Our ‘Insights into MFRS 3’ series summarises the key areas of the Standard, highlighting aspects that are more difficult to interpret and revisiting the some relevant features that could impact your business.

This article sets out the definition and underlying principles of fair value, gives a brief overview of permissible valuation techniques and presents MFRS 3’s specific guidance on fair value measurement.

MFRS 3’s measurement principle

The identifiable assets acquired and liabilities assumed in a business combination are measured in accordance with the general measurement principle in MFRS 3 which states they should be measured at their acquisition-date fair values. However, there are a few exceptions to this measurement principle, which are discussed in our article ‘Insights into MFRS 3 – Specific recognition and measurement provisions’ which will be released later.

If an identifiable asset or liability has a quoted price in an active market (for example, listed shares), this price should be used as fair value. However, few assets and even fewer liabilities have such quoted prices. So in many cases, fair value then needs to be estimated using a valuation technique. As a result estimating fair values can be a complex exercise requiring considerable management judgement and many acquirers engage professional valuation specialists to assist in this stage of the process.

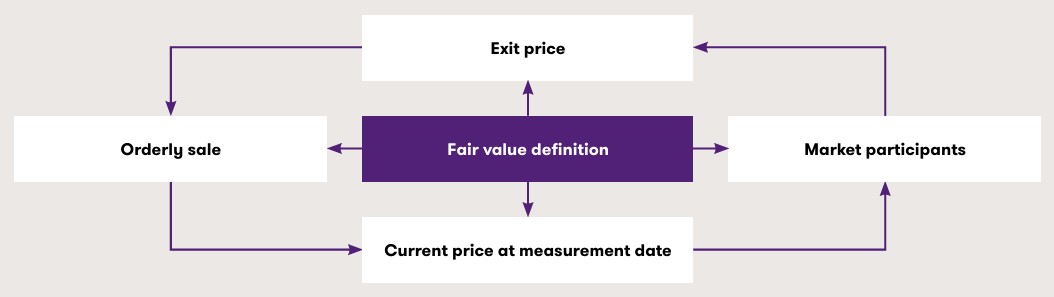

Fair value definition:

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Fair value is defined in MFRS 13 ‘Fair Value Measurement’ as follows:

A number of concepts are embodied in this definition. Firstly, it clarifies fair value is an ‘exit’ price – for example it refers to the transfer of a liability rather than settlement. Secondly, it assumes an orderly sale or transfer (ie not a forced transaction or a distressed sale).

Thirdly, there is an explicit reference to ‘market participants’, emphasising fair value is a marketbased concept and not an entity specific value. Finally, MFRS 13 clarifies fair value is a current price at the measurement date (eg the acquisition date in a business combination).

Fair value estimates have a pervasive effect on business combination accounting. Aside from measuring identifiable assets acquired and liabilities assumed, the acquisition method uses fair value to measure:

- consideration transferred

- any previously held interest in the acquiree

- any present ownership interests in the acquiree retained by non-selling shareholders, referred to in MFRS 3 as noncontrolling interests (NCI), but only if that measurement method (ie fair value) is elected for those interests that entitle their holders to a proportionate share of the entity’s net assets in the event of liquidation. Refer to our article ‘Insights into MFRS 3 – Recognising and measuring noncontrolling interest’ for more details.

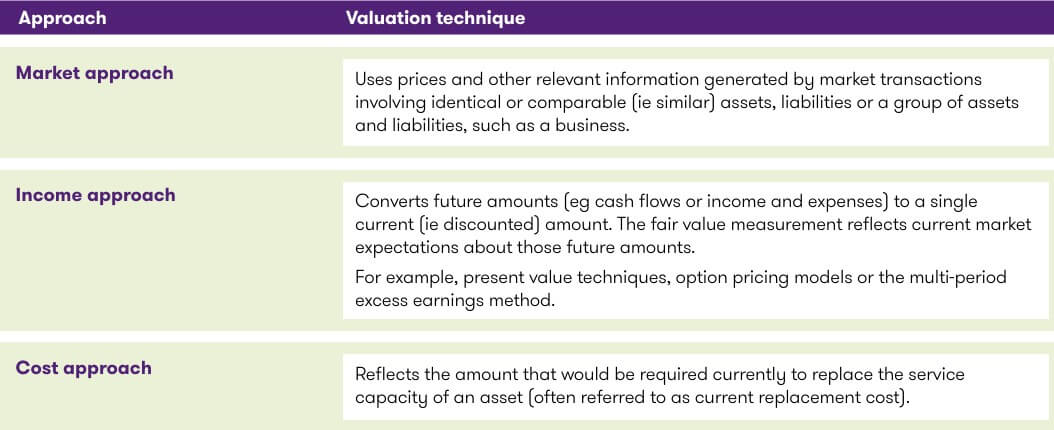

Valuation Approaches under MFRS 13

MFRS 3 defines fair value (consistently with MFRS 3) but does not provide detailed guidance on the valuation methodology and instead refers to MFRS 3 for valuation models and techniques. MFRS 3 does however include limited guidance on some specific situations.

With respect to MFRS 13, the Standard notes there are three widely used ‘families’ of valuation techniques (see the following) that can be grouped into three broad approaches and states entities should use valuation techniques consistent with one or more of them to measure fair value:

The complexity of the valuation depends on the asset or liability in question and management judgement is required to not only select the most appropriate valuation technique but also to determine all relevant inputs and material assumptions. Some valuations require specialist expertise and may need to engage a valuation professional.

Whether or not a valuation professional is engaged, management’s involvement in the process and in developing assumptions should be commensurate with its overall responsibility for preparing the financial statements.

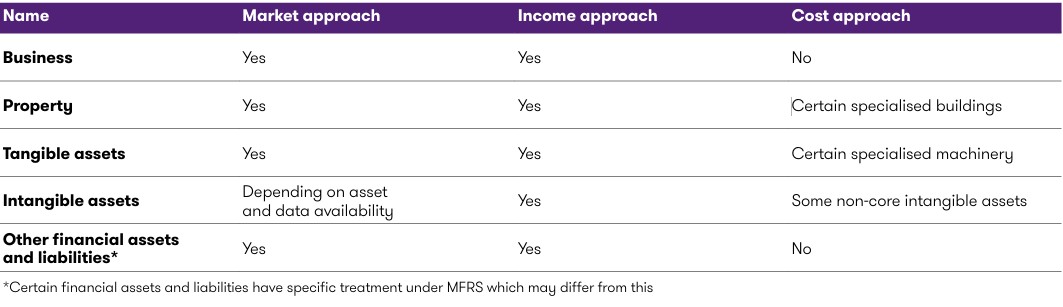

The valuation techniques are commonly used as follows:

Whichever technique is used, the resulting valuation should be consistent with the definition and underlying concepts of fair value. The acquirer should ensure the valuation:

- has an objective to estimate the price that would be paid or received in a hypothetical sale or transfer to other market participants (ie potential buyers and sellers)

- uses techniques and assumptions that are consistent with how other market participants would determine fair value

- does not take account of factors that are specific to the actual acquirer, such as the acquirer’s intended use of an asset or synergies that would not be available to other market participants

- reflects conditions at the acquisition date

- prioritises observable market inputs when available, and

- incorporates MFRS 3’s specific guidance, as applicable.

For more information on MFRS 13’s guidance on fair value measurement, please refer to our article ‘Insights into MFRS 13 Fair Value Measurement’.

MFRS 3’s specific guidance on fair value measurement

MFRS 3 provides guidance on the determination of fair value in specific situations, as follows:

Assets with uncertain cash flows (valuation allowances)

The acquisition-date fair value of assets such as receivables and loans should reflect the effects of uncertainty about future cash flows. A separate valuation allowance should not be recognised.

Assets subject to operating leases – acquiree is the lessor

If the acquiree is the lessor (of say a building), when measuring the acquisition date fair value of the lessor’s underlying asset, the terms of the operating lease are taken into account. No separate asset or liability is recognised on acquisition even if the operating lease terms are either favourable or unfavourable when compared with market terms.

Assets that the acquirer intends not to use or to use in a way that is different from the way other market participants would use them

Fair value should be determined in accordance with the asset’s expected use by market participants (highest and best use) and should not be affected by the acquirer’s intended use of the asset.

Concepts of fair value

Example 1 – Fair value and buyer intentions

Entity A acquires a competitor, Entity B. The identifiable assets of Entity B include its trade name, under which Entity B’s products are marketed to its customers. Entity A plans to discontinue any marketing support to the acquired trade name and migrate Entity B’s customers to its own products.

Entity A intends to retain the trade name to prevent competitor access to Entity B’s products. Two valuations of the acquired trade name were determined: 1) estimated market value derived from other recent market transactions and 2) a lower value-in-use calculation based on the plan to discontinue its use.

Analysis

In this situation, the fair value of the acquired trade name is based on the price that could be obtained in an orderly, arm’s length transaction with other market participants.

The higher valuation based on evidence of the estimated market value derived from other recent market transactions should be used and the acquirer’s plan to discontinue the use of the trade name should not affect the valuation.

Matters to consider after the acquisition date

This type of asset is commonly referred to as a defensive intangible asset. The value of a defensive intangible asset is expected to diminish over a period of time resulting mainly from the lack of marketing support and exposure. For this reason, the immediate impairment of the asset may not be appropriate. Determining the useful life of the asset, however, can be difficult.

Since there is no intention to use the trade name, the useful life may then be viewed as the period of time for which holding the trade name will be effective in discouraging competition. It is expected this would be a fairly short period, as the value of an unsupported trade name diminishes rather quickly.

Example 2 – Identifying comparable market transaction

An acquirer is determining the fair value of the acquiree’s parcel of land in an industrial park. An analysis of recent sales in similar locations indicated a diversity in transaction prices per unit of area. Further analysis identified some ‘outlier’ prices related to:

- a sale of land by a company in liquidation;

- a sale between related parties; and

- a sale to a developer of a property for which planning consent for conversion to residential use has been obtained.

Analysis

In this situation, judgement will be required to identify those recent market transactions that are relevant from a fair value perspective. A liquidation sale may be a distress sale rather than a willing seller.

A related party sale may not be at arm’s length. The price the developer paid is likely to reflect the planning consent and the highest and best use of that specific property.

Further analysis is required to assess whether possible alternative uses (including, if applicable, the likelihood of planning consent) would be taken into account by market participants in agreeing a price for the acquired property.

Guidance on fair value measurement of specific items

Inventory

Fair value of inventory acquired in a business combination is often different from the carrying amount of the same inventory in the acquiree’s books at the date of acquisition.

This is because fair value represents an exit price, ie a price that a market participant would receive to sell the inventory in its principal (or most advantageous) market, instead of a ‘historical cost’ concept.

The complexity of the calculation of the amount of the adjustment to make to the carrying amount of the inventory usually depends on the nature of the inventory acquired and the industry in which the acquiree operates:

Raw materials

Usually determined using current replacement cost.

Work-in-progress

Usually determined as the estimated selling price of the related finished goods in the ordinary course of business, less:

- the estimated costs of completion

- the estimated costs necessary to make the sale, and

- a reasonable profit allowance for the completing and selling effort, based on the profit for similar finished goods.

Finished goods

Usually determined as the estimated selling price of the finished goods in the ordinary course of business less:

- the estimated costs necessary to make the sale, and

- a reasonable profit allowance for the acquirer’s selling effort, based on the profit for similar finished goods.

Fair Value Measurement of Inventory in Business Combinations

The methods described above for measuring fair value of work-in-progress and finished goods aim to ensure that the fair value of the inventory acquired includes the profit generated by the selling and other efforts (manufacturing) of the acquiree before the date of acquisition as this profit does not belong to the acquirer and as such the acquirer cannot recognise it.

Deferred revenue

Deferred revenue is an obligation to transfer products or services to a customer because a payment has already been obtained (or an amount is due) from the customer.

As part of a business combination transaction, an acquirer recognises deferred revenue as a part of the liabilities they assumed if the acquiree still has an obligation to provide goods or services after the date of acquisition.

As fair value is defined as an exit price, fair value of deferred revenue represents a price a market participant is willing to pay to assume the obligation to which the deferred revenue relates.

As such fair value of deferred revenue is usually different from the acquiree’s carrying value. Measurement of this amount can be complex and may require a significant use of judgement in certain circumstances.

A method frequently seen in practice to measure fair value of deferred revenue is called the ‘build-up’ or ‘bottom-up’ approach.

Conclusion

Under this method, an acquirer determines the fair value of deferred revenue based on an estimate of the direct and incremental costs a market participant must incur to fulfil the performance obligation after the date of acquisition, plus a ‘reasonable’ profit margin for the products or services provided and a premium for any risks assumed.

The ‘reasonable’ profit margin should consider the different types of work that a market participant would need to perform to complete any remaining performance obligation.

MFRS 3

How should the identifiable assets and liabilities be measured? Read our publication to know more.

How we can help

We hope you find the information in this article helpful in giving you some insight into MFRS 3. If you would like to discuss any of the points raised, please do not hesitate to contact us.