Designed with our clients in mind, our audit and assurance services focus on critical areas and risks that matter most to your business. The ability to manage...

-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

At Grant Thornton we use a single audit methodology (LEAP) across our global network. This means that our clients get a consistent, high-quality approach wherever they are.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Reporting Accountants

Reporting Accountants

-

Our local experts

Our local experts

At Grant Thornton Malaysia, tax is a key part of our organisation and our tax teams can offer you a range of solutions.

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

As your business grows, our advisory services are designed to help you achieve your goals. Successful growth often means navigating a complex array of...

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business consulting

Our business consulting services help organisations improve operational performance and productivity throughout the growth life cycle.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Forensic and investigation

We take a 360-degree view of your situation using our deep experience, industry specialization and global reach to help you get to the core of the issue with a full service portfolio of capabilities.

Sustainability and Climate Change Services

Japan Desk in Grant Thornton Malaysia was established in October 2013 to serve as bridge between Malaysia and Japan.

Support clients in identifying strategic business or investment partners in China or other region

With our unique culture and opportunities, Grant Thornton Malaysia is a place where you can grow. Wherever you are in your career, we help you to make a...

At Grant Thornton, talented people are at the heart of our strategy and drive all of our successes in more than 140 countries.

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your potential for growth, allowing you to be at your best every day. And when you are at your best, we are the best at serving our clients

-

In the community

Many Grant Thornton member firms provide a range of inspirational and generous services to the communities they serve.

Experienced hires

Fresh graduates

-

Internship

Internship

Vacancies listing

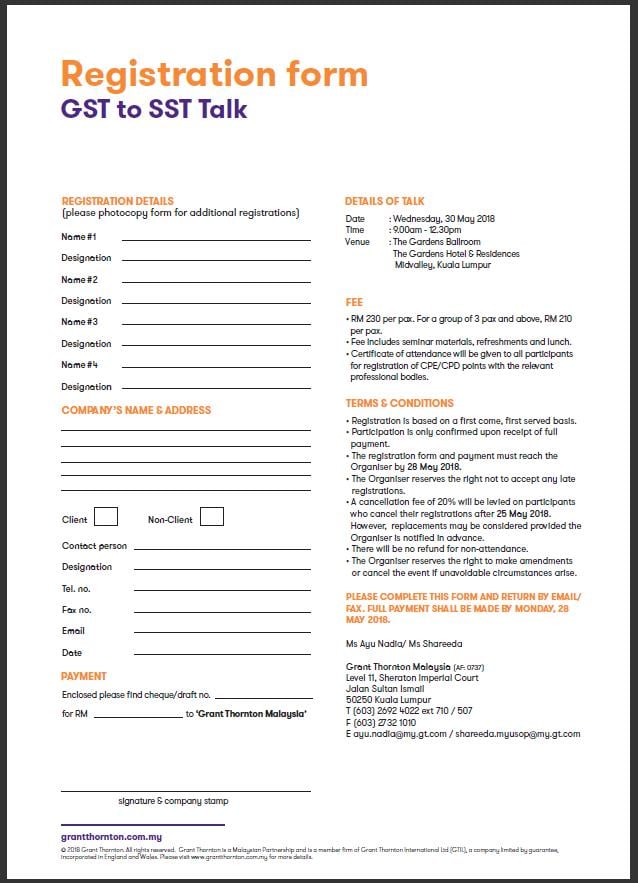

The Goods and Services Tax (GST) system which was implemented since 1 April 2015 is slated to be replaced by the Sales and Service Tax (SST) system. In the transition, the supply of goods and services in Malaysia will be subject to GST at 0% instead of 6% with effect from 1 June 2018.

Our half-day talk on GST to SST will guide you through transitional issues, recommend practices and also answer your concerns about the change of GST rate from 6% to 0%, as well as the transition from GST to SST.

Speakers

Alan Chung, Executive Director of Indirect Tax & GST

Fellow of CPA of Australia (FCPA), member of the Malaysian Institute of Accountants (Chartered Accountant) and Chartered Tax Institute of Malaysia (Associate). He is an approved tax agent under Section 170 of the Goods and Services Tax Act 2014 and Section 153 of the Income Tax Act 1967.

Chong Ee-Feng, Senior Manager of Indirect Tax & GST

Member of the Malaysian Institute of Accountants (Chartered Accountant), Chartered Tax Institute of Malaysia (Associate), and CPA Australia (CPA). She is an approved tax agent under Section 170 of the Goods and Services Tax Act 2014

|

9.00am |

Registration |

|

9.30am |

Opening Remarks |

|

9.40am |

Presentation & Knowledge Sharing on GST & SST |

|

11.00am |

Tea Break |

|

11.30am |

Q&A session |

|

12.30pm |

Lunch / End |

GST to SST Talk

Ayu Nadia

- The Gardens Ballroom

- The Gardens Hotel & Residences

- Kuala Lumpur