-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

At Grant Thornton we use a single audit methodology (LEAP) across our global network. This means that our clients get a consistent, high-quality approach wherever they are.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Our local experts

Our local experts

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business consulting

Our business consulting services help organisations improve operational performance and productivity throughout the growth life cycle.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Forensic and investigation

We take a 360-degree view of your situation using our deep experience, industry specialization and global reach to help you get to the core of the issue with a full service portfolio of capabilities.

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your potential for growth, allowing you to be at your best every day. And when you are at your best, we are the best at serving our clients

-

In the community

Many Grant Thornton member firms provide a range of inspirational and generous services to the communities they serve.

-

Internship

Internship

The Budget 2020, themed ‘Shared Prosperity: Sustainable And Inclusive Growth Towards High Income Economy’ will be tabled in Parliament on 11th October 2019. Budget 2020 is said to reflect the Government’s ongoing policy shift towards high-quality growth to achieve developed nation status. Can the budget achieve a sustainable and inclusive growth for our nation? Will the budget also benefit all segments of our society?

Programme - Kuantan

08.30am Registration & Networking

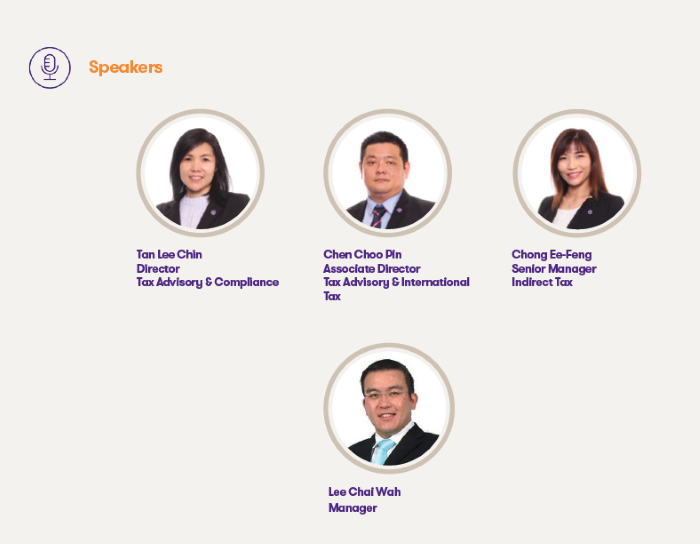

09.30am Overview of 2020 Budget

Lee Chai Wah, Manager

10.00am 2020 Budget Highlights (Personal and Corporate Tax)

Tan Lee Chin, Director of Tax Advisory & Compliance

Chen Choo Pin, Associate Director of Tax Advisory & Compliance

11.30am 2020 Budget Highlights (SST)

Chong Ee-Feng, Senior Manager of Indirect Tax

12.30pm Q&A Session

01.00pm Lunch / End of seminar

Seminar fee

• RM220 nett per participant (Grant Thornton clients/alumni) or

RM240 nett per participant (non-clients) inclusive of 6% service tax.

• Enjoy a group discount of 10% for 3 or more registrations from the same organisation.

• Fee includes seminar materials, refreshments and lunch.

• Certificate of attendance will be given to all participants for registration of CPE/CPD points with the relevant professional bodies.

Registration by 1 November 2019.

Mr. Lee Chai Wah / Ms. Han Siew Bueh

Grant Thornton Malaysia (AF: 0737)

A105-A, 1st Floor

Sri Dagangan, Jalan Tun Ismail

25000 Pahang

T (609) 515 6124, 012 262 6111

F (609) 515 6126

E chaiwah.lee@my.gt.com / siewbueh.han@my.gt.com

- Kuantan