-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

We have adopted Grant Thornton International's Horizon audit approach and Voyager software, a revolutionary paperless audit designed to achieve a consistent standard of audit service.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Our local experts

Our local experts

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

-

M&A, Restructuring & Forensics

Forensic

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

Dato’ NK Jasani, Managing Partner of SJ Grant Thornton said, “The IBR has also revealed that +52% of Malaysian businesses are expecting higher revenue for the year ahead.”

Kuala Lumpur, 2 January 2013: Hopes for a strong start to economic recovery in 2013 look to be diminishing globally especially in the United States and Europe. The latest data from the Grant Thornton International Business Report (IBR), a survey of 3,200 business leaders in 44 economies reveals that global business optimism stands at just net 4% heading into the New Year. Optimism level is at 0% this time last year.

Kuala Lumpur, 2 January 2013: Hopes for a strong start to economic recovery in 2013 look to be diminishing globally especially in the United States and Europe. The latest data from the Grant Thornton International Business Report (IBR), a survey of 3,200 business leaders in 44 economies reveals that global business optimism stands at just net 4% heading into the New Year. Optimism level is at 0% this time last year.

However, the forecast and scene is entirely different for Asia and particularly for the ASEAN nations.

Optimism in Malaysia

Malaysian business owners have expressed that they are gaining confidence on the country’s economy, pushing our position back on the positive +12% as compared to -4% this time last year.

Dato’ NK Jasani, Managing Partner of SJ Grant Thornton said, “The IBR has also revealed that +52% of Malaysian businesses are expecting higher revenue for the year ahead.”

“+42% of businesses are expecting to invest in plant and machinery and +35% are expecting profitability for the year ahead,” he continued.

Business owners in our neighbouring countries are also optimistic on the economy next year. The Philippines reigns as the most optimistic at +72% in the region followed by Singapore at +26% and Thailand at +19%. Vietnam has dropped from +34% (last year) to -10%.

The fall in global business optimism

The fall in global business optimism has been largely driven by a huge fall in the world’s largest economy, the United States. The report suggests that economic uncertainty caused by concerns over the United States ‘fiscal cliff’ and ongoing fears over the long-term viability of eurozone is dampening growth prospects.

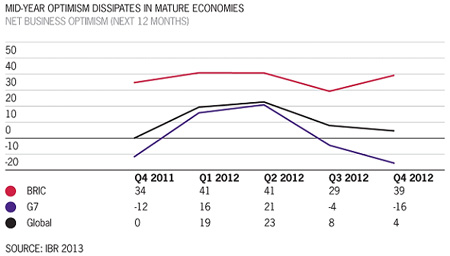

Business optimism most volatile in mature markets

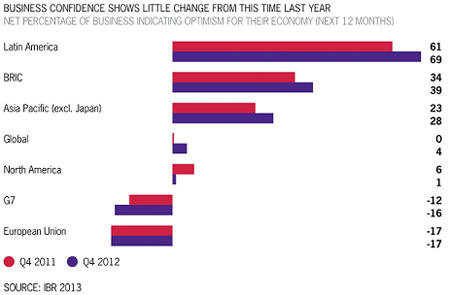

Regionally, the IBR reveals a more mixed picture. Business optimism in the emerging markets of Latin America remained relatively stable over the last year, and actually increased to 69% in Q4, up from 61% this time last year. The BRIC economies (34% to 39%) also remained consistently optimistic, while Asia Pacific (excl. Japan) has seen a rise from 23% to 28% over the same period.

By comparison, optimism in North America swung from 6% in Q4 2011 to 52% in Q2 2012, before falling back to just 1% in Q4 2012. The G7 economies have seen similar swings, while European businesses have reported a slow decline in business optimism.

Dato NK Jasani added: “The upswing in mature economy business optimism we saw in the first half of 2012 followed pronouncements by the ECB and the Federal Reserve on the level of support they were prepared to provide their respective economies. However, this confidence has dissipated over the second half of the year. By contrast, emerging economies have remained far less volatile. It’s a fascinating trend which drives home where the major problems in the global economy lie at present.

“Economic uncertainty understandably elicits a ‘wait and see’ policy from businesses, but we would urge owners not to lose sight of their long-term growth objectives. Opportunities exist for those dynamic businesses which are prepared to balance reason with instinct in their decision making.

Those that lock in their best people be pro-active in marketing and back-up planning and invest to be first out of the gate in a recovery are likely to find themselves ahead of the competition.”

For more information please contact:

Sharon Sung, Technical and Corporate Affairs Partner, T +60 3 2692 4022,

Charmane Koh, Corporate Affairs Assistant Manager, T +60 3 2692 4022,