Revision of sales tax rates

The rates of sales tax for various goods have been reviewed and effective from 1 July 2025, sales tax will be applied at the rate of 5% or 10% on various types of goods.

Salient points include the following:

- The new sales tax rates will be imposed on manufactured taxable goods sold, used or disposed, on or after the effective date of the new tax rate. The date of sale is based on the date the invoice was issued.

- The new sales tax rate will be imposed on imported taxable goods when the goods are released from Customs control on or after the effective date of the new tax rate.

- Ministry of Finance has further clarified on agricultural produce grown in Malaysia are not

manufactured and thus are not subject to sales tax. - New sales tax registrants are required to register by the end of August 2025 and the effective date will be the beginning of September 2025.

Below is a summary of the sales tax rates:

For further details, you may refer to the Guidelines on Transitional Measures for Sales Tax Rate Change dated 9 June 2025 (currently only available in the Malay language version of the website) (https://mysst.customs.gov.my/IndustryGuides). Please contact your respective Grant Thornton indirect tax adviser should you require further guidance.

Click on the publication cover to read more:

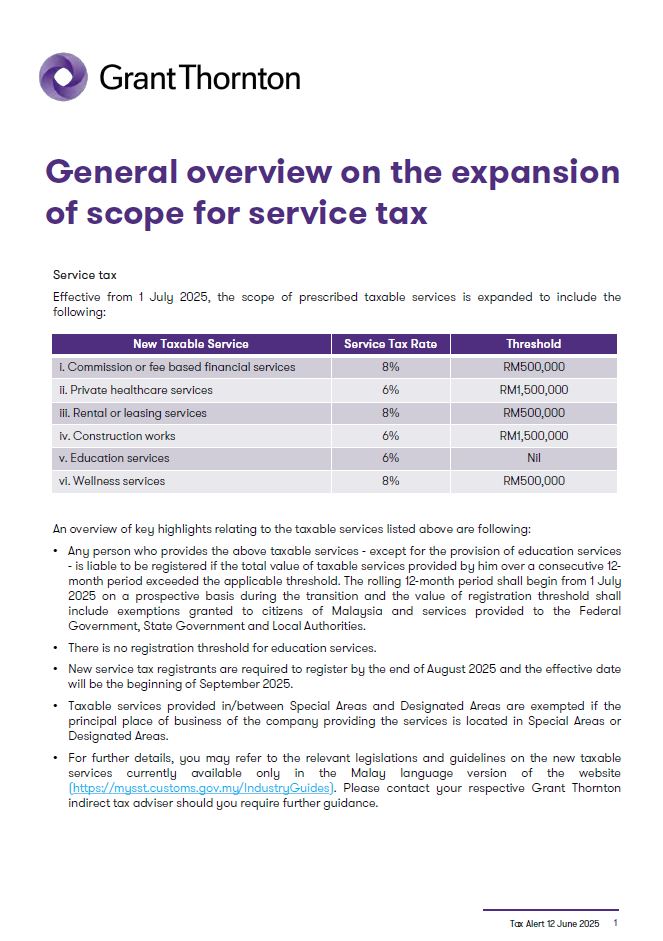

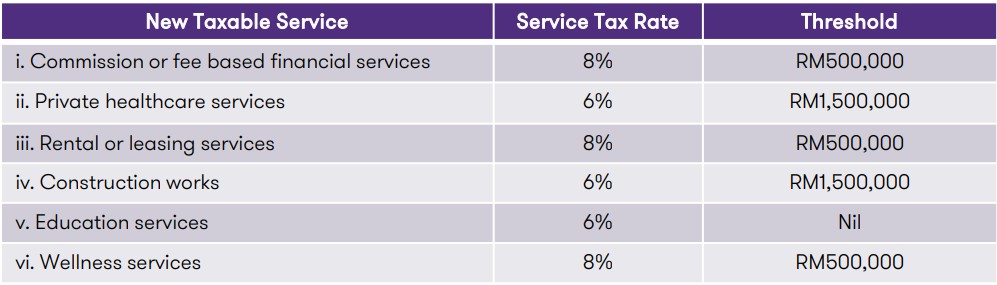

Expansion of scope for service tax

Effective from 1 July 2025, the scope of prescribed taxable services is expanded to include the following:

- Commission or fee based financial services

- Private healthcare services

- Rental or leasing services

- Construction works

- Education services

- Wellness services

An overview of key highlights relating to the taxable services listed above are following:

- Any person who provides the above taxable services - except for the provision of education services - is liable to be registered if the total value of taxable services provided by him over a consecutive 12-month period exceeded the applicable threshold. The rolling 12-month period shall begin from 1 July 2025 on a prospective basis during the transition and the value of registration threshold shall include exemptions granted to citizens of Malaysia and services provided to the Federal Government, State Government and Local Authorities.

- There is no registration threshold for education services.

- New service tax registrants are required to register by the end of August 2025 and the effective date will be the beginning of September 2025.

- Taxable services provided in/between Special Areas and Designated Areas are exempted if the principal place of business of the company providing the services is located in Special Areas or Designated Areas.

- For further details, you may refer to the relevant legislations and guidelines on the new taxable services currently available only in the Malay language version of the website (https://mysst.customs.gov.my/IndustryGuides). Please contact your respective Grant Thornton indirect tax adviser should you require further guidance.

Service tax on financial services

Financial Services

Effective from 1 July 2025, financial services shall be taxable services subject to service tax at the rate of 8%. The prescribed taxable services under financial services include the following:

- i. Insurance or takaful services. Medical insurance, medical takaful insurance, life insurance and family takaful services against risk in Malaysia borne by an individual are excluded. Further exclusions apply to transportation, educational and religious organisations, export of goods and services, and risks outside Malaysia.

- ii. Financial services charged for or subject to fees, commissions or similar payments. There are exclusions, including for basic banking services and other selected services.

Salient points include the following:

- The determination of whether registration threshold for financial services has been met will be based on the total value of services comprising of taxable services and exempted services.

- Business-to-Business (“B2B”) exemptions are available to persons regulated by the Labuan Financial Services Authority.

- Certain charges (e.g. penalty) or returns (e.g. spread) related to financial services are not subject to tax, even if they included as part of the taxable financial services.

- Financial services are exempted if the principal place of business of the company providing the services is located in Special Areas or Designated Areas.

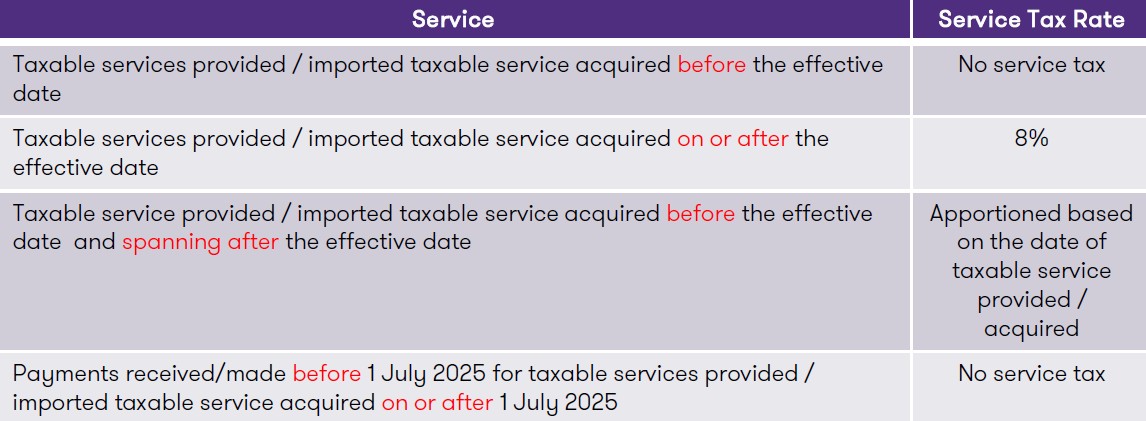

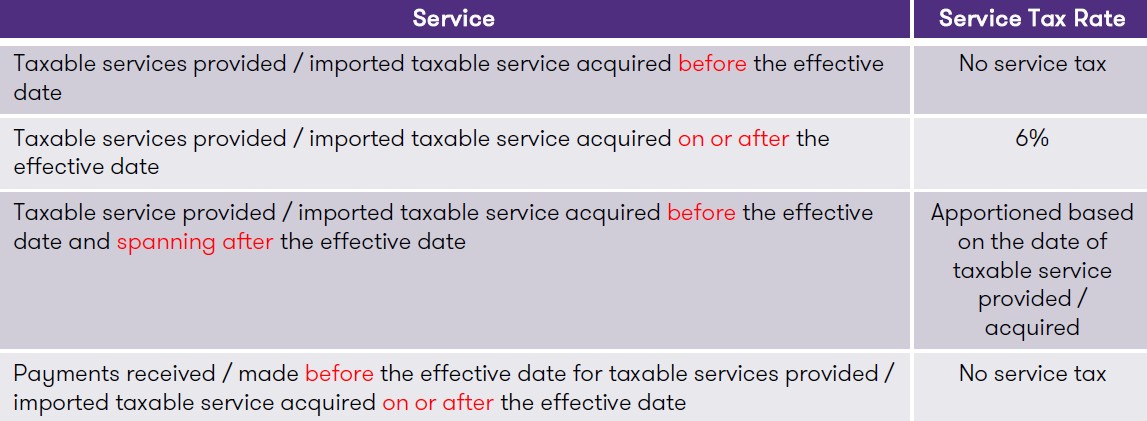

Below are the transitional general concepts of the imposition of service tax on financial services according to a guideline released by the Royal Malaysian Customs Department (“RMCD”):

Service tax on private healthcare services

Private healthcare services

Effective from 1 July 2025, healthcare services shall be taxable services subject to service tax at the rate of 6%. The prescribed taxable services include:

- i. Healthcare services provided by a private healthcare facility registered and licensed under the Private Healthcare Facilities and Services Act 1998;

- ii. Traditional and complementary medicine services; or

- iii. Allied health services.

Healthcare services provided by any university or university colleges, University Malaya Specialist Centre, Universiti Kebangsaan Malaysia Specialist Centre, Universiti Teknologi MARA Medical Specialist Centre and International Islamic University Malaysia Medical Specialist Centre are not taxable.

Salient points include the following:

- Citizens of Malaysia are exempted from payment of service tax.

- Sale of medical aid products (e.g. wheelchair) are not subject to service tax.

Below are the general transitional concepts of the imposition of service tax on healthcare services according to a guideline released by the Royal Malaysian Customs Department (“RMCD”):

Service tax on rental or leasing services

Rental or Leasing Services

Effective from 1 July 2025, rental or leasing services of tangible assets shall be taxable services subject to service tax at the rate of 8% except the following:

- i. Rental or leasing of housing accommodation

- ii. Rental or leasing of reading materials

- iii. Rental or leasing of tangible assets located outside Malaysia (including Special Areas and Designated Areas)

- iv. Leasing of tangible assets through a financial lease

Salient points include the following:

- Business-to-Business (“B2B”) exemption is available subject to conditions.

- Exemptions will be granted for micro and small enterprises with annual turnover less than RM500,000.

- Non-reviewable contracts will be exempted from service tax subject to conditions, for a period of one year from the effective date (i.e. 1 July 2025).

Below are the general transitional concepts of the imposition of service tax on rental or leasing services according to a guideline released by the Royal Malaysian Customs Department (“RMCD”):

Service tax on construction works

Construction works

Effective from 1 July 2025, construction works excluding construction of residential buildings and public facilities related to the residential buildings (e.g. carpark, lift, swimming pool), shall be taxable services subject to service tax at the rate of 6%. However, construction of residential buildings and public facilities related to the residential building approved by a local authority for mixed development shall be a taxable service.

Salient points include the following:

- Retention sums for projects handed over prior to 1 July 2025 shall not be subject to service tax.

- Liquidated and ascertained damages charges shall not be subject to service tax.

- Business-to-Business (“B2B”) exemption is available subject to conditions.

- Non-reviewable contracts will be exempted from service tax subject to conditions, for a period of one year from the effective date (i.e. 1 July 2025).

Below are the general transitional concepts of the imposition of service tax on construction works according to a guideline released by the Royal Malaysian Customs Department (“RMCD”):

Service tax on education services

Education services

Effective from 1 July 2025, education services shall be taxable services subject to service tax at the rate of 6%. The prescribed taxable services include:

- i. Pre-school, primary school, lower secondary school, upper secondary school or post-secondary (pre-university) education services with fees exceeding RM60,000 per student for each academic year by any private educational institutions registered under the Education Act 1996 excluding special schools and language centres.

- ii. Education related services to non-citizens of Malaysia by any higher education institutions registered under the Universities and University Colleges Act 1971 or Education Act 1996, or private higher education institution registered under the Private Higher Educational Institutions Act 1996.

- iii. Education related services to non-citizens of Malaysia by language centres registered under the Education Act 1996.

Salient points include the following:

- There is no registration threshold.

- Service tax applicable on fees charged for the following academic semester or year beginning after the effective date.

- Exemption will be granted to holders of a valid Kad OKU who are citizens of Malaysia for pre-school, primary school, lower secondary school, upper secondary school or post-secondary (pre-university) education services.

- Importation of education taxable services is subject to service tax.

Below are the transitional general concepts of the imposition of service tax on education services according to a guideline released by the Royal Malaysian Customs Department (“RMCD”):

Expansion of scope for service tax – Group C, D & E

Effective from 1 July 2025, the scope of prescribed taxable services is expanded to include beauty treatment as taxable services under Group C.

According to the Guide on Group C, D and E released in Malay version on 9 June 2025 by the Royal Malaysian Customs Department (“RMCD”), beauty services includes any treatment of the body or any part of the body, face, or hair intended to treat or restore the skin of the body or face using any substance or equipment, which includes but is not limited to the following:

i. Hydrotherapy

ii. Slimming services

iii. Facial, hand, feet or whole body massages

iv. Hair styling

v. Manicures and pedicures

vi. Saunas

vii. Herbal, milk or flower baths

viii. Tattoo services

ix. Spa

The above mentioned guide provides further clarification on the determination of rate of service tax for the services prescribed in Group C, D and E:

*The services mentioned above excludes private healthcare services, private traditional and complementary medicine services or private allied health services

Click on the publication cover to read more: