The Budget 2020, themed ‘Shared Prosperity: Sustainable And Inclusive Growth Towards High Income Economy’ will be tabled in Parliament on 11th October 2019. Budget 2020 is said to reflect the Government’s ongoing policy shift towards high-quality growth to achieve developed nation status. Can the budget achieve a sustainable and inclusive growth for our nation? Will the budget also benefit all segments of our society?

Programme - Kuantan

08.30am Registration & Networking

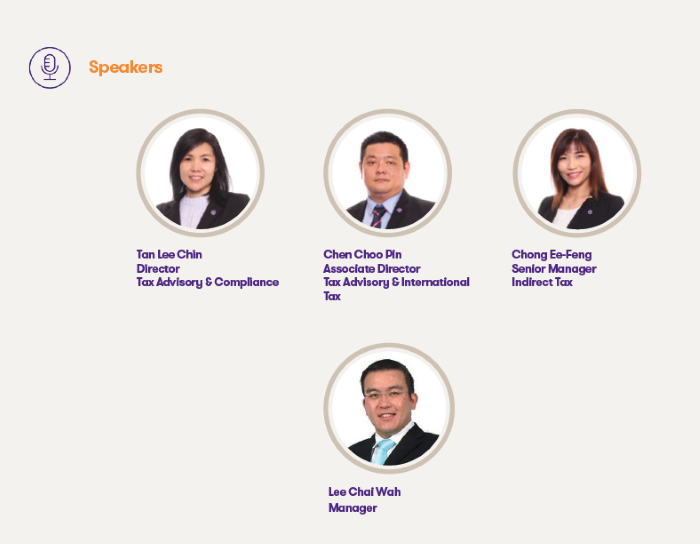

09.30am Overview of 2020 Budget

Lee Chai Wah, Manager

10.00am 2020 Budget Highlights (Personal and Corporate Tax)

Tan Lee Chin, Director of Tax Advisory & Compliance

Chen Choo Pin, Associate Director of Tax Advisory & Compliance

11.30am 2020 Budget Highlights (SST)

Chong Ee-Feng, Senior Manager of Indirect Tax

12.30pm Q&A Session

01.00pm Lunch / End of seminar

Seminar fee

• RM220 nett per participant (Grant Thornton clients/alumni) or

RM240 nett per participant (non-clients) inclusive of 6% service tax.

• Enjoy a group discount of 10% for 3 or more registrations from the same organisation.

• Fee includes seminar materials, refreshments and lunch.

• Certificate of attendance will be given to all participants for registration of CPE/CPD points with the relevant professional bodies.

Registration by 1 November 2019.

Mr. Lee Chai Wah / Ms. Han Siew Bueh

Grant Thornton Malaysia (AF: 0737)

A105-A, 1st Floor

Sri Dagangan, Jalan Tun Ismail

25000 Pahang

T (609) 515 6124, 012 262 6111

F (609) 515 6126

E chaiwah.lee@my.gt.com / siewbueh.han@my.gt.com

- Kuantan