The ESG Tax Deduction Rules [Income Tax (Deduction for Expenditure in relation to Environmental Preservation, Social and Governance) Rules 2025] was gazetted on 23 June 2025.

The salient points included in the ESG Tax Deduction Rules are as follows:

- Effective from Year of Assessment (YA) 2024 to YA 2027

- Tax deduction of up to RM50,000 per YA is allowed on expenditure incurred in relation to the ESG

i. Financial institution supervised by the Central Bank or a company listed on Bursa Malaysia on expenditure incurred for the ESG reporting:

- Validation, verification and certification the use of ESG practices, calculation and tracking of the greenhouse gas emissions, and ESG exposure;

- Subscription of technology or software systems for data collection, tracking the use of ESG metrics, risk management, scenario analysis and calculation of greenhouse gas emissions;

- Capacity building including training, education and skills development for employees; and

- Services of consultant expert or subject matter expert to perform activities as specified above.

ii. A company or Labuan company on expenditure incurred for:

- Preparing the reporting as required under the Tax Corporate Governance Framework (TCGF) guidelines issued by the Inland Revenue Board of Malaysia (IRBM) and appointing an independent reviewer to perform review assessment of compliance with the guidelines, subject to obtaining the said certificate of compliance; or

- Preparing the contemporaneous transfer pricing documentation.

iii. Micro enterprise or small and medium enterprises (MSMEs) on expenditure incurred for:

- Consultation fees for the development of customised software for the implementation of e-Invoice and obtaining services of external service providers but excludes:

- Any expenses incurred at the planning stage or preliminary procedures for the provision of the customised software; and

- Any consultation fee relating to the issuance of e-Invoice through MyInvois Portal.

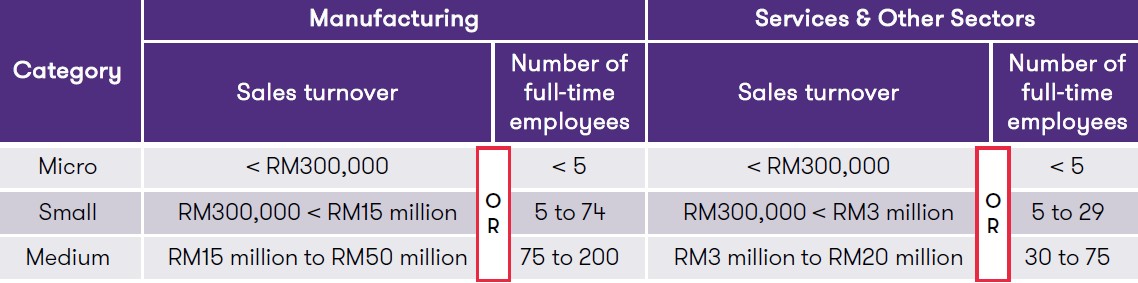

iv. The definition of MSMEs are as follows:

Note: If a business fulfils either one criterion across the different sizes of the operation, then the smaller size will be applicable.

v. The type of establishments that qualify as MSMEs are:

- Locally incorporated under the Companies Act 2016; or

- Registered under the Registration of Business Act (1956) or Limited Liability Partnerships

(LLP) Act 2012; or - Registered under respective authorities or district offices in Sabah and Sarawak; or

- Registered under respective statutory bodies for professional service providers.

vi. The definition of MSMEs does not apply to the following businesses:

- Listed companies on Main Market of Bursa Malaysia or main bourses of other countries;

- Large firms (non-MSMEs), Multinational corporations (MNCs), Government-linked companies (GLCs), MOF Incorporated and State-owned enterprises; and

- Subsidiaries of the above.

The complete definition of MSMEs can be found in the Guideline for SME Definition issued in March 2024 by the National Entrepreneur and SME Development Council (NESDC) [(formerly known as National SME Development Council (NSDC)].

Read our publication to know more details of the deduction for various ESG expenditures.

ESG Tax Deduction Rules

Read our publication to know more details of the deduction for various ESG expenditures.

We would like to highlight that the ESG Tax Deduction Rules and the Guideline for SME Definition may be subject to changes. For further details, please click on the links above or please contact your respective Grant Thornton tax adviser should you require further guidance.