Join us in our full-day programme to get the latest insights to demystify SST exemptions and navigate audits. Our programme includes live consultation clinics where the RMCD will be available on site to guide and directly address your concerns.

Sales Tax and Service Tax (SST) are single-staged consumption taxes unlike the multi-staged Goods and Services Tax (GST). Various Sales Tax facilities and Service Tax exemptions are available to avoid unintended taxation and to maintain the competitiveness of Malaysian businesses. In order to optimise businesses’ tax position, it is crucial for businesses to understand the entire concept of the available facilities and exemptions, and to benefit from them.

In the recent years, the RMCD has also actively conducted audits on businesses to ensure SST compliance as well as proper import declarations in Malaysia. It is essential for businesses to comprehend the audit concept and process to ensure that the audit objectives are fulfilled.

PROGRAMME *HRD Corp Claimable*

| 8.30am | Registration |

| 8.45am | Welcome Speech |

| Dato’ Narendra Jasani (Chairman of Grant Thornton Malaysia) | |

| Opening Address | |

| Almirulita Binti Mohd Yusoff (Director of Customs, Compliance Management Division) | |

| 9.00am | Session 1 - Sales Tax Facilities |

| • Type of facilities • Condition of the facilities • Application process • Latest updates on the facilities |

|

| Moderator: Alan Chung Senior Executive Director, Indirect Tax & Transfer Pricing Grant Thornton Malaysia |

|

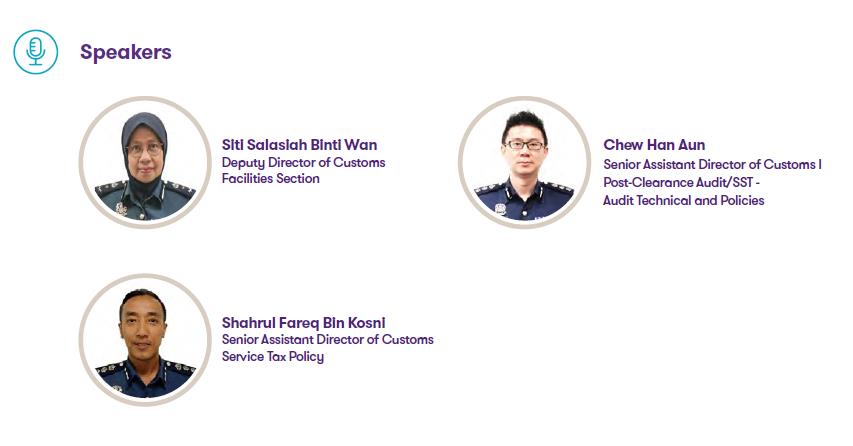

| Speaker: Siti Salasiah Binti Wan Deputy Director of Customs, Facilities Section |

|

| 11.00am | Morning Refreshments |

| 11.30am | Session 2 - Type of Audits and Audit Verifikasi Pematuhan (AViP) |

| • Type of audits (i.e. SST audit and Post-Clearance audit) • The importance of record keeping • What is the concept of AViP (New audit approach and how taxpayers may participate and benefit)? |

|

| Moderator: Alan Chung Senior Executive Director, Indirect Tax & Transfer Pricing Grant Thornton Malaysia |

|

| Speaker: Chew Han Aun Senior Assistant Director of Customs I, Post-Clearance Audit/SST - Audit Technical and Policies |

|

| 12.30pm | Lunch Break |

| 2.00pm | Session 3 - Service Tax Exemption |

| • Type of exemptions • Condition of the exemptions and how to claim the exemptions • Latest updates on the exemptions |

|

| Moderator: Chong Ee-Feng Director, Indirect Tax Grant Thornton Malaysia |

|

| Speaker: Shahrul Fareq Bin Kosni Senior Assistant Director of Customs, Service Tax Policy |

|

| 3.30pm | Tea Break |

| 3.40pm | RMCD’s consultation clinics (concurrent sessions) |

| • Table 1 - Sales Tax • Table 2 - Service Tax • Table 3 - Imports and Exports • Table 4 - Facilities |

|

| 5.00pm | End of programme |

SPEAKERS

FEE

- RM500 per participant (Grant Thornton clients/alumni), RM550 per participant (non-clients)

- 10% discount for 3 or more registrations

- Seminar fee is inclusive of 8% Service Tax, seminar materials, refreshments and lunch.

- Certificate of attendance will be given to all participants for registration of CPE/CPD points with the relevant professional bodies.

- Methodology: Presentations and live Q&A will be carried out during the course of the programme. Face-to-face live clinics will also held with RMCD officers and Grant Thornton Malaysia’s indirect tax specialists.

Contact us

Ms Ayu Nadia / Ms Fariha

- The Gardens – A St Giles Signature Hotel & Residence