Going public comes with many benefits covering brand visibility and prestige, business and customer growth and valuations, but it also means the start of a new life in the public spotlight.

While there may be multiple reasons to consider a listing, an IPO is a long-term project, which requires commitment by various stakeholders and senior management. The IPO event requires significant planning and execution strategy by the company to navigate multiple challenges.

Challenges include regulatory compliances, complex accounting rules and reporting requirements, pressures on time and resources, creating governance structure and boards and management of all stakeholders including employees, customers, board and shareholders.

Key advantages of listing

Raise funds

An IPO helps a company meet its financial obligations through issue of fresh share capital.

Enhanced visibility

Listing helps in enhancing brand awareness. This plays an important role in enhancing goodwill and reputation of the company.

Liquidity and marketability of shares

Once listed on the stock exchange, the company’s shares become marketable and liquid which further motivates investors to own a stake in the company.

Increased trust of stakeholders

Listing ensures compliance with the rules and regulations of stock exchanges. This boosts the confidence of the company’s stakeholders to further invest in the company.

Possibility of takeovers

Listing of securities can help companies for M&A and use shares as currency.

Employee motivation through ESOPs

When a company is listed, the company can use its shares to attract talents via ESOPs (Employee Stock Ownership Plans).

IPO journey cycle

Key considerations

1. Evaluate IPO readiness and IPO plan

- Assessing IPO readiness

- Creating a compelling equity story

- Culture transformation

- Building the project management team and choosing right advisers

- Choosing the right place to list

2. Executing the IPO plan

- Getting your house in order

- Enabling financial reporting

- Robust internal controls and management reporting framework

- Ensuring corporate governance

- Creating capital and legal structure

- Engaging anchor investors, including PE/VCs and brand positioning

- Pricing of the issue and valuation

- Filing prospectus and engaging with regulators

- Investor relations and communication strategy

3. Listing on the capital markets

- Filing prospectus and engaging with regulators

- Investor relations and communication strategy

Listing in Malaysia

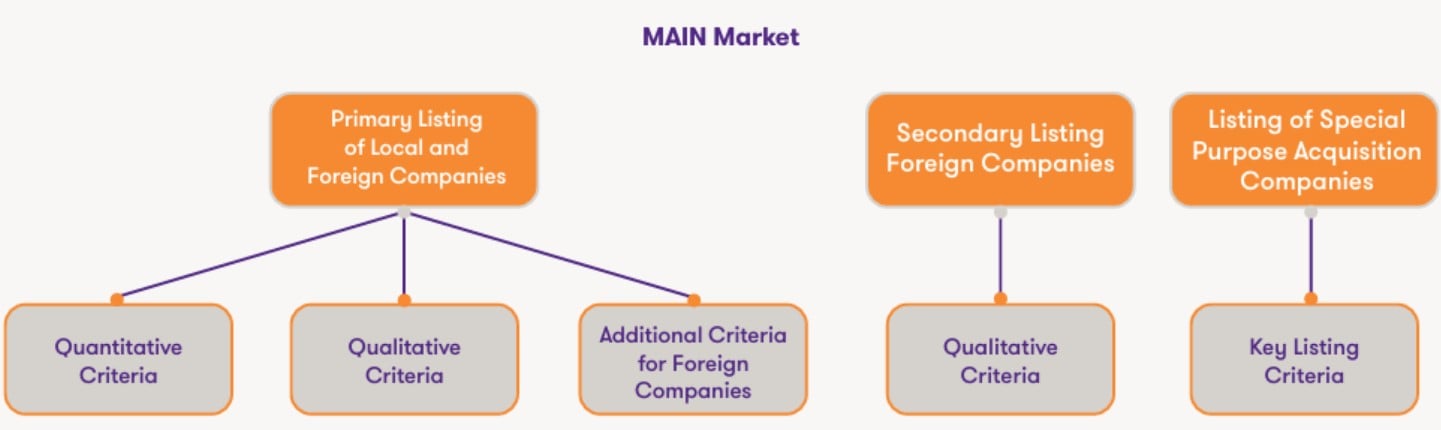

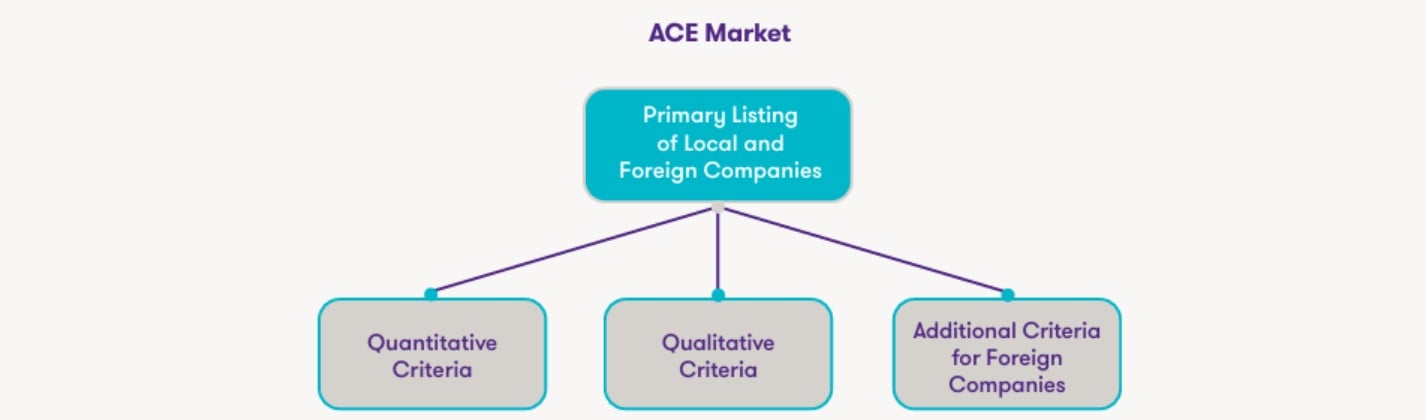

Stock Exchange Markets on Bursa Malaysia

Bursa Malaysia offers a choice of three markets to companies seeking for listing in Malaysia

- MAIN Market is a prime market for established companies that have met the standards in terms of quality, size and operations.

- ACE Market is a sponsor-driven market designed for companies with growth prospects.

- LEAP Market is an adviser-driven market which aims to provide emerging companies, including small- and medium-sized enterprises with greater fund raising access and visibility via the capital market.

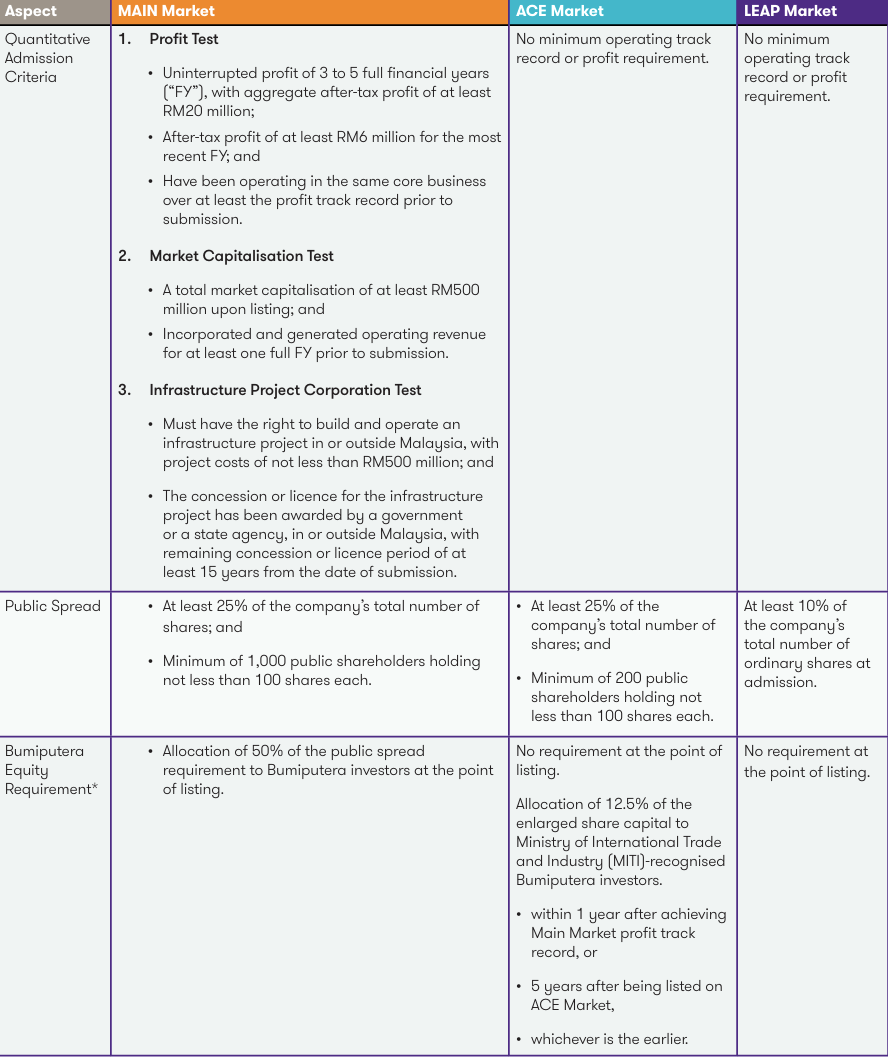

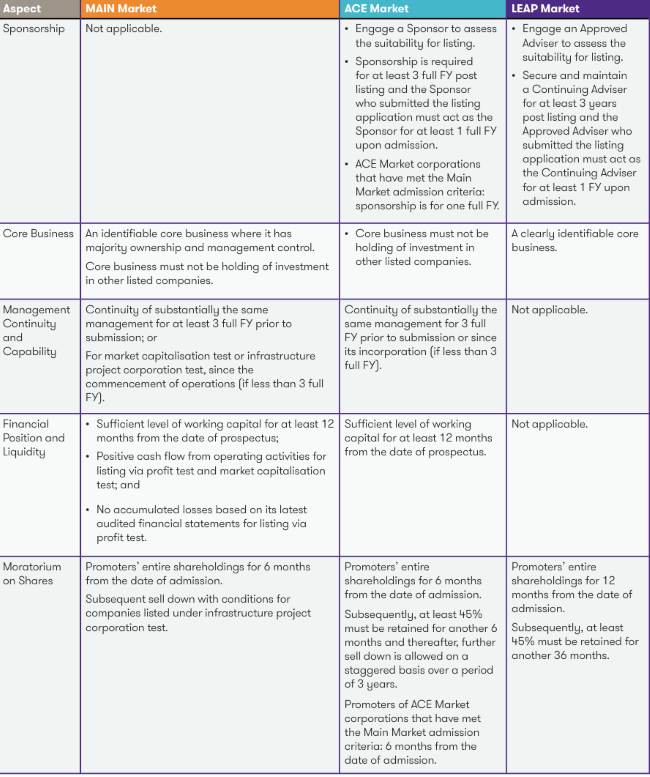

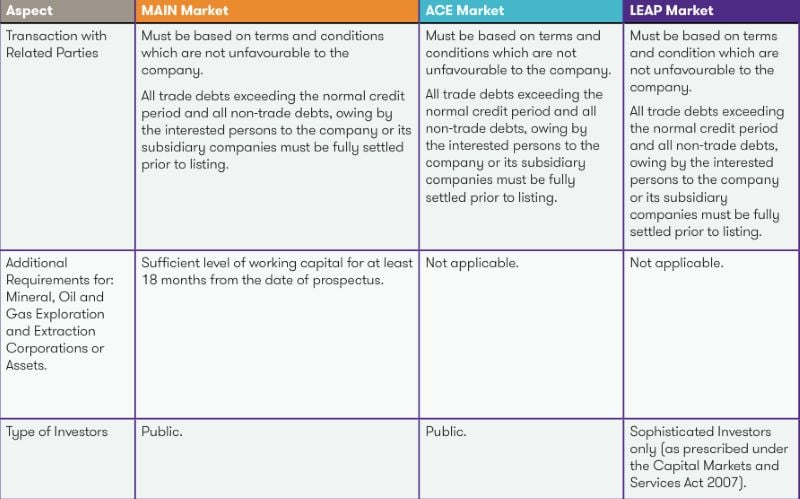

Listing criteria

Primary listing of local or foreign companies

Quantitative criteria

(As obtained from Bursa Malaysia on June 2024)

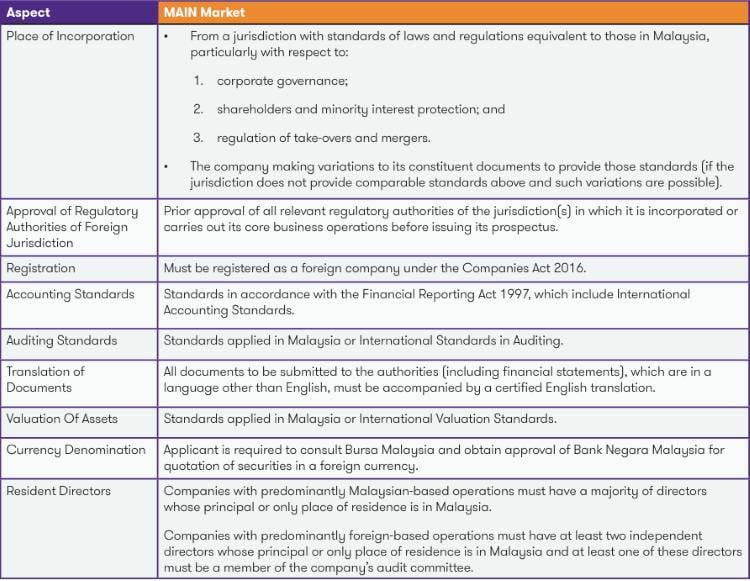

Additional criteria for foreign companies

(As obtained from Bursa Malaysia on June 2024)

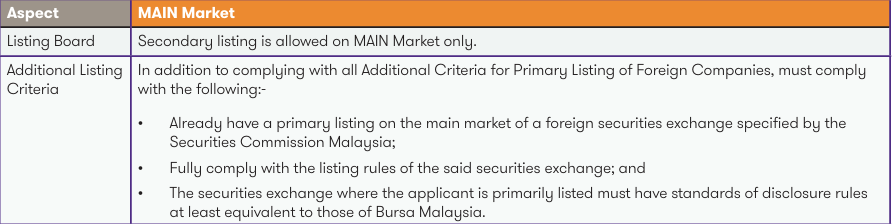

Secondary listing of foreign companies

Additional criteria

(As obtained from Bursa Malaysia on June 2024)

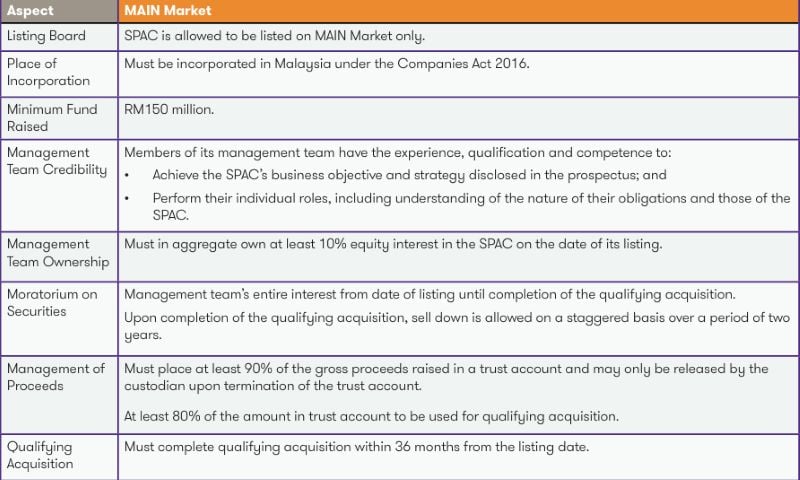

Listing of Special Purpose Acquisition Companies (“SPAC”)

Additional criteria

How much can you raise in an IPO?

Proceeds from an IPO

The proceeds that can be raised in an IPO will depend on the valuation of your company and the percentage of the total shares that will be sold to the public.

Amount raised

= Valuation of your company (say RM80 mil) x % sold to the public (say 25%) = RM20 million

Valuation of your company

The valuation of your company depends on the profit track record, the nature of the business, the growth rate of your company in terms of turnover and profits, dividend policy and many other factors. Eventually, based on these factors, investors will arrive at an earnings multiple to be placed on your company known as the Price Earnings (PE) ratio. The PE ratio should be comparable to companies in your industry which are already listed on the stock exchange, after adjusting for discounts or uplifts to take into consideration certain factors eg competitive strengths, size of your company, management quality and etc. To arrive at the valuation, this PE ratio will be multiplied by your company’s profit after tax (PAT). The PAT is usually the sustainable PAT in the coming year.

Valuation

= PE ratio (say 8 times) x profit after tax (say RM10 mil) = RM80 million

Recipient of the IPO proceeds

The proceeds of the IPO can flow either to your company or to the shareholders of your company depending on whether the sale of shares to the public is a public issue or an offer for sale. In a public issue, your company will be issuing new shares to the public, in which event, the proceeds from the new issue will flow to your company. However, if the shares to be sold to the public are from the existing shareholders who wish to sell down their existing shareholding, the proceeds from the offer for sale will flow to the shareholders of your company.

In most cases, an IPO would involve a public issue solely or a combination of both public issue and offer for sale. It is very rare for the IPO to consist solely of an offer for sale.

Proceeds flowing to your company

= new issue of shares (say 6 million shares) x IPO share price (say RM2 each) = RM12 million

Proceeds flowing to the shareholders of your company

= offer for sale (say 4 million shares) x IPO share price (say RM2 each) = RM8 million

Total proceeds from the IPO = RM20 million

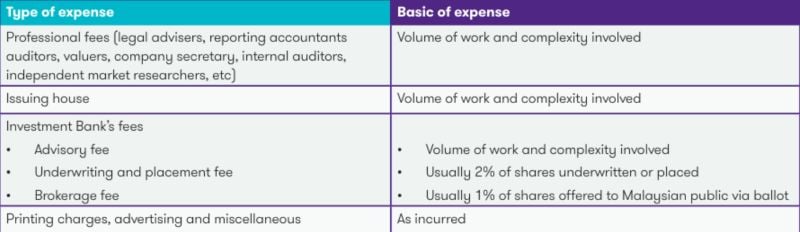

Cost of listing

Total cost of listing

- Bursa cost

- Other cost

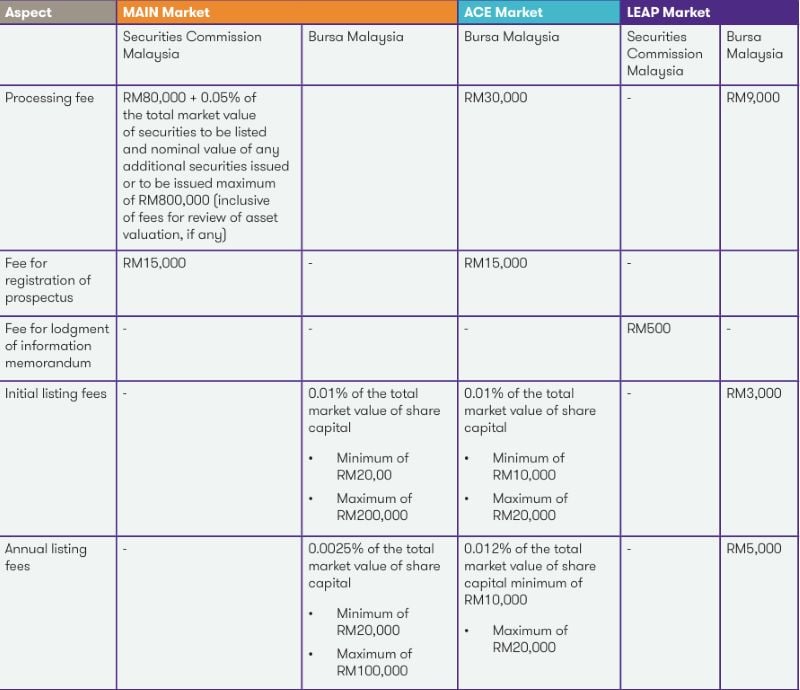

The costs of raising equity through an initial public offering vary for Main Market and ACE Market. In general, the total listing costs for ACE Market may range from RM2 million to RM5 million. The listing costs for Main Market are usually above RM3 million, depending on the size and complexity of the case as well as the amount to be raised.

Some of the key components in the total IPO expenses are:-

- Professional fees, depending on the size and complexity of the case and subject to negotiation.

- Underwriting, placement and brokerage fees, which generally range from 1% to 3% of the value of the shares, subject to negotiation.

- Regulatory fees, payable to:

(As obtained from Bursa Malaysia on June 2024)

Overall estimated costs of listing

![]()

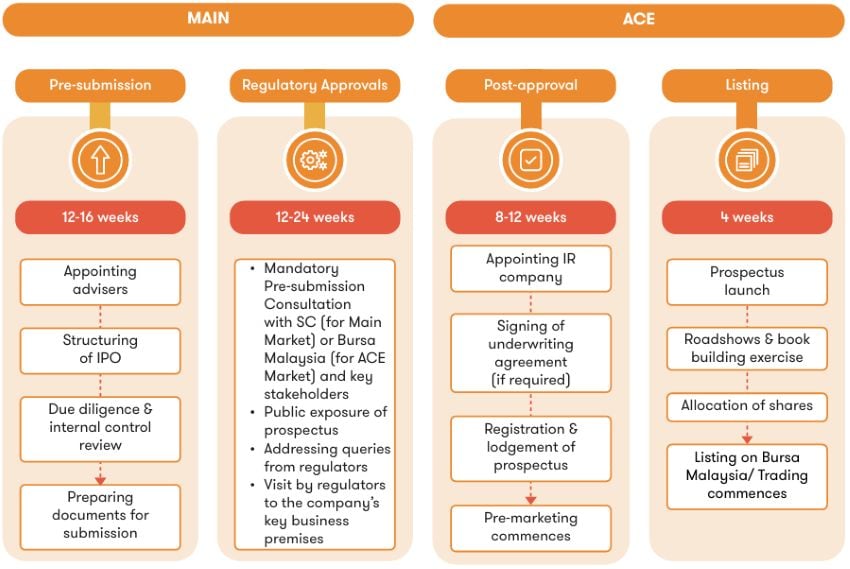

Listing process

Listing process for MAIN Market and ACE Market

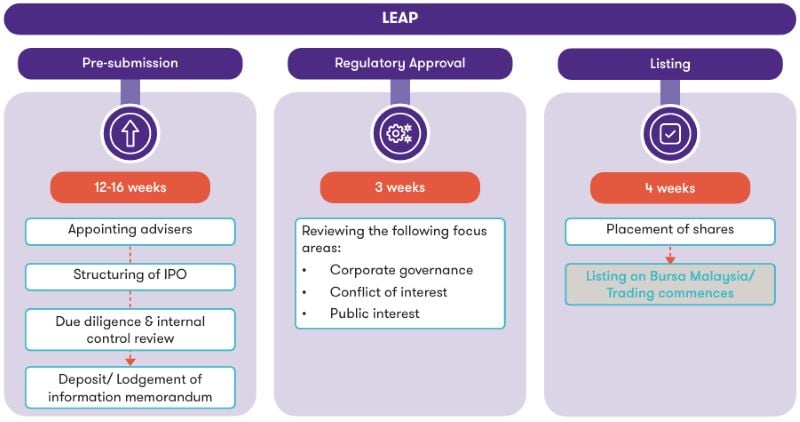

Listing process for LEAP Market

The timeline below gives you an estimated indication of the duration of your listing process from start to finish:

Regulations, accounting and standards

Malaysian Financial Reporting Standards (“MFRS”)

Malaysian Financial Reporting Standards (“MFRS”) are a set of accounting standards that determine the prescribed manner in how the transactions and events should be disclosed in the financial statements. MFRS was introduced by the Malaysian Accounting Standards Board (“MASB”) and came into effect on 1 January 2012.

It is fully compliant with the International Financial Reporting Standards (“IFRS”), which fostering greater confidence in financial reporting.

Applying them correctly will increase your company’s credibility and improve access to credit and investment opportunities.

The Standards are very detailed and technical. To the untrained eye, they can appear hard to navigate. But at Grant Thornton, we have people who are very well versed in their intricacies and can translate them into language that you can understand and apply to your financial statements.

Prospectus Guidelines

A prospectus is an essential disclosure document that describes the details of a new investment securities being offered to the public. These documents provide key context and detailed information that guide an investment decision about stocks, bonds and mutual funds. Information on a prospectus may include:

- Objectives of the investment

- Type of security offered

- Company background and information about its management team

- Details of offering, including number of funds offered, utilisation of proceeds and etc

- Risk factors

- Bank or financial institution doing the underwriting

Guidance Note on Combined Financial Statements

- Combined financial statements are prepared by combining the financial statements of separate entities, segments or components that are under common control, but that are not necessarily part of a legal sub-group.

- Combined financial statements are typically found in capital market transactions such as initial public offerings, business combinations, acquisitions or disposals and spinoffs.

- Though combined financial statements can be prepared in accordance with Malaysian Financial Reporting Standards (“MFRS”), there is no specific guidance under MFRS on the preparation of combined financial statements. To that effect, the Malaysian Institute of Accountants (“MIA”)’s Capital Markets Advisory Committee (“CMAC”) has issued a Guidance Note to aid in the preparation of combined financial statements in November 2018.

Guidance Note for Issuers of Pro Forma Financial Information (“PFI”)

- The Malaysian Institute of Accountants (“MIA”) has recently issued a GN providing guidance to issuers of PFI for inclusion in documents for public circulation (“DFPC”) such as prospectuses, circulars to shareholders and information memorandums. The GN is effective for Pro Forma Financial Information (“PFI”) issued on or after 19 July 2020. All MIA members are expected to adhere to this GN when preparing PFI.

- PFI illustrates the hypothetical impact of an event or a proposed transaction on a company’s f inancial position, earnings or cash flows, as if the event had occurred or the proposed transaction had been undertaken at an earlier date selected for purposes of the illustration.

- PFI is not a forecast and hence does not purport to represent what a company’s actual financial position or performance will be like had the proposed transaction occurred at the date assumed for the PFI.

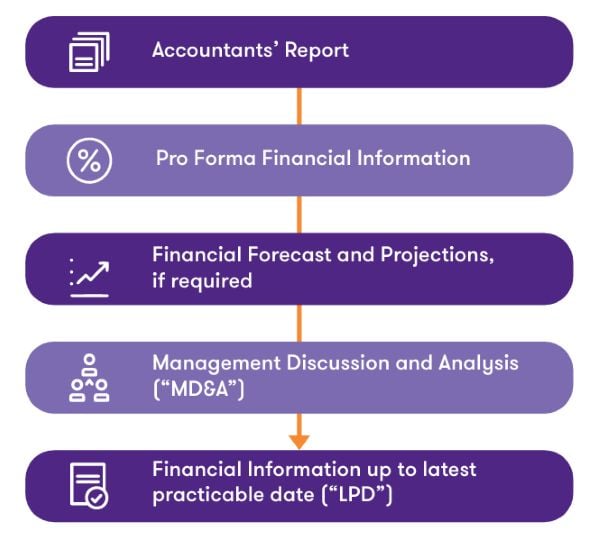

Accounting and financial related reports

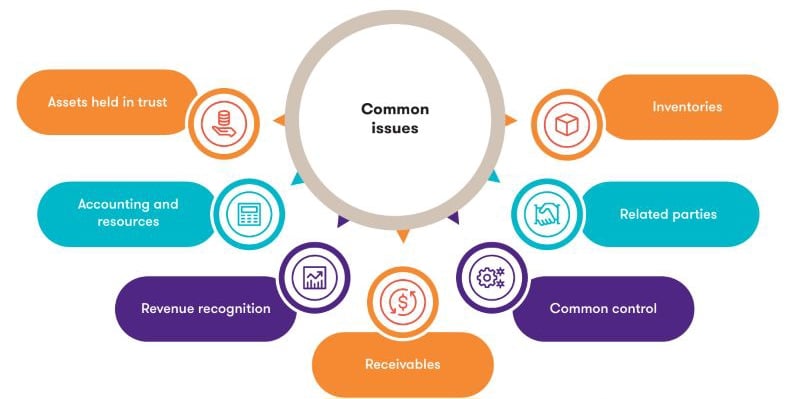

Common operational and accounting issues

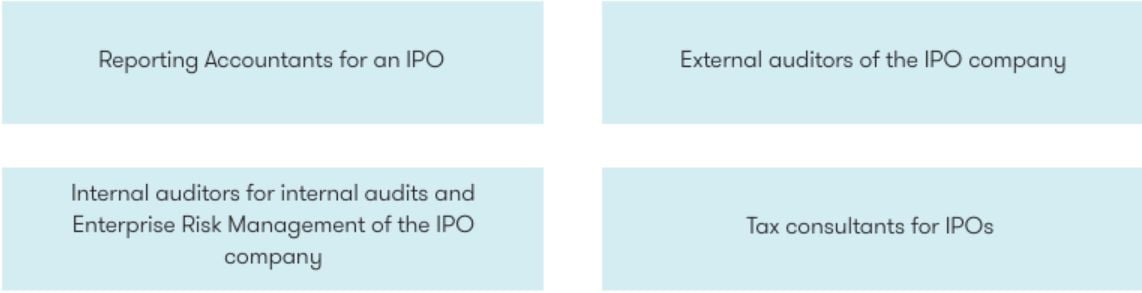

How Grant Thornton Malaysia can help?

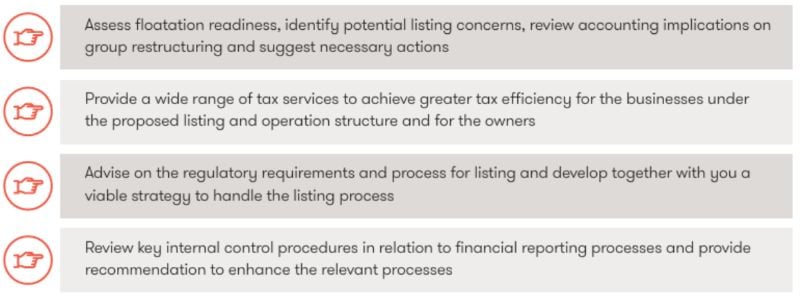

Pre-listing

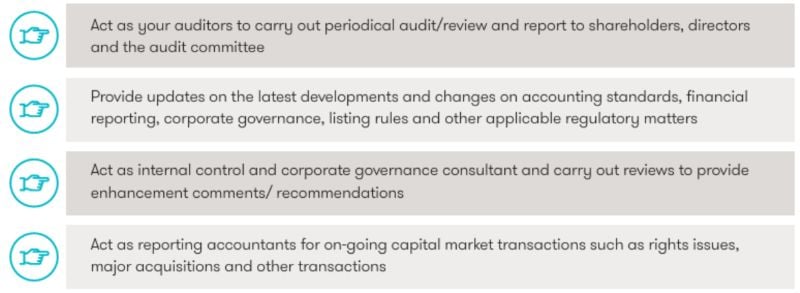

During-listing

Post-listing

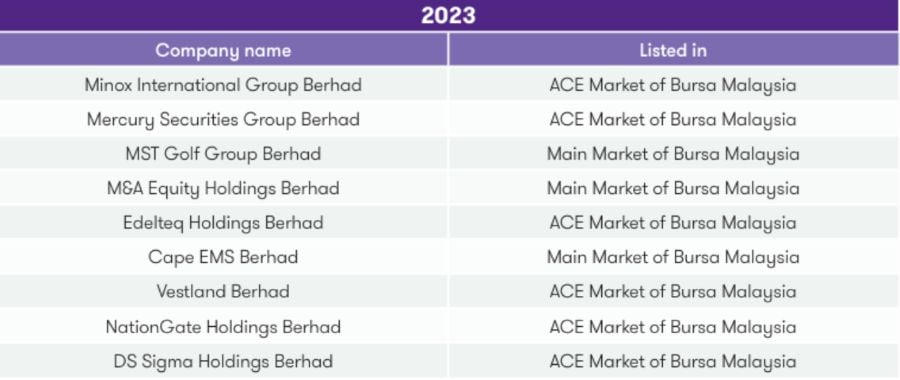

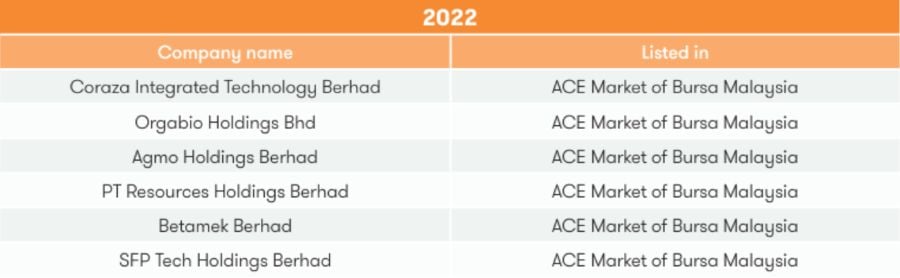

Success stories for the past 10 years

Grant Thornton Malaysia PLT