Share-based payments have become increasingly popular over the years, with many entities using equity instruments or cash and other assets based on the value of equity instruments as a form of payment to directors, senior management, employees and other suppliers of goods and services.

The accounting of share-based payments is an area that remains not well understood and this is evidenced by a number of Interpretations and agenda decisions being issued by the IFRS Interpretations Committee (IFRIC). Considerable care needs to be applied in evaluating the requirements set out in MFRS 2 and other authoritative guidance to increasingly complex and innovative share-based payment arrangements.

Why use share-based payments

One of the most persuasive reasons is that share-based payments allow entities to better align the interests of their employees with those of the shareholders. By remunerating employees using shares, share options and other equity instruments, entities are able to incentivise their employees to act in the best interest of the business and create long-term shareholder wealth.

In addition, share-based payments are an attractive payment method for entities that have cash flow issues but need to attract and retain highly qualified and talented people for the development of their business. For example, many exploration and start-up companies often have cash flow issues or are unable to raise traditional debt funding and therefore might pay their employees and suppliers using share-based payment arrangements. In fact, it is often the only viable payment method available to such entities.

Share-based payments are also of significant concern to investors as they dilute the value of their existing shareholdings. Accordingly, there is generally increased shareholder interest and scrutiny on accounting for sharebased payment transactions and the associated disclosures.

Objective of MFRS 2

The objective of MFRS 2 is to specify the financial reporting by an entity when it undertakes a share-based payment transaction. In particular, it requires an entity to reflect the effects of share-based payments in its financial statements, including expenses related to share options granted to employees.

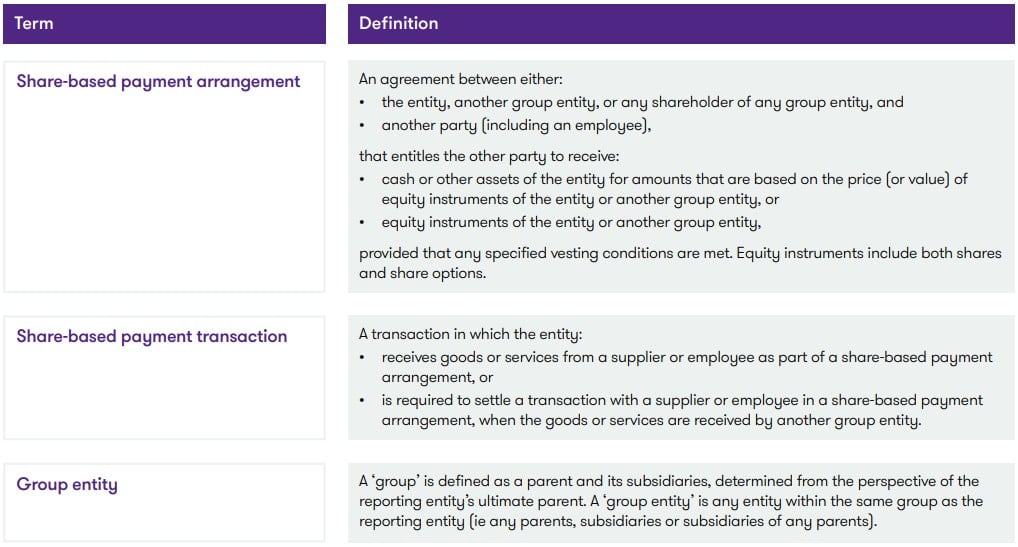

Definition of a share-based payment

A share-based payment is accounted for in accordance with MFRS 2 if it meets the definition of a share-based payment transaction and it is not specifically scoped out of the standard. MFRS 2 contains the following definitions of a share-based payment:

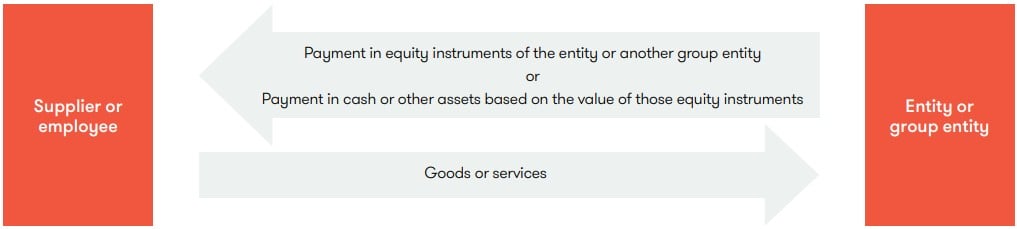

The diagram below demonstrates the basic definition of a share-based payment transaction:

These definitions show that MFRS 2 applies not only to share-based payments directly between the reporting entity and its suppliers or employees, but also to share-based payments that involve other group entities and their suppliers or employees.

Scope of MFRS 2

When does MFRS 2 apply?

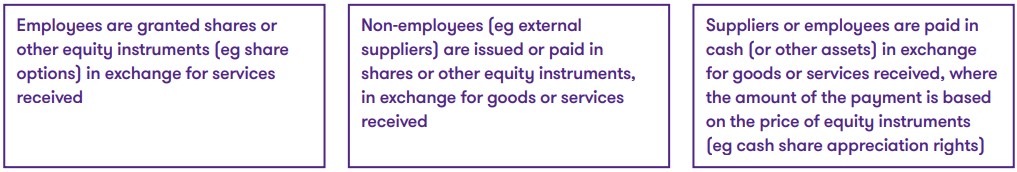

In practice, MFRS 2 applies to a range of situations as follows:

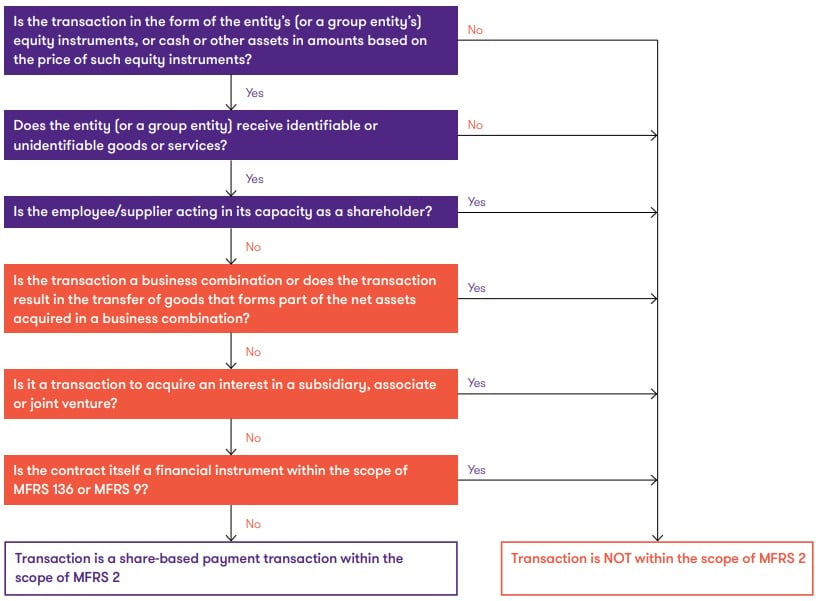

For MFRS 2 to apply, the equity instruments transferred or used as a basis for the amount of payment must be those of the entity or another group entity.

Does MFRS 2 apply to all share transactions with employees?

Employees sometimes receive equity instruments in their capacity as a shareholder rather than in their capacity as an employee. For example, an employee may already hold shares in an entity from past share-based payments. If the entity decides to grant all of its shareholders (which includes its employees to the extent that the instruments that were issued were not subject to any service

conditions) an option to purchase additional shares at less than fair value, such a transaction is not within the scope of MFRS 2 as the employee is receiving the payment in their capacity as a shareholder rather than as an employee.

Do the goods or services received need to be identifiable?

MFRS 2 applies to share-based payments in which an entity (or another group entity) receives goods or services. Share-based payments are often exchanged for employee services, but can also include services provided by non-employees such as consulting, advisory, legal advice, etc. Goods can include inventories, consumables, property, plant and equipment, intangible assets and other non-financial assets.

In some cases, it may be difficult to identify the specific goods or services received from parties other than employees. Even when there are identifiable goods or services, the identifiable consideration received in the form of those goods or services could be less than the fair value of the equity instruments granted.

MFRS 2 presumes, when making a share-based payment, that the entity would expect to receive some goods or services in return for the equity instruments issued, as it would not issue valuable consideration in exchange for nothing. For example, an entity that issues shares to the benefit of disadvantaged communities, in exchange for no identifiable goods or services (eg black economic

empowerment in South Africa), still benefits from enhancing its image as a good corporate citizen.

Accordingly, the Standard concludes that in the absence of specifically identifiable goods or services, other circumstances may indicate that unidentifiable goods or services have been (or will be) received, in which case MFRS 2 still applies to account for the cost of those unidentified goods or services.

Note that MFRS 2 does not apply where the transfer of shares or options is clearly for a purpose other than payment for goods or services (eg a transfer to settle a shareholder’s personal obligation to an employee that is unrelated to employment, or if the shareholder and employee are related and the transfer is a personal gift attributable to that relationship).

Does MFRS 2 apply to arrangements where the equity instruments are granted by another group entity (or by a shareholder of any group entity)?

In some cases, share-based payment arrangements may be settled by another group entity (or a shareholder of any group entity) on behalf of the party receiving the goods or services. For example, a parent may issue its own shares or options to a subsidiary’s employees or suppliers, for various legal or tax reasons, or a shareholder of the parent may award shares in the parent as settlement for goods or services received by the subsidiary.

MFRS 2 is clear that its requirements apply even where the entity receiving the goods or services has no direct obligation to settle a share-based payment arrangement (ie because another group entity or shareholder has the obligation to settle it). Similarly, MFRS 2 also applies in the financial statements of the entity required to settle the share-based payment arrangement on behalf of another group entity receiving the goods or services.

Does MFRS 2 apply to share-based payment transactions that are business combinations or form part of a business combination?

MFRS 2 applies to share-based payment transactions in which an entity acquires goods or services. However, entities often acquire net assets in a business combination, where the consideration paid or payable may include shares or other equity instruments. MFRS 3 ‘Business Combinations’, the more specific standard dealing with business combinations, applies to such transactions. Therefore, the equity instruments issued in exchange for control of an acquiree in a business combination are not within the scope of MFRS 2.

However, the acquirer sometimes also grants equity instruments to employees of the acquiree in their capacity as employees (eg in return for their continuing service after the business combination has taken place). Such share-based payments are within the scope of MFRS 2. MFRS 2 also applies to any cancellations, replacements or other modifications of existing share-based payment arrangements that occur because of a business combination or other equity restructurings.

In some cases, the selling shareholders of the acquiree will continue on as employees of the acquiree following a business combination. If those sellers receive a share-based payment as part of the business combination, guidance in MFRS 3 must be applied to determine what portion of the equity instruments issued is (a) in return for future services to be provided postcombination, and therefore within the scope of MFRS 2, or (b) part of the consideration transferred to obtain control of the acquiree and therefore within the scope of MFRS 3 instead. Refer to our article on ‘Insights into MFRS 3 – Determining what is part of a business combination transaction’ which provides further information on scoping between MFRS 2 and MFRS 3.

Does MFRS 2 apply to transactions that are within the scope of MFRS 132 ‘Financial Instruments: Presentation’ or MFRS 9 ‘Financial Instruments’?

MFRS 2 applies to share-based payments in which goods or services are acquired. As noted earlier, the term ‘goods’ includes non-financial items. This means share-based payments involving financial assets that fall within the scope of MFRS 132 or MFRS 9 are excluded from the scope of MFRS 2.

Even contracts to acquire non-financial items or services are excluded from MFRS 2 if the contract itself falls within the scope of MFRS 132 and MFRS 9. For example, contracts to purchase commodities for short-term profit-taking rather than for the entity’s expected purchase, sale or usage requirements (ie the contract is not an ‘own use’ contract) must be treated as financial instruments under MFRS 132 and MFRS 9 even if the contract is settled with a share-based payment.

However, equity instruments granted by a borrower to a lender as part of a financing agreement may fall within the scope of MFRS 2 if they were issued in exchange for services provided by the lender, as opposed to forming part of the overall return to the lender (which would fall under MFRS 9 instead). Judgement may be required to determine whether the equity instruments transferred are remuneration for a distinct service versus the fees that form part of the lender’s return.

Practical insight – Relationship between MFRS 2 and MFRS 132 when share-based payments are used to acquire a group of assets

When an entity issues share-based instruments to acquire a business, the guidance in MFRS 3 ‘Business Combinations’ applies. However, when an entity issues share-based instruments to acquire a group of assets that does not constitute a business (and therefore is not within the scope of MFRS 3), the IFRIC (equivalent to IC Interpretation in Malaysia) in October 2022 clarified what was set out in its September 2022 IFRIC Update that the entity may be required to apply both

MFRS 2 and MFRS 132 to determine the classification of equity instruments issued.

This is because, as noted earlier, the term ‘goods’ under MFRS 2 refers to non-financial items. Therefore MFRS 2 applies to the instruments issued to acquire any non-financial goods and services in the transaction, while MFRS 132 applies to the instruments issued to acquire any financial instruments in the transaction. Judgement may be required when allocating the share-based instruments between these two categories, such as using a relative fair value basis. This distinction is important because the classification of the share-based instruments as equity or a liability differs between MFRS 2 and MFRS 132 even when the instruments have the same features.

For example, if an entity issues shares to acquire a mix of financial instruments (such as cash), and goods or services (such as a stock exchange listing), the entity would apply MFRS 2 to account for the shares issued to acquire the stock exchange listing, and MFRS 132 to account for the shares issued to acquire the cash. See the IFRIC Agenda Decision titled ‘Special Purpose Acquisition Companies (SPAC): Accounting for Warrants at Acquisition’ for further information.

Does MFRS 2 apply to financial assets outside the scope of MFRS 132 or MFRS 9, such as the acquisition of investments in subsidiaries, associates or joint ventures?

As mentioned above, share-based payments involving the acquisition of financial assets that fall within the scope of MFRS 132 or MFRS 9 are excluded from the scope of MFRS 2. However, while investments in subsidiaries, associates and joint ventures are financial assets, they are also scoped out of MFRS 9 when an entity’s policy choice is to account for them at cost or using the equity method in its unconsolidated financial statements. In other words, such investments are outside the scope of both MFRS 2 and MFRS 9.

As a result, there is no specific guidance in MFRS for a transaction to acquire an interest in a subsidiary, associate or joint venture in exchange for shares or other equity instruments. Entities would need to develop an accounting policy for such transactions. For example, by referring to MFRS 128 ‘Investments in Associates and Joint Ventures’ and considering whether it would be appropriate to analogise to other standards, such as MFRS 3, and applicable IFRIC Agenda decisions, to determine the cost of the investment.

The following flowchart summarises the main scoping requirements of MFRS 2:

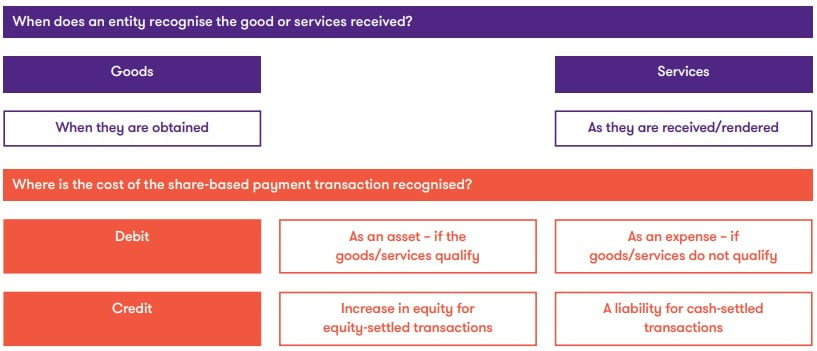

Under the general principles in MFRS 2, an entity recognises the goods or services acquired in a share-based payment transaction at the time when the goods are acquired or as the services are rendered by the counterparty.

Services are typically consumed as they are received, in which case an expense is recognised as the counterparty provides the service. On the other hand, some services may qualify for capitalisation as part of an asset (eg as part of inventory, property, plant and equipment, or intangible assets) and therefore would be expensed later, as the asset is consumed.

In contrast, goods are often consumed over a period of time, in which case an expense is recognised as the entity consumes the goods. Where goods are sold at a future point in time (eg inventories), an expense is recognised when the goods are sold. However, it is also possible that some goods will need to be expensed before they are consumed or sold, in particular when they do not qualify for recognition as assets (eg purchase of goods during the research phase of a project to develop a new product, where the goods do not qualify for recognition as assets under the applicable accounting standard).

When the cost of the share-based payment transaction is recognised, the entity records a credit entry as folllows:

Refer to our article ‘Insights into MFRS 2 – Classification of share-based payment transactions and vesting conditions’ (to be released later) which provides further information on these two categories of transactions.

The following diagram summarises the general recognition principles discussed above:

How we can help

We hope you find the information in this article helpful in giving you some insight into MFRS 2. If you would like to discuss any of the points raised, please do not hesitate to contact us.