Applying MFRS 107 Statement of Cash Flows gives rise to a number of interpretive and application issues. Increasingly, regulators and other commentators on financial statements are highlighting errors or inconsistencies in application of the standard.

This series of Hot Topics aims to provide selected guidance to identify

and address some of the common pitfalls and difficult interpretative issues

arising from the application of MFRS 107.

Definition of cash and cash equivalents

General

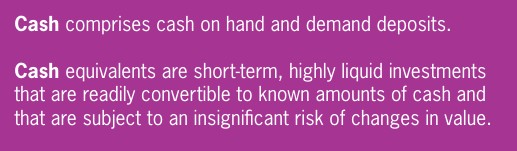

The statement of cash flows reflects movements in cash and cash equivalents. The definitions of these terms are therefore central to its proper preparation.

MFRS 107.6 provides the following definitions:

MFRS 107.7 goes on to explain that cash equivalents are held for the purpose of meeting short-term cash commitments rather than for investment or other purposes.

MFRS 107 does not define ‘short-term’ but does state ‘an investment normally qualifies as a cash equivalent only when it has a short maturity of, say, three-months or less from the date of acquisition’ (MFRS 107.7). Consequently, equity or other investments that do not have a maturity date are excluded from cash equivalents unless they are, in substance, cash equivalents (see ‘Money market funds’ below). This three-month time limit is somewhat arbitrary but is consistent with the concept of insignificant risk of changes in value and a purpose of meeting short-term cash commitments. In our view, exceptions to this three-month time limit are rare and investments with a longer maturity at inception may be included in cash equivalents only if there is strong evidence to show that they are, in substance, cash equivalents (see discussion of ‘Demand deposits and other types of deposit accounts’ for examples).

Any investment or term deposit with an initial maturity of more than three months does not become a cash equivalent when the remaining maturity period reduces to less than three months.

Bank overdrafts are generally classified as borrowings but MFRS 107.8 notes that if a bank overdraft is repayable on demand and forms an integral part of an entity’s cash management then it is included as a component of cash and cash equivalents. A characteristic of such a banking arrangement is that the bank balance often fluctuates from being positive to overdrawn.

Demand deposits and other types of deposit accounts

MFRS 107 does not provide a definition of demand deposit. In practice, these are generally considered to be deposits with financial institutions that are repayable on demand within one working day and without penalty.

Other types of deposit accounts need to be considered carefully to assess whether they are classified as cash equivalents. Examples include:

- fixed-term deposits (ie deposits with a fixed maturity, often referred to simply as ‘term deposits’)

- open-ended or perpetual deposits requiring a period of notice for withdrawal without penalty

- longer-term deposits with early withdrawal provisions subject to some form of penalty, such as loss of interest.

Inclusion of these other deposit accounts within cash equivalents depends on both:

- the terms of the deposit or investment account (short maturity, convertible to known amounts of cash, insignificant risk of changes in value)

- the purpose for which it is held (to meet short-term cash commitments rather than for investment or other purposes).

Many open-ended or perpetual deposit accounts (ie those with no stated maturity date) offer a marginally better rate of interest than demand deposits but require some period of notice for withdrawal without penalty (ie interest is earned at the stated rate until the date of withdrawal). Entities will often use such accounts to temporarily hold cash required for working capital cash management if the withdrawal period is reasonably short. If the notice period is less than three-months, then the deposit account can be classified as a cash equivalent if the cash is intended to be used to meet short-term cash commitments.

Longer-term deposits with early withdrawal provisions subject to a penalty present particular issues. If an entity places cash in a deposit account with a stated maturity of over three months, but with early access subject to a significant penalty, it is unlikely that the intended purpose is to meet short-term cash commitments. The significant penalty also casts doubt on whether the conversion into cash is possible without a significant loss of value. The investment is unlikely to be classified as a cash equivalent for those reasons.

However, there may be limited circumstances where classification of a longer-term deposit with early withdrawal provisions subject to a penalty as a cash equivalent is appropriate. The entity may be hopeful that identified short-term cash commitments can be satisfied from its forecast or budgeted cash flows but place some cash in a term deposit with early access in case the forecast cash inflows do not materialise. In such cases, the terms and conditions of these deposits need to be carefully reviewed at the inception of the deposit to identify if it can be classified as a cash equivalent. It is critical that, at inception, the term deposit can be converted to known amounts of cash with insignificant risk of change in value. This usually means that the terms for early withdrawal are not punitive (which would in turn mean that the interest rate for the full term is less than it would be for the same term with no early access). The entity’s past practices in managing these deposits, and their role in its overall cash and treasury management strategy, are also relevant.

Example – Term deposits

Entity A recently sold surplus plant and machinery for cash proceeds of CU250,000. Management decide to deposit the funds with the bank in two term deposit accounts as follows:

- a. CU175,000 into a 12-month term account, earning 4.5% interest. The cash can be withdrawn by giving 7 days’ notice but the entity will incur a penalty, being the loss of all interest earned. Analysis

- b. CU75,000 into a 12-month term account earning 3.5% interest. The cash can be withdrawn by giving 7 days’ notice. Interest will be paid for the period of the deposit but only at the rate of 3%, which is equivalent to the bank’s stated rate for short-term deposits.

Management are confident that they will not need to withdraw the cash from the higher-rate deposit within the term, but want to keep easy access to the remaining CU75,000 to cover any working capital shortfalls that might arise.

Analysis

An investment in a term deposit can be classified as a cash equivalent only when it is held for the purpose of meeting short-term cash commitments and is convertible into known amounts of cash, subject to an insignificant risk of change in value:

- a. although the principal will be fully recoverable with early withdrawal, the entity will lose all accumulated interest over the term, which seems to be a significant penalty. The cash is not needed to meet short-term cash commitments and so would not qualify as a cash equivalent.

- b. although the deposit is stated to have a 12 month maturity period, it can be withdrawn with 7 days’ notice. Although this incurs a penalty, the reduction in the rate of interest from 3.5% to 3% is unlikely to be considered significant. The intention of management is to keep these funds available for short-term cash needs and so this deposit is likely to qualify as a cash equivalent.

Money market funds

Money market funds are investment vehicles that invest in relatively short-term (usually between one day and one year) debt instruments such as treasury bills, certificates of deposit and commercial papers. In some jurisdictions the description ‘money market fund’ can be used only by funds that meet defined criteria and are subject to specific legal and regulatory requirements. As the main purpose of the investment is usually preservation of principal with modest dividends, they are generally regarded as being at low risk of significant changes in value.

Shares or units in these funds are typically redeemable with little or no notice period, at a redemption value based on the share of net assets of the fund. Because the redemption value is based on a net asset value, rather than a fixed amount of cash, the legal form is not consistent with the definition of cash equivalents. However, in limited cases these investments are nonetheless regarded as cash equivalents in substance.

In our view it is acceptable to classify an investment in a money market fund as a cash equivalent only if there is sufficient evidence that, in substance, the definition of cash equivalents is satisfied. In particular, it is not sufficient that the investment can readily be realised in cash. The investment must be readily convertible (normally through redemption with the fund) to an amount of cash that is subject to an insignificant risk of change. The assessment of risk must be done at the time of the initial investment. This assessment would include a review of the fund’s investment rules, the nature of its underlying investments and the stability of the redemption value. Again, the entity’s past practices in managing these investments, and their role in its overall cash and treasury management strategy, are also relevant.

Example – Money market funds

Entity A holds units in two money market funds that are redeemable on demand at net asset value:

- a. high-returns fund – the fund aims to achieve superior returns and may invest in longer-term (up to 2 years) sovereign and corporate bonds to do so, including some bonds with higher credit risk. During the year, entity A invested CU80,000 in this fund and recorded a related fair value gain of CU9,300 in profit or loss. Two weeks after the reporting date, entity A converted the investment into CU87,900 cash (ie CU1,400 less than the year-end value)

- b. short-term fund – the fund holds a low risk portfolio of short-maturity, low credit risk investments designed to achieve a stable level of income while maintaining the value of each unit at close to nominal value. The entity uses this fund to ‘park’ surplus cash and invested CU100,000 in this fund at the beginning of the year. The entity will convert this into cash whenever needed to satisfy any working capital shortfalls or other cash needs.

Analysis

An investment in a money market fund can be classified as an ‘in substance’ cash equivalent only when it is held for the purpose of meeting short-term cash commitments, and is convertible into an amount of cash that is subject to an insignificant risk of change.

- a. high-returns fund - although the investment in the high-growth fund is readily convertible into cash, the high risk portfolio and observed exposure to changes in value determine that it is not a cash equivalent.

- b. short-term fund - by comparison, the low risk fund seems to be subject to an insignificant risk of change in value. The investment is readily convertible into cash and is held to meet short-term cash commitments. It is therefore likely to be classed as a cash equivalent.

‘Restricted’ cash

Sometimes, cash deposits are described as ‘restricted’ because they are set aside for a specific purpose and are either notionally or legally ‘ring-fenced’. The nature of the restriction needs to be considered to identify whether the deposit can be classified as cash or cash equivalent.

For example, a bank account may be subject to a floating charge to provide general security for a loan or loans. Such a charge is unlikely to restrict the account from being classified as cash or cash equivalent (assuming the other criteria are met), because a f loating charge does not restrict the use of the account for normal trading purposes. This may be compared to a deposit account subject to a fixed charge which is held as security for a specific loan. The charge may prevent the deposit account from being used for any purpose other than providing the lender with a right of set-off to secure repayment of the loan if the borrower defaults on the scheduled payments. The restriction in this case would prevent classification as a cash equivalent because the deposit cannot be converted into cash ‘on demand’ and is not available to meet shortterm cash needs.

Another situation is a ‘client money’ account used by an entity such as an insurance broker or travel agent. Before considering MFRS 107 classification, an assessment should be made as to whether the client money account should be recognised as an asset by the entity in its statement of financial position. If the entity does not recognise the client money account it does not appear in the cash flow statement.

In a group situation, there may be restrictions on the transfer of monies from a foreign subsidiary to the parent because of exchange control restrictions. This restriction would not prevent classification as cash or cash equivalent in the consolidated f inancial statements, provided it meets the definition as such in the subsidiary.

Where a restriction applies but does not prevent classification as cash or a cash equivalent, the nature of the restriction needs to be disclosed (MFRS 107.48). If the restriction prevents classification as a cash equivalent, this may need to be shown as a separate item in the reconciliation of cash and cash equivalent balances with the appropriate line items in the statement of financial position.

Example – Restricted cash: designated account

Entity A is a property company. During the year it has secured CU5m of finance, which is ring-fenced for use only for a specific development. The funds are held in a designated bank deposit account to be used only for the purposes of the specific development project, which is expected to take 3 years to complete. Withdrawals from the account can only be made with the approval of the lender when specified milestones are met. At the year end, CU1m of the fund has been used on the development and CU4m remains in the designated account.

Analysis

In this situation, the money has been obtained in order to support long-term cash needs, being the completion of the development over the three-year period. Although the designated account may not have a specified term, withdrawals can only be made to pay for actual expenditure when certain conditions are met on the specified project, which is expected to occur over the three-year lifespan of the project. Consequently, the account is not available ‘on demand’ and is not available to meet short-term cash commitments. Consequently, it will not meet the definition of cash equivalents. The balance in the designated account at the reporting date is likely to be included in the ‘cash at bank’ line item in the statement of financial position so adequate disclosure on the amount of and the reasons for the restrictions should be given in a note.

Example – Restricted cash: Government restrictions

Entity A has a wholly owned subsidiary Entity B, which holds bank accounts with domestic banks. Entity B can use the money freely within its local jurisdiction and classifies the amounts as cash and cash equivalents in accordance with IAS 7, but Government restrictions prevent it from remitting cash abroad to Entity A or to any fellow subsidiary outside the local jurisdiction.

Analysis

Entity B has appropriately classified the amounts as cash and cash equivalents in its individual financial statements and it seems likely that this is still an appropriate classification in the consolidated financial statements. However, the amounts are only available to meet the short-term cash commitments of the subsidiary, Entity B. The restriction preventing remittance to the rest of the group should be disclosed in sufficient detail to enable users to understand the impact on the group’s financial position and liquidity.