Granting lease incentives is a common way to encourage a new lessee to sign up to a new lease contract and fill vacant premises. Lease incentives may take various forms depending on the negotiation between the lessee and the lessor.

When accounting for lease incentives in accordance with MFRS 16 ‘Leases’ from a lessee perspective, questions may arise in how to identify a lease incentive and when the accounting treatment changes depending on how the lease incentive is granted. This publication aims to resolve these lessee accounting questions.

MFRS 16 defines lease incentives as:

Lease incentives definition

Payments made by a lessor to a lessee associated with a lease, or the reimbursement or assumption by a lessor of costs of a lessee (MFRS 16. Appendix A).

The Standard and the Basis for Conclusions do not elaborate on this definition. In addition, MFRS 16 does not provide guidance on the various types of arrangements between the lessor and the lessee that may satisfy this definition (with the exception of the Illustrative Example 13 which has subsequently been amended by the MASB – see below).

In our view, even though not clearly stated, we believe the definition could suggest that an analysis similar to the MFRS 15 ‘Revenue from Contracts with Customers’ guidance relating to the consideration payable to customers could be applied. Accordingly, any payments made to or on behalf of a lessee within the context of the lease contract should be considered as an integral part of the net consideration of the lease and therefore be accounted for as an incentive. This is to the extent they are not made for:

- the transfer of distinct goods and services or any other asset from the lessee; or

- the costs incurred by the lessee on lessor’s behalf.

In addition, we believe the former iC Interpretation 115 ‘Operating Leases—Incentives’, which dealt with such type of transactions under MFRS 117, is helpful in delimiting the scope.

iC Interpretation 115 stated all incentives provided in consideration of the agreement for a new or renewed lease had to be recognised as an integral part of the net consideration agreed for the use of the leased asset, irrespective of the incentive’s nature or form or the timing of payments. We think this is still true under MFRS 16 and therefore similar accounting considerations with respect to the definition and scope would apply.

Forms of lease incentives

In negotiating a new or renewed lease, the lessor may provide incentives that can consist of:

This list is not exhaustive and other types of incentives may be offered to the lessee. MFRS 16 requires a lessee to include lease incentives in the measurement of both the right-of-use asset and the lease liability. Therefore all forms of lease incentive should be considered when determining the carrying amount of the lease liability and the right-of-use asset. However, it should be noted some lease incentives may have an impact on the right-of-use asset but not the lease liability if they are paid immediately by the lessor.

Lease incentives decision tree

This publication discusses ways to improve entities' going concern disclosures.

“MFRS 16 requires a lessee to include lease incentives in the measurement of both the right-of-use asset and the lease liability”

Example 1 – Reimbursement of relocation costs

An entity agrees to enter into a lease arrangement with a new lessor. The lessor agrees to pay the lessee’s relocation costs as an incentive to the lessee for entering into the new lease. The lessee’s moving costs are CU1,000. The lease has a term of 10 years, at a fixed rate of CU2,000 per year. The lessor agrees to pay the relocation costs immediately (ie prior to or at commencement of the lease).

Analysis

The reimbursement of the relocation costs is a lease incentive. The payment is part of the net rental consideration the lessee has agreed to pay to the lessor for the lease and would have never been provided should the lessee had not entered into the new lease. Therefore, it should not be recognised immediately in profit or loss by the lessee but instead should be accounted for as a reduction of the right-of-use asset in accordance with MFRS 16.

Therefore, the lessee recognises relocation costs of CU 1,000 as an expense in Year 1. The net consideration of the lease is CU19,000 and consists of CU2,000 for each year of the lease term, less a CU1,000 incentive for relocation costs. The lessee recognises at the commencement date:

- a lease liability for the discounted value of the 10-year rentals of CU2,000 (discounted at a rate of 5%); and

- a right-of-use asset corresponding to the amount of the liability as determined above less the reimbursement of CU1,000.

As the lessor pays for the costs immediately there is no adjustment to the lease liability for the lease incentive. The journals are as follows:

Where the lease incentive is provided to the lessee after commencement of the lease, it is taken into account in the measurement of the lease liability. MFRS 16 states the lease liability at the lease commencement date includes all unpaid fixed payments less any lease incentives receivable, as well as other unpaid components – which are discussed in more detail in our article ‘Insights into MFRS 16 – lease payments’.

Example 2 – Rent free period

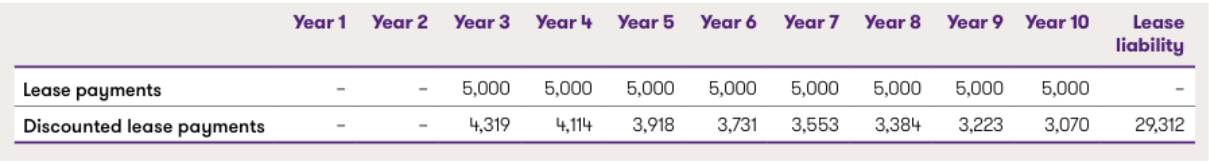

An entity agrees to enter into a lease arrangement with a new lessor. The lessor agrees to a rent-free period for the first two years as an incentive to the lessee for entering into the new lease. The lease has a term of ten years, at a fixed rate of CU5,000 per year for years three to ten.

Analysis

Even though the incentive does not generate a receivable from the lessee’s perspective at the commencement of the lease, the two-year rent-free period affects the measurement of the lease liability because of the impact of discounting.

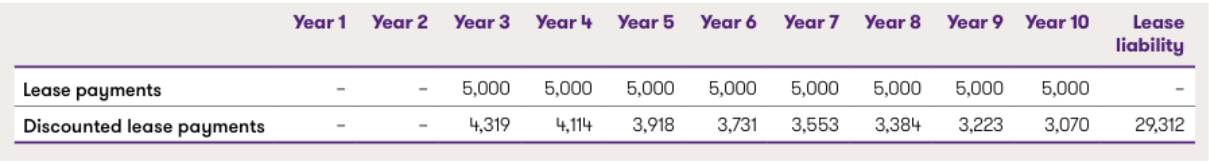

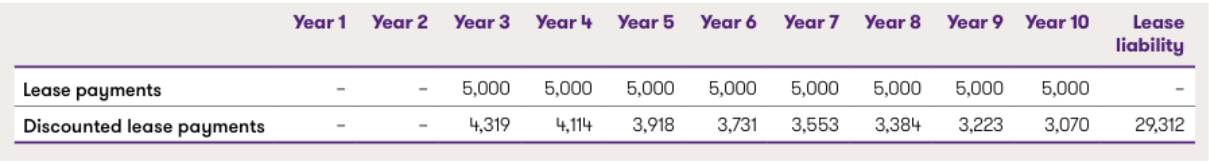

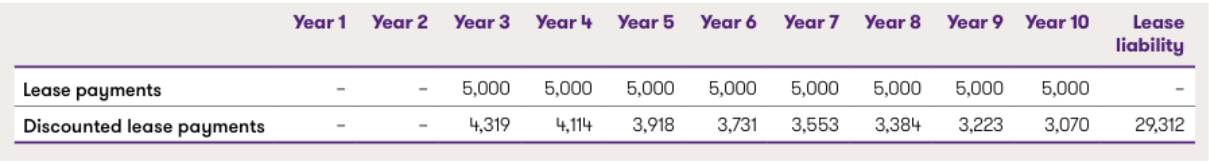

The net consideration of CU40,000 would consist of CU5,000 for each of eight years in the lease term and considering the two-year rent-free period at the beginning of the lease. The payments are discounted at a rate of 5%. The computation of the lease liability would be as follows:

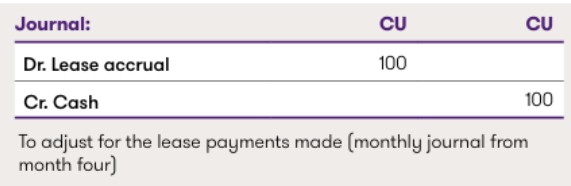

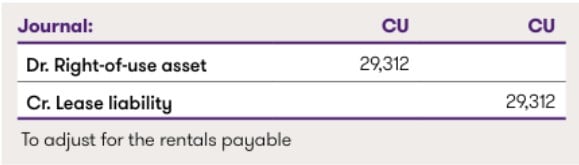

The journal entry is as follows:

As mentioned the incentive might have a different impact on the measurement of the lease liability compared to the carrying amount of the right-of-use asset, depending on the timing of the incentive. For instance, if the lessor agrees to reimburse a penalty incurred by the lessee as the result of terminating a previous lease, it would have a similar impact on the right-of-use asset as if it were a rent-free period (assuming both have a similar value). However, even if they have the same value this would have a different impact on the amount of the liability.

Example 3 – Reimbursement of a penalty

Lessee “A” agrees to transfer its headquarters from location X to location Y and enters into a new lease contract with lessor “Welcome”. Welcome has agreed to provide A with a lease incentive by reimbursing A for the penalty A paid to its former landlord C for terminating its lease early. The amount of the penalty (eg CU100) corresponds to one-year’s rent with the new lessor, however is paid at the commencement of the lease rather than adjusted against future rentals. The lease term of the new contract is ten years and the incremental borrowing rate A is using to compute the lease liability is 5%.

Analysis

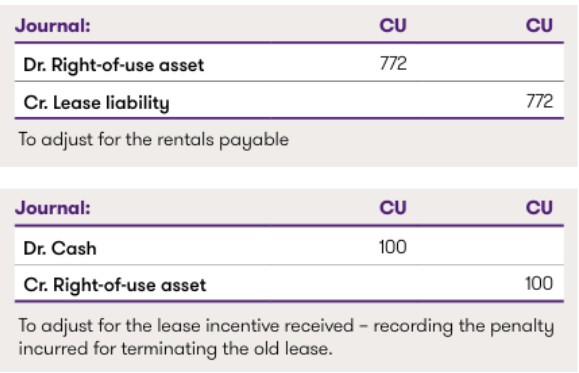

Applying MFRS 16, the lease liability corresponding to 10-year rentals of CU100 is estimated at CU772 and the value of the right-of-use asset amounts to CU672, being the amount of the liability less the upfront incentive received from the lessor at the commencement of the lease (ie CU772 – CU100). The penalty paid to the former landlord C will form part of the profit or loss on termination of the old lease (journals for the termination of the old lease not shown).

Example 4 – Rent free period plus reimbursement of legal fees

Let’s assume that the lessor “Welcome” prefers to reimburse the lessee’s penalty by adjusting the total amount of the lease payments to CU 900 ie by providing a rent free period of one year (the first year) and by assuming the legal transaction costs of CU 5 at the date of the transfer instead of making a CU 100 up-front payment at the inception of the lease.

Analysis

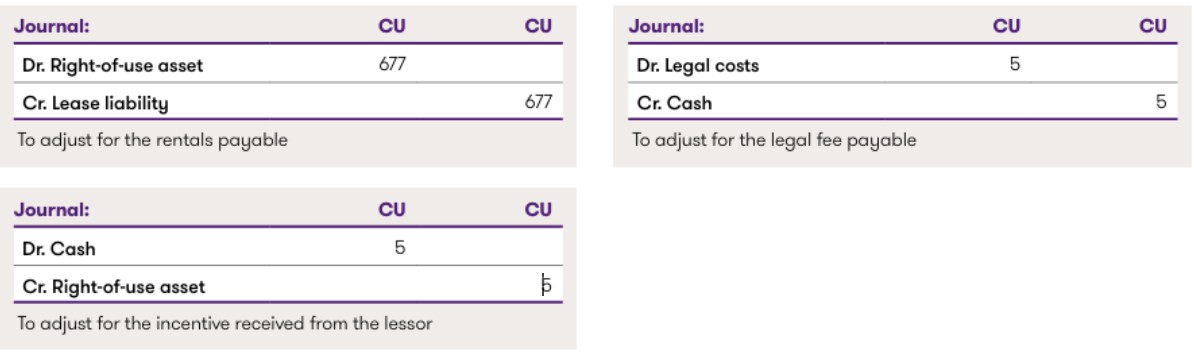

At the date of the transfer, the lease liability would be CU 677 (compared to CU 772 above) for the same carrying amount of the right-of-use asset ie CU 672 (CU 677 less the legal transaction costs of CU 5).

Most lease incentives will not require complex accounting judgement when measuring either the lease liability or the right-of-use asset (eg up-front payment, rent free period), but other more sophisticated arrangements may need a deeper analysis.

Leasehold improvement incentives

MFRS 16 does not contain explicit guidance on how to account for leasehold improvements made by the lessee or when reimbursements made by the lessor in respect of those leasehold improvements can be regarded as lease incentives. Illustrative Example 13 of MFRS 16 created some confusion on how a lessee should account for such reimbursement by stating that the lessee should apply the appropriate standard and should not account for the reimbursement as a lease incentive. Following concerns raised by stakeholders, the IASB decided to delete the reimbursement relating to leasehold improvements from Illustrative Example 13.1

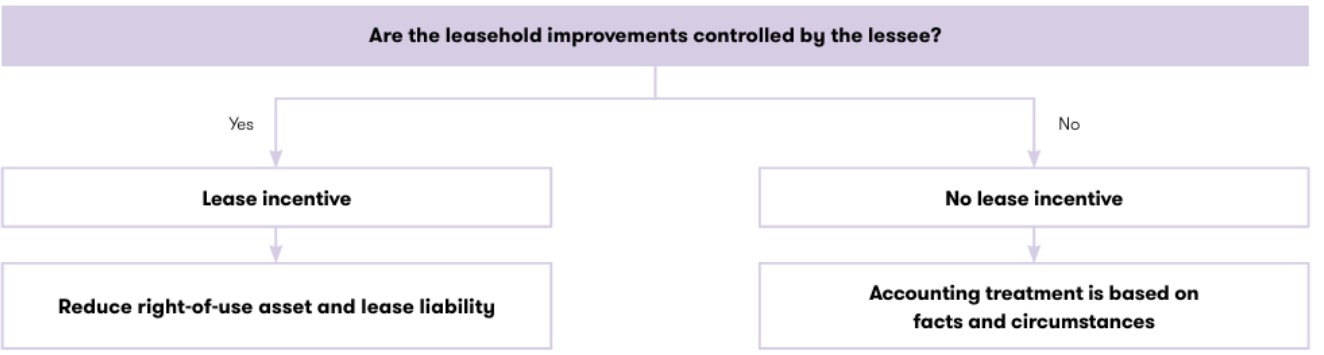

In our view, the reimbursement by the lessor of the cost of leasehold improvements that are controlled by the lessee and are accounted for as its property, plant and equipment would constitute a lease incentive and should be treated accordingly.

Conversely, where the reimbursements relate to leasehold improvements made by the lessee but which are controlled by the lessor and are accounted for in its statement of financial position then the lessor’s payment would not represent a lease incentive (but instead as a reimbursement to the lessee for a payment made on behalf of the lessor).

In our view in assessing whether the reimbursement of leasehold improvements is the reimbursement of lessee’s assets and therefore they should be a lease incentive, the lessee should consider whether:

- it is exposed to any overruns related to the construction of leasehold improvements;

- it is allowed to remove/replace the leasehold improvements without authorisation of the lessor; and

- the leasehold improvements are only useful for the lessee.

Judgement will often be required for this assessment.

Contingent lease incentives

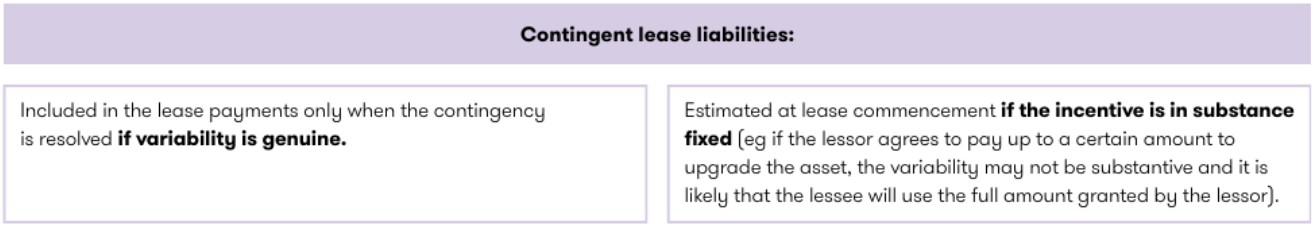

Lease contracts might also include lease incentives contingent on the occurrence of a future event. For example, the lessor may agree to reimburse the lessee for the costs of lessee’s leasehold improvements with payment contingent upon the lessee actually buying or constructing the improvements and providing evidence of the actual costs incurred.

Lease contracts might also include lease incentives contingent on the occurrence of a future event. For example, the lessor may agree to reimburse the lessee for the costs of lessee’s leasehold improvements with payment contingent upon the lessee actually buying or constructing the improvements and providing evidence of the actual costs incurred.

Lease incentives that exceed lease liabilities

There may be a lease contract structured in such a way the incentive exceeds the amount of the lease liability measured in accordance with MFRS 16. This situation may occur for instance when the contract involves lease payments that are genuinely variable, because they are based on the sales generated by a retail store and then excluded from the initial measurement of the lease liability and consequently from the right-of-use asset.

In these circumstances, any lease incentive received by the lessee at inception would raise the question of how it should be accounted for from the lessee’s perspective. In our view, and considering the specific facts and circumstances, the portion of the incentive that exceeds the lease liability should be deferred and amortised over the lease term. We believe this provides a faithful representation, particularly in circumstances where the lease incentive compensates for above-market rental payments. We observe the basic principle of deducting the lease incentive from the right-of-use asset, is the incentive being part of the lease payments. Therefore, in our view, if there is an expectation the lease will still generate a net outflow, taking the upfront payment into revenue at commencement would be inappropriate.

"There may be a lease contract structured in such a way the incentive exceeds the amount of the lease liability measured in accorfance with MFRS 16."

Example 5 – Lease incentives that exceed lease liabilities

A lessee enters into a lease for a retail store where 100% of the required lease payments are variable based on the store’s sales and are consequently excluded from the initial measurement of the lease liability and right-of-use asset. The lessor is required to pay a lease incentive of CU1 million to the lessee before commencement.

Analysis

MFRS 16 normally requires such payments to be deducted as part of initially measuring the right-of-use asset. However, as all the payments are variable there is no right-of-use asset recorded. Considering the specific facts and circumstances, we believe a deferral and amortisation approach would be the best representation of the economics of the contract.

Incentives agreed after commencement of the lease

MFRS 16 guidance on incentives only addresses incentives that are originally stated in the contract and are either paid at inception or over the lease term. The standard does not specifically deal with lease incentives which are granted by the lessor subsequent to the contract’s inception, raising the question of how they should be accounted for. For instance, such incentives could be provided by the lessor as a result of situations that might affect the temporary availability of the leased asset (eg accessibility of a retail space reduced due to refurbishment works undertaken by the lessor in the common areas of a shopping mall). Those incentives may take the form of a one-time cash payment to the lessee or a reduction of the future lease payments and are not intended to modify the other terms of the lease contract.

In our view, no matter how the incentive is provided (ie one-time cash payment or reduction of the future lease payments over a certain period) this situation would generally be considered a lease modification as it is effectively a reduction in the consideration for the lease that was not in the original terms and conditions of the contract. The lessee does not account for such modification as a separate lease as there is no change in the scope of the lease. Therefore, the lease liability would be remeasured by discounting the revised lease payments using a discount rate as of the modification date, and the carrying amount of the right-of-use asset would be correspondingly adjusted with the resulting effect in a lower depreciation expense for the remaining lease term.

Depending on the form of the “payment” of the incentive by the lessor the remeasurement of the lease liability would reflect only the effects of the change in the discount rate (one-time payment) or also the effects of the change in the future cash flows (reduction of the subsequent lease payments).

During the COVID-19 pandemic, lessors have been providing lessees with rent concessions. In response, the IASB has added a practical expedient to provide relief for lessees from lease modification accounting for rent concessions related to COVID-19. The practical expedient avoids the need for lessees to carry out an assessment to decide whether a COVID-19related rent concession received is a lease modification or not. The lessee accounts for the rent concession as if the change was not a lease modification. For more details on how to apply this practical expedient, refer to our article ‘COVID-19 Accounting for Lease modifications’.

"MFRS 16 guidance on incentives only addresses incentives that are originally stated in the contract and are either paid at inception or ovwe the lease term."

Example 6 – Incentive for the inconvenience generated by refurbishment works

Lessee A enters into a ten-year lease for 5,000 square metres of retail space in a shopping mall. At the end of year five, the lessor undertakes refurbishment works of the common areas of the shopping mall. Those works will last several months and will affect A’s activity at least during the period of refurbishment. To compensate A’s reduction of activity the lessor agrees to amend the original lease and to reduce the lease payments from CU100,000 per year to CU85,000 for the coming year (ie year six). The remaining lease payments for the subsequent periods, ie from year seven to year ten, remain unchanged. The interest rate implicit in the lease cannot be readily determined and lessee’s incremental borrowing rate at the commencement date is 6%. Lessee’s incremental borrowing rate at the end of year five is 7%. The annual lease payments are payable at the end of each year.

Analysis

The reduction of the lease payments is a lease incentive and should be computed in the new lease liability. At the effective date of the modification (at the end of year five), A remeasures the lease liability based on:

- 1. the five-year remaining lease term

- 2. annual payments of CU85,000 for year six and 100,000 for years seven to ten, and

- 3. A’s incremental borrowing rate of 7%.

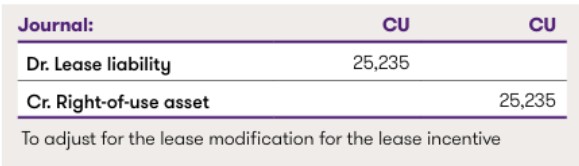

A recognises the difference between the carrying amount of the modified liability (CU396,001) and the lease liability immediately before the modification (CU421,236) of CU25,235 as an adjustment to the right-of-use asset. The journal entries would be:

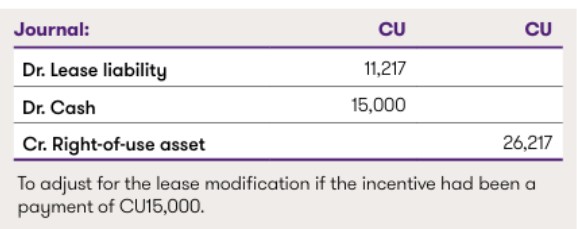

If instead of reducing the future lease payments, the lessor had made a one-off cash payment at the end of year five of say CU15,000, then the lease liability would have been remeasured using the revised discount rate of 7% (CU410,020) and the carrying amount of the right-of-use asset would have been adjusted for (i) the consideration received and (ii) the difference between the carrying amount of the modified liability (CU410,020) and the lease liability immediately before the modification (CU421,236) of CU11,217.

The journal entries would have been the following:

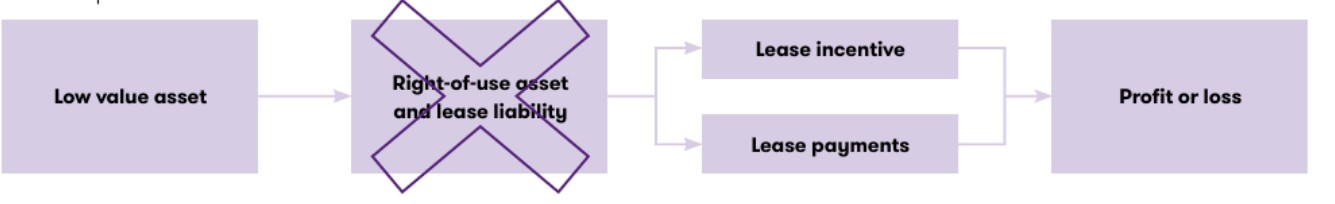

Incentives on low value assets

MFRS 16 only refers to lease incentives when determining the amount of the right-of-use asset and the lease liability that should be recognised for a lease contract. However, lease incentives can also be granted by a lessor when the lessee elects to apply the low-value asset or short-term lease exemption. This means the lessee would not have recognised a right-of-use asset and a lease liability in its statement of financial position.

In our view, a lease incentive related to a lease for which the lessee has elected to apply the low-value asset exemption should be accounted for in profit or loss, recognised on the same straight-line basis as the lease payments. This will result in a net rental expense of lease payments less lease incentives received.

Example 7 – Lease incentive on a low value printer

A lessee enters into a new lease contract for a printer which has a value of CU4,000 when new. The printer is regarded as a low-value asset from the lessee’s perspective. The lessee agrees to lease the printer for four years with no payments required for the first three months of the lease.

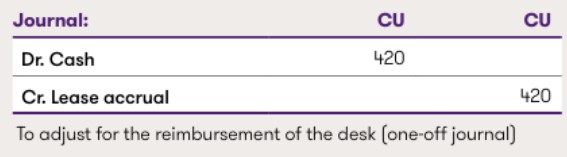

In addition, the lessor agrees to reimburse lessee for the value of the desk the lessee purchased to put the printer on in its office and which is accounted for amongst the lessee’s property, plant and equipment of CU420.

Lease payments are CU100 per month. It is assumed that the lessee benefits from the printer under the lease on a straight-line basis over the lease term.

Analysis

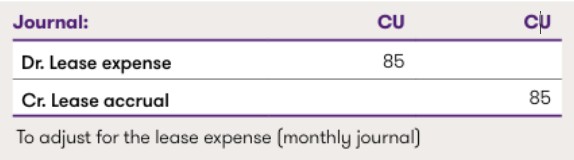

Each month, the lessee accounts for the following entry:

(1): [(48 months x CU100) – (3 months free x CU100) – (CU420)] / 48 months = CU4,080 / 48 months = CU85

When the lessor reimburses the lessee for the desk the following entry is recorded:

When the lessor reimburses the lessee for the desk the following entry is recorded: