On 24 September 2024, the Advisory Committee on Sustainability Reporting (ACSR) with the support of the Ministry of Finance Malaysia, chaired by the Securities Commission and comprising of members from the Audit Oversight Board, Bank Negara Malaysia, Bursa Malaysia, Companies Commission of Malaysia and the Financial Reporting Foundation, has launched the National Sustainability Reporting Framework (NSRF).

In the keynote speech by our Minister of Finance II, YB Senator Datuk Seri Amir Hamzah Azizan during the launch of NSRF, he said “Malaysia now joins more than 20 jurisdictions, collectively representing 55% of global GDP, which have decided or taking steps to use the ISSB Standards”. This marks another significant step forward in the Malaysia’s commitment to integrating sustainability at the core of its economic development.

The National Sustainability Reporting Framework (NSRF)

The NSRF addresses the use of IFRS Sustainability Disclosure Standards issued by the International Sustainability Standards Board (ISSB), specifically the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosure (ISSB Standards) as the baseline sustainability disclosure for companies in Malaysia as well as the assurance requirements for sustainability reporting.

By adopting the ISSB Standards, corporate Malaysia is able to provide consistent, reliable and comparable sustainability information to enhance Malaysia’s competitiveness and attractiveness to investors.

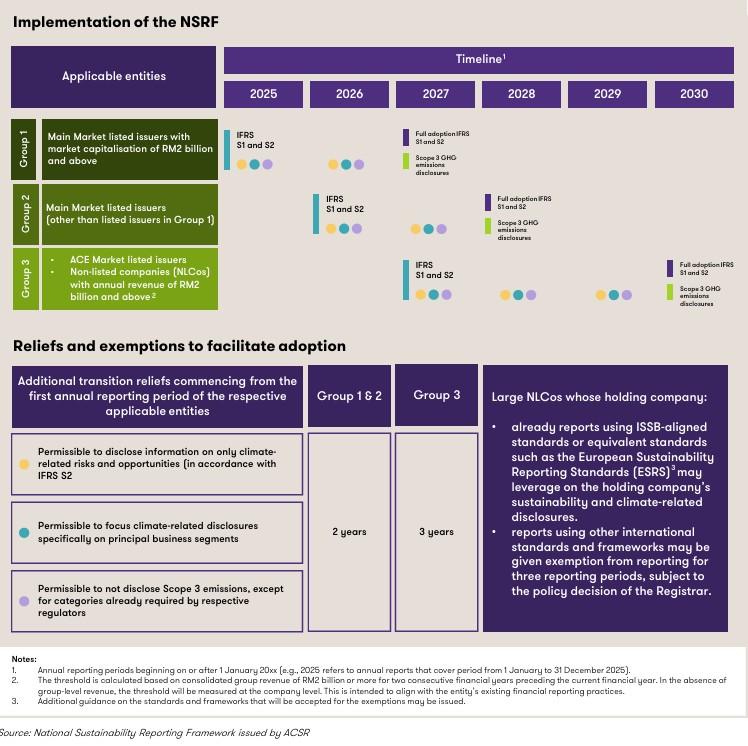

The ACSR is cognizant of varying maturity of companies’ readiness to use the ISSB Standards, their sustainability reporting practices, level of resources and expert capabilities. As such, the NSRF will be implemented through phased and developmental approach with implementation support initiative by ACSR referred to as PACE (Policy, Assumptions, Calculators and Education) – an implementation support hub for NSRF. Further, ACSR has incorporated proportionality mechanisms into NSRF, along additional transition reliefs. The proportionality mechanisms are in line with what ISSB had introduced within the ISSB Standards.

The NSRF approach in moving forward is:

Sustainability Assurance

Timing

Proposed reasonable assurance on Scope 1 and Scope 2 GHG emissions after 2 years initial adoption of the ISSB Standards starting with Group 1 for annual reporting periods beginning on or after 1 January 2027, Group 2 – 1 January 2028 and followed by Group 3 – 1 January 2029. The proposed timeline for mandatory reasonable assurance is subject to further consultation.

Assurance Standards

Expected to be performed in accordance with the assurance standards as adopted by the Malaysian Institute of Accountants (MIA). The assurance framework will be subjected to further consultation and engagements with the relevant stakeholders.

On a side note, the International Auditing and Assurance Standards Board (IAASB) has recently approved the International Standard on Sustainability Assurance 5000 (ISSA 5000) which serves as a global baseline for sustainability assurance. This standard is neutral, profession-agnostic, and interoperable with ethical frameworks, enabling high-quality, independent assurance across various sustainability reporting standards. The IAASB expects to publish the standard by the end of the year with guidance and application materials scheduled for release in January 2025. The adoption of ISSA 5000 in Malaysia is still under discussion.

Location of disclosures and timing of reporting

Applicable entities shall adhere to their respective regulator’s requirements on the location of disclosures and timing of reporting.

Related legal instruments and policy of documents

Consequential amendments to the relevant legislation, rules, and guidelines shall be undertaken to adopt this framework, which include and are not limited to the following:

- a. Financial Reporting Act 1997;

- b. Companies Act 2016;

- c. Securities Commission Malaysia Act 1993;

- d. Capital Markets and Services Act 2007;

- e. Bursa Malaysia’s Main Market and ACE Market Listing Requirements; and

- f. Relevant standards issued by Bank Negara Malaysia.

In tandem with this, Bursa Malaysia has issued a public consultation paper with regards to the consequential amendments to the Main Market and ACE Market Listing Requirements in relation to the NSRF. The public consultation will be closed on 25 October 2024.

What’s Next for Companies

All companies within the reporting scope should start considering action plans. To prepare for the adoption of the ISSB Standards and other related sustainability requirements within NSRF, companies can consider the following actions:

Determine the Approach to Governance

Consider both board and management oversight in identifying, assessing, and managing climate-related risks and opportunities, as well as in the reporting process itself.

Identify Gaps and Recalibrate the Action Plan

Determine what additional disclosures, resources, and management actions are needed to meet the new reporting requirements.

Assign Responsibility

Convene a cross-functional working group with representation across all key functions (Sustainability, Finance, Risk, Legal, Human Resources, Procurement, etc.). Determine whether additional capacity is needed for immediate uplift and/or longer-term implementation.

Increase Awareness and Build Capability Across the Organisation

The company’s approach to climate risk and opportunity management should not be confined to a few key personnel. This requires a whole-of-business response, necessitating training and development.

Enhance Data Metrics Measurement and Governance

For example, improve the measurement of Scope 3 GHG emissions. Determine metrics for identified climate-related risks and opportunities, and establish internal monitoring and control processes.

Relevant sustainability services we offer to our clients: