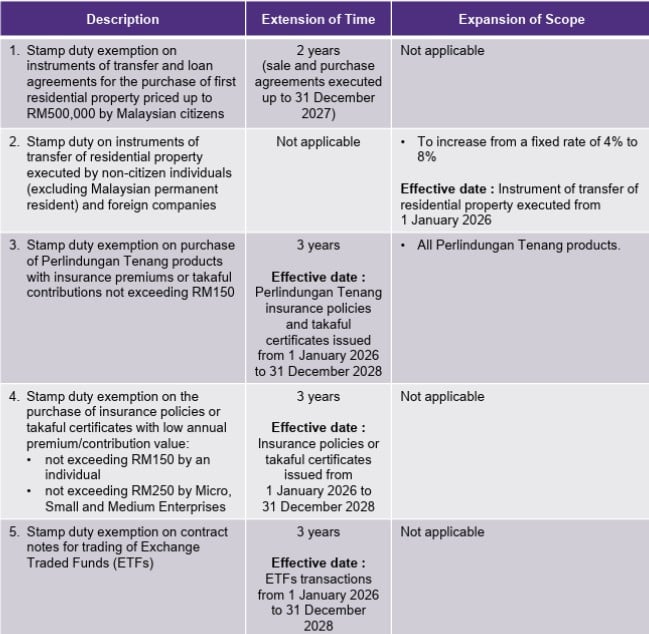

Summary of Extension of Time and Expansion of Scope

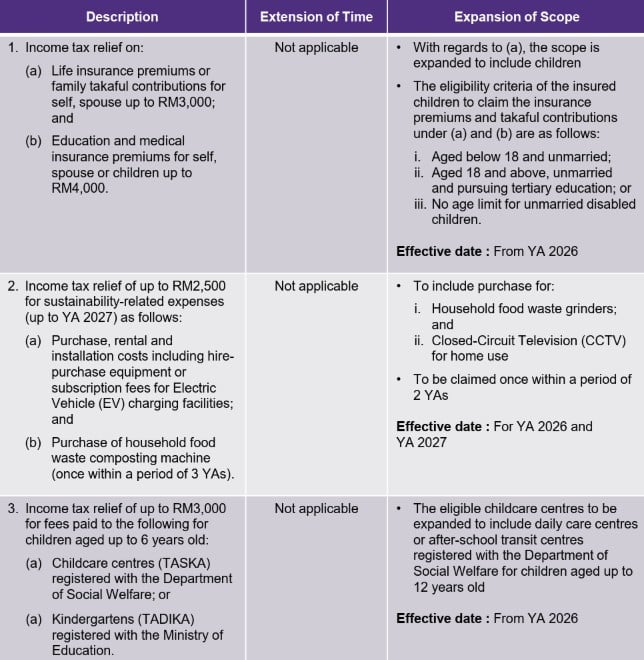

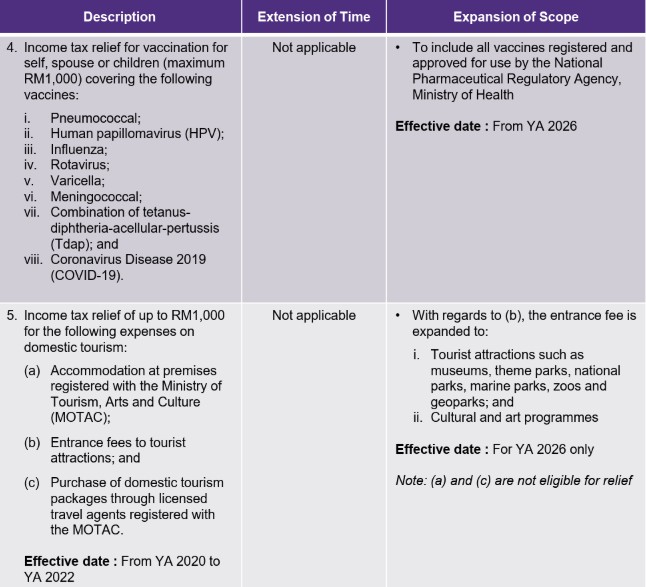

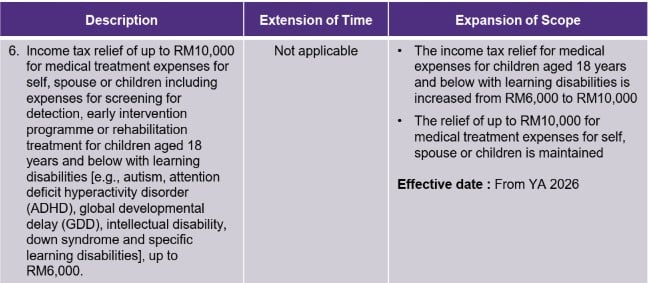

INDIVIDUAL TAX

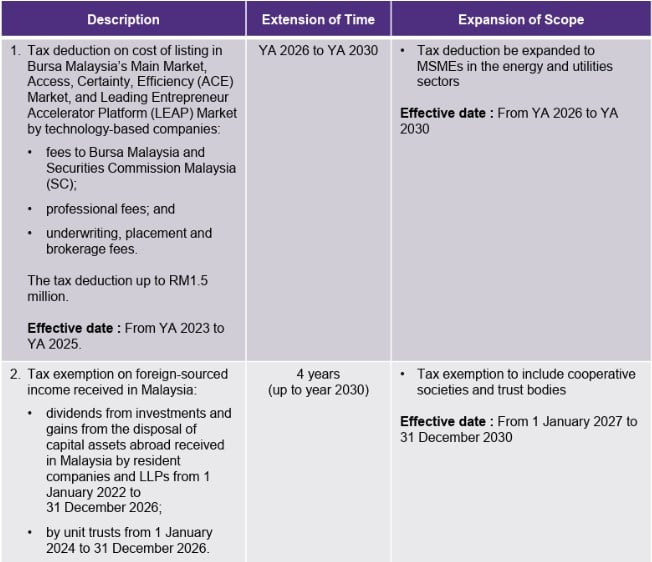

CORPORATE TAX

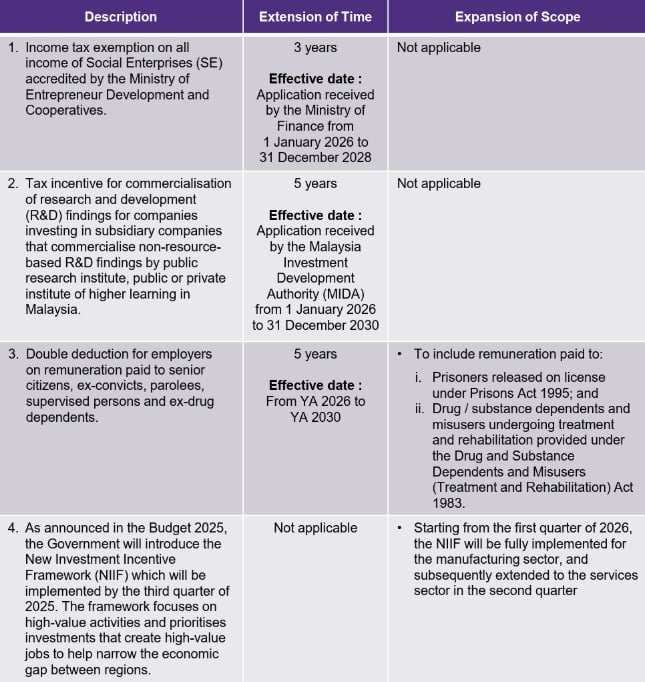

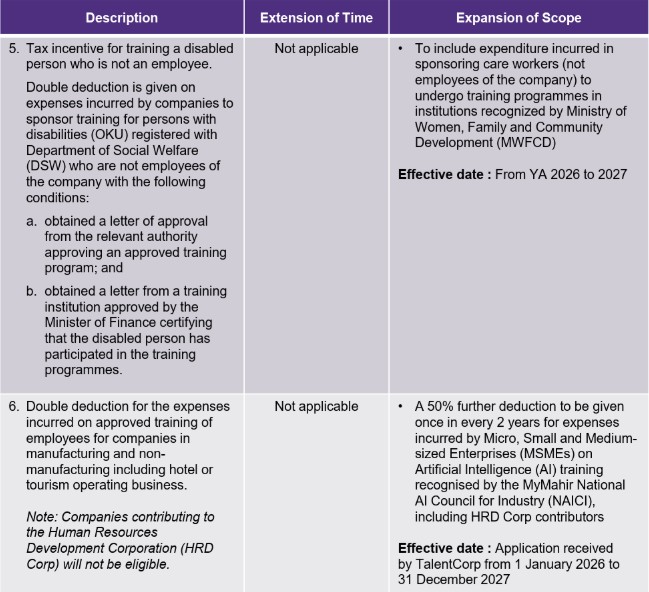

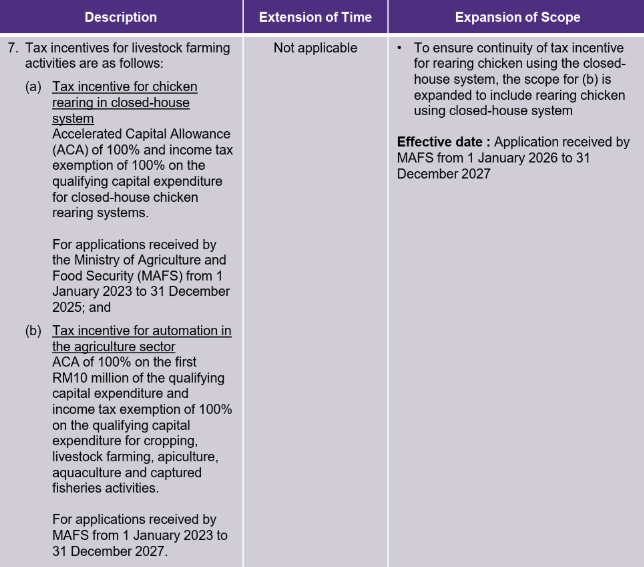

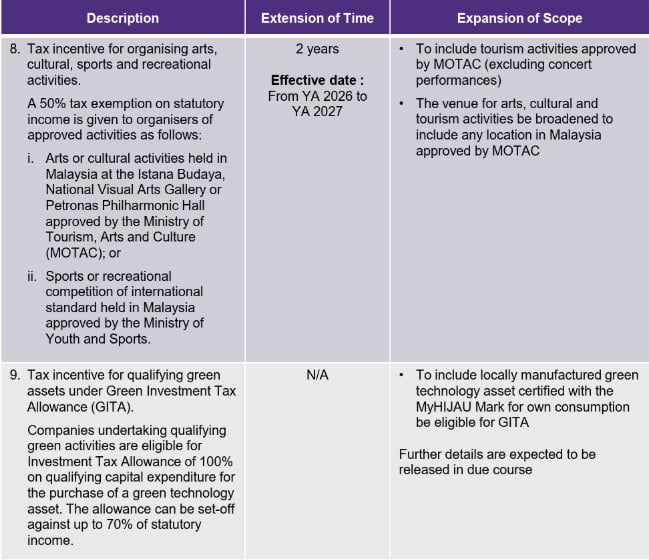

TAX INCENTIVE

INDIRECT TAX

STAMP DUTY

Grant Thornton Taxation Sdn Bhd offers a comprehensive range of tax services through our team of dedicated tax specialists. Our team has a vast amount of expertise that enables us to pro-actively bring practical, cost-effective tax solutions to our clients and to add value.

Whether you are an individual or a corporation, a wellestablished business or a growing operation, we are able to offer you a multitude of domestic and international tax services.

Our expertise:

- Tax Compliance

- Tax Consultancy & Advisory

- Tax Audit & Investigation

- Tax Incentives Application

- Transfer Pricing

- International Tax

- Global Mobility

- Business Processing

- E-invoicing

- Indirect Tax- Sales Tax and Service Tax- Goods and Services Tax

- Tax Training & Seminar

- Employment Permit & Professional Pass Applications