We are pleased to share with you our updated Budget Adviser.

Malaysia’s Budget 2025 was tabled in Parliament on 18 October 2024. In line with the “Ekonomi MADANI Negara Makmur, Rakyat Sejahtera” theme, Budget 2025 is a continuation of Ekonomi MADANI, a long-term economic framework aimed at raising the ceiling of the nation’s economic potential and improving the standard of living for its people.

Read our updated Budget Adviser to understand the numerous updates on the various existing tax measures, as well as new tax initiatives.

Individual Tax

1. TAX RELIEF FOR HOUSING LOAN INTEREST PAYMENT FOR FIRST RESIDENTIAL HOME

Effective from year of assessment 2009 to year of assessment 2016, tax relief for housing loan interest payment for first residential home of up to RM10,000 per year was provided to individual taxpayer for 3 consecutive years of assessment, commencing from the first year the housing loan interest was paid which is subject to the following conditions:

- i. the taxpayer is a Malaysian citizen and resident;

- ii. limited to one residential property including flats, apartments or condominiums;

- iii. the sale and purchase agreement executed from 10 March 2009 until 31 December 2010; and

- iv. the taxpayer has not derived any income in respect of that residential property.

To stimulate the purchase of a first residential home and to increase disposable income, it is proposed that tax relief be given on interest payments for the first residential home loan (individually or jointly owned) as follows:

The tax relief on interest payments for individual taxpayer is subject to the following conditions:

i. the taxpayer is a Malaysian citizen and resident;

ii. the residential property must be the first property purchased by the taxpayer for occupation as a place of residence and is limited to one unit, which can include a house, condominium, apartment or flat;

iii. the residential home must not be used to generate any income;

iv. the sale and purchase agreement must be executed from 1 January 2025 to 31 December 2027;

v. the amount of tax relief on allowable interest payments is applicable for 3 consecutive years of assessment, commencing from the first year the housing loan interest is paid; and

vi. two or more individual taxpayers are eligible to claim tax relief on housing loan interest for the same residential home based on apportionment of the interest payment as per the formula below:

A x B/C

A - total amount of deduction allowed for the property for that relevant year i.e. RM5,000 or RM7,000;

B - total interest expended in the basis year for that relevant year by that taxpayer; and

C - total interest expended in the basis year for that relevant year by all taxpayers.

The relief applies to the amount expended by the wife or husband:

i. where the husband or wife elects for joint assessment, and their total income is aggregated in the name of either the husband or the wife; or

ii. where the wife or husband has no source of income or total income, the amount is considered to be expended by the spouse who has income.

Effective date : For the sale and purchase agreement of the first residential home executed from 1 January 2025 to 31 December 2027

2. TAX EXEMPTION ON PRIZE MONIES RECEIVED BY ATHLETES

Currently, income tax exemption is given on prize monies received by professional sportsmen and sportswomen (individuals who engaged in sports for a livelihood).

It is proposed that prize monies from sports winnings received by athletes under the Skim Hadiah Kemenangan Sukan from the National Sports Council be exempted from tax.

Further details are expected to be released in due course.

3. TAX ON DIVIDENDS RECEIVED BY INDIVIDUAL SHAREHOLDERS

Prior to the year of assessment 2008, dividends distributed by companies were taxed based on the full imputation system. Under this system, tax on dividends was imposed at the company as well as shareholder levels. Nevertheless, the tax imposed on the shareholders would be adjusted to reflect the amount already paid by the company through tax credits.

With effect from the year of assessment 2008, Malaysia has switched to the single-tier tax system. Under this system, the tax on the company’s profit is final and dividends distributed are exempted from tax at the shareholder level.

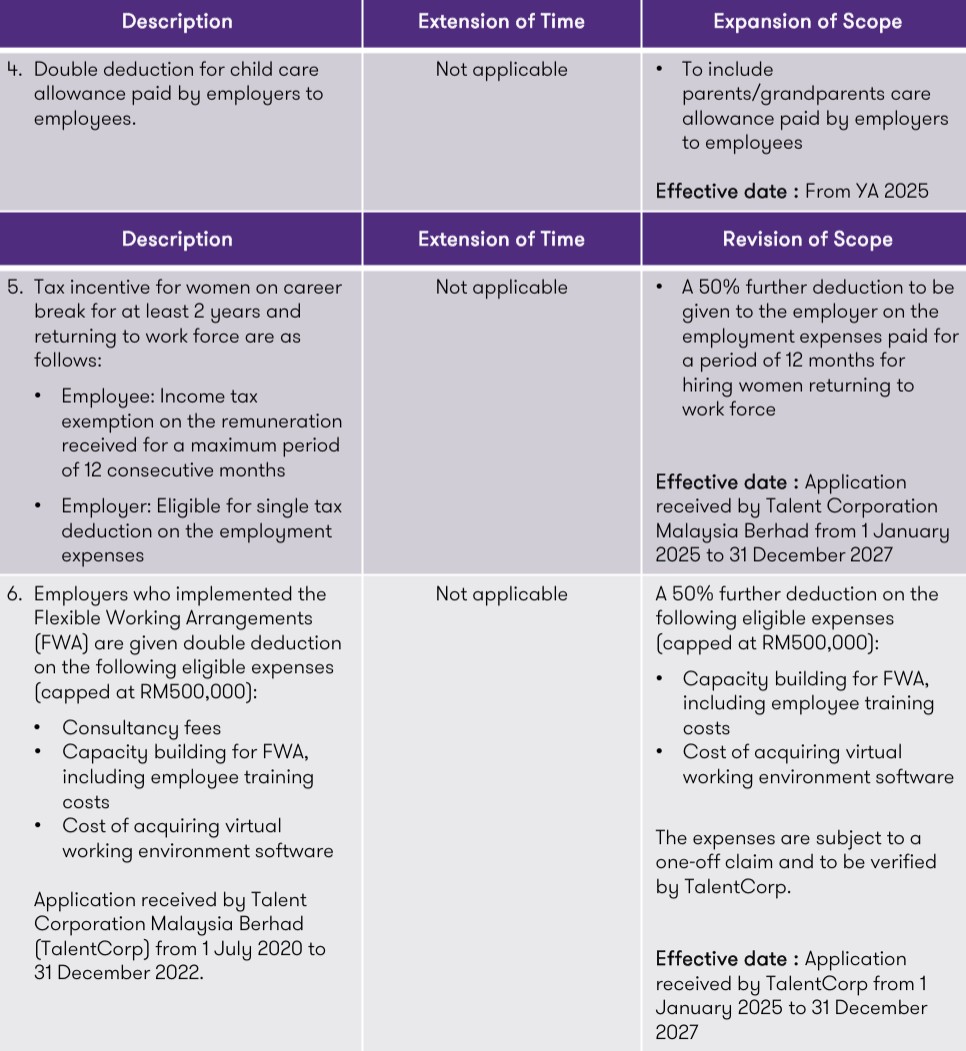

To enhance the individual income tax structure to be more progressive and broaden the tax base, it is proposed that a “Dividend Tax” be introduced as follows:

Effective date: From year of assessment 2025

Corporate Tax

1. TAX DEDUCTION FOR EMPLOYERS PROVIDING CAREGIVING PAID LEAVE BENEFIT

Currently, employers who provide paid leave benefit for employees are eligible for tax deductions under Section 33 of the Income Tax Act 1967. However, there are no tax incentives for employers who provide additional paid leave to employees caring for children or ill or disabled family members.

To cushion the impact of loss of income on affected individuals and to support job retention in line with the care economy policy, it is proposed that a 50% further deduction be given to employers who provide additional paid leave of up to 12 months for employees caring for children or ill or disabled family members.

Effective date : Application received by Talent Corporation Malaysia Berhad from 1 January 2025 to 31 December 2027

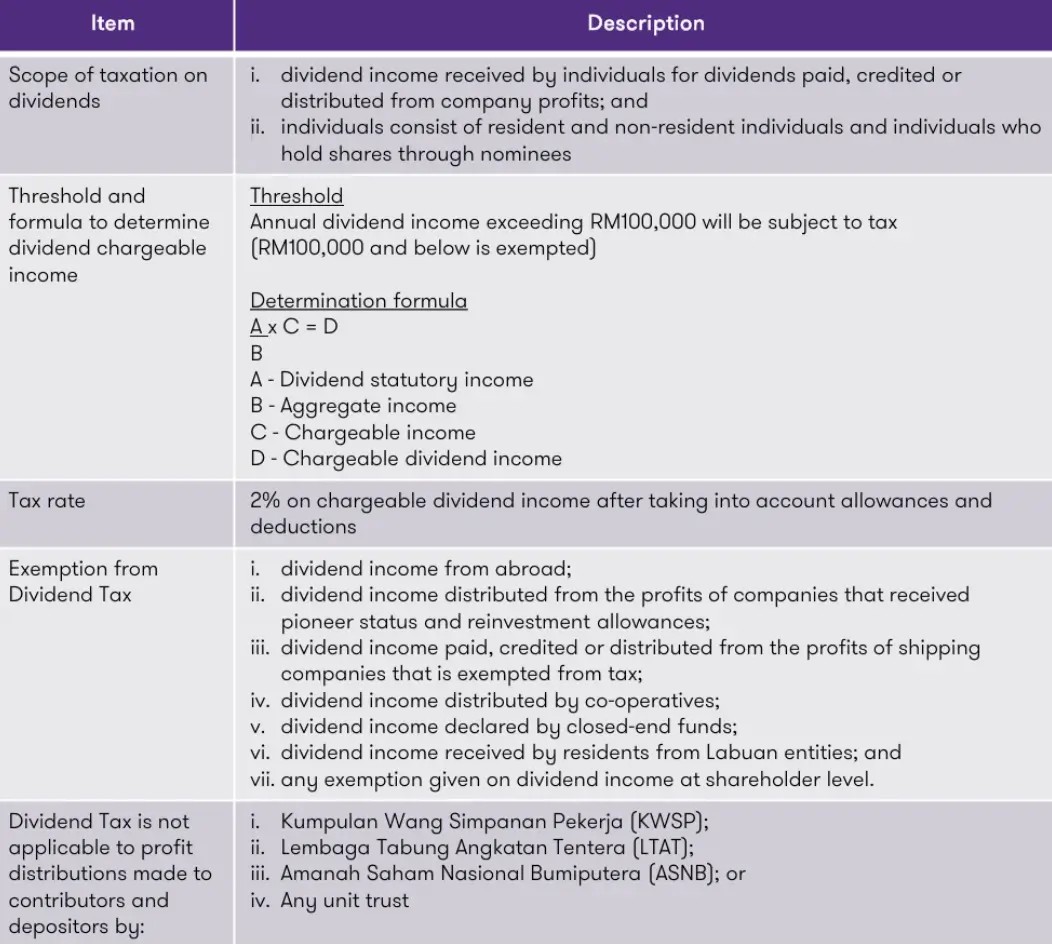

2. TAX INCENTIVES FOR IMPLEMENTATION OF E-INVOICING

To encourage taxpayers to fully implement e-Invoicing, it is proposed that the expenses for the following qualifying expenditure be given Accelerated Capital Allowance:

With the revised rates, the capital allowance claim shall be reduced from 3 years to 2 years.

Effective date : From year of assessment 2024 to year of assessment 2025

Note: The above Accelerated Capital Allowance will only be granted to taxpayers that will not be utilising the 6 months interim relaxation period in implementing e-invoice.

3. TAX DEDUCTION ON CORPORATE CONTRIBUTIONS FOR VOCATIONAL TRAINING

It is proposed that tax deduction be granted to companies for donation of new equipment and machinery to Institusi Latihan Kemahiran Awam (ILKA), polytechnics or registered vocational colleges.

Effective date : From year of assessment 2025 to year of assessment 2027

4. INTRODUCTION OF SUPPLY CHAIN RESILIENCE INITIATIVE

To strengthen the local supply chain and key ecosystem sectors, it is proposed that the Supply Chain Resilience Initiative be introduced with the following incentives:

i. double deduction of up to RM2 million per annum for 3 consecutive years for manufacturing expenditure of multinational enterprises (MNEs);

ii. joint investment by an MNE or its suppliers with a local supplier be given tax deduction based on the amount invested;

iii. local suppliers involved in this initiative will be eligible for outcome-based tax incentive package; and

iv. an investment matching fund of over RM100 million will be provided through a public fund equity platform to develop local suppliers in the sectors of Electrical and Electronics (E&E), specialty chemicals and medical devices.

Further details are expected to be released in due course.

Effective date : To be implemented in the 3rd quarter of 2025

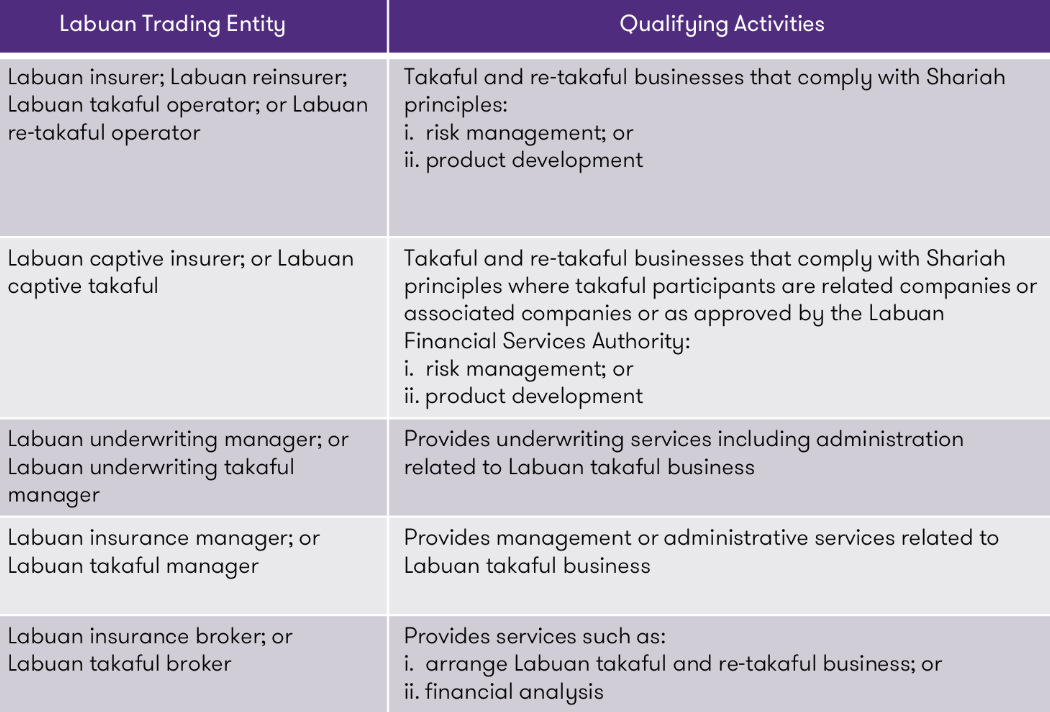

5. EXPANSION OF TAX EXEMPTION FOR ISLAMIC FINANCIAL ACTIVITIES UNDER LABUAN INTERNATIONAL BUSINESS AND FINANCIAL CENTRE (IBFC)

Currently, Labuan trading entities that undertake Islamic finance activities such as Islamic digital banking, Islamic digital bourses, ummah-related companies and Islamic digital token issuers are given tax exemption for a period of 5 years from year of assessment 2024 to year of assessment 2028.

To further attract investment in the Islamic finance sector driven by digital technology at the Labuan IBFC, it is proposed that the 5 years tax exemption be expanded to include qualifying Labuan takaful business activities and Labuan takaful related activities as follows:

Effective date : From year of assessment 2025 to year of assessment 2028

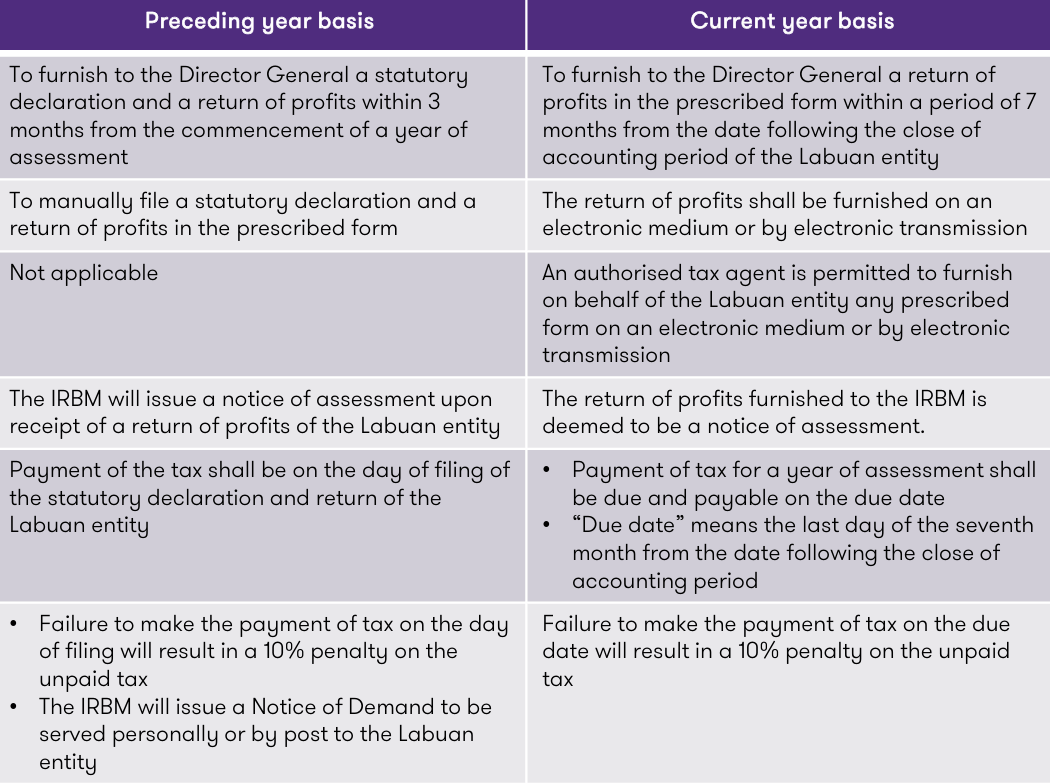

6. IMPLEMENTATION OF SELF-ASSESSMENT SYSTEM FOR AN ENTITY UNDER THE LABUAN BUSINESS ACTIVITY TAX ACT 1990 (LBATA)

Currently, a Labuan entity carrying on a Labuan business activity and taxed under the LBATA is assessed under “preceding year basis”.

It is proposed that the self-assessment system be introduced and the assessment be changed to “current year basis”. In this regard, for the year 2025 there will be 2 years of assessment, i.e.:

- Preceding year basis: For basis period ending in the year 2024; and

- Current year basis: For basis period ending in the year 2025.

Effective date : 1 January 2025

Some of the pertinent administrative changes are as follows:

Effective date : Year of assessment 2025 in respect of the basis period ending in year 2025 and subsequent years of assessment

7. SUBMITTING INCORRECT RETURNS, INFORMATION RETURNS OR REPORTS

Currently, a taxpayer could avoid being guilty of an offence if he satisfies the court that the incorrect return, information return or report, or incorrect information was made or given in good faith.

It is proposed that if no prosecution is initiated in respect of the incorrect return, information return or report, or incorrect information, the taxpayer may still be liable to a penalty of not less than RM20,000 and not more than RM100,000. If the taxpayer fails to pay the imposed penalty, the IRBM can invoke its authority to recover it as part of the tax payable of the taxpayer. Once this penalty is paid or adjusted, the taxpayer shall not be charged for the same offence again.

8. REVISION OF INCOME TAX ESTIMATE IF DEEEMED REVISED TAX ESTIMATE IS ISSUED

Currently, a company, limited liability partnership, trust body or cooperative society is allowed to revise its tax estimate in the 6th, 9th or 11th month of its basis period, provided that the Director General had issued a directive on the amount of instalment payments before the 9th month of the basis period. However, it is not clear whether the 11th month revision will be allowed if the Director General had issued the directive after the 9th month of the basis period.

To clarify the above, it is proposed that the 11th month revision be allowed if the Director General had issued the directive before the 11th month of the basis period.

Effective date : From year of assessment 2025

Real Property Gains Tax

1. FAILURE TO SUBMIT RETURNS AND OTHER OFFENCES

It is proposed that the court is empowered to issue further orders directing taxpayers to submit returns within 30 days after being convicted for failure to submit returns and other offences, including:

- Failure to file returns by a nominee • Failure to file returns in cases of asset transfer to a company’s trading stock

- Failure to comply with notice to produce information/documents required by Director General of the Inland Revenue Board of Malaysia.

Effective date : 1 January 2025

2. IMPLEMENTATION OF THE SELF-ASSESSMENT SYSTEM FOR REAL PROPERTY GAINS TAX

Currently, real property gains tax (RPGT) returns shall be submitted by the taxpayer within 60 days from the disposal date to the Inland Revenue Board of Malaysia (IRBM).

To enhance efficiency, it is proposed that mandatory submission of RPGT returns via electronic medium be implemented. The certificate of non-chargeability will be deemed to have been issued by the Director General of the IRBM to the disposer upon the submission of returns in an electronic medium or by way of an electronic submission. The payment period for deemed assessments will be extended from 60 days to 90 days from the date of disposal. A 10% penalty may be imposed for late payments made beyond the specified period.

Effective date : 1 January 2025

3. TAX TREATMENT ON GAINS OR LOSSES FROM DISPOSAL

Currently, real property gains tax is imposed on the total gains from the disposals of real property and real property company shares with current losses allowed as deductions against the total gains, including gains from previous disposals within the same year of assessment.

It is proposed that each disposal shall be treated and taxed separately, with losses from disposals only claimable against subsequent disposals within the same year of assessment. In addition, unabsorbed losses arising from the disposals can be carried forward to the following year of assessment and offset sequentially.

Effective date : 1 January 2025

Tax Incentive

1. TAX INCENTIVES FOR SMART LOGISTICS COMPLEX

The Smart Logistics Complex (SLC) is a modern warehousing facility that uses technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) aimed at automating various warehousing operations, reducing costs and enhancing the overall supply chain performance. However, there are no specific incentives provided to companies in Malaysia that incorporate the Fourth Industrial Revolution (IR4.0) elements in smart warehousing.

For Integrated Logistics Services (ILS) such as delivery, transportation and warehousing, tax incentives are provided as follows:

- i. Pioneer Status with tax exemption of up to 70% of the statutory income for a period of 5 years; or

- ii. Investment Tax Allowance (ITA) of 60% on the qualifying capital expenditure incurred within a period of 5 years. The allowance can be set-off against up to 70% of the statutory income for each year of assessment.

In addition, tax incentives for automation in the form of Accelerated Capital Allowance and income tax exemptions equivalent to the ITA are available to companies in the services sector that invest in machinery and automation equipment with IR4.0 elements. The qualifying capital expenditure for the first RM10 million can be claimed under this incentive. The incentive is eligible for applications received by the Malaysian Investment Development Authority (MIDA) until 31 December 2027.

To further enhance the supply chain efficiency through the adaptation of advanced technology in logistics activities, including the use of IR4.0 elements such as AI, IoT and blockchain, it is proposed that tax exemption equivalent to an ITA of 60% on qualifying capital expenditure incurred for a period of 5 years be provided to SLCs. The allowance can be offset against up to 70% of the statutory income for each year of assessment, subject to the following conditions:

A. eligible SLC companies

- i. SLC investor and operator that invest in the construction of smart warehouses and undertake eligible logistics services activities; or

- ii. SLC operator that leases a smart warehouse under a long-term lease of at least 10 years and undertake eligible logistics services activities.

B. eligible logistics services

- i. regional distribution centres;

- ii. integrated logistics services;

- iii. storage of hazardous goods; or

- iv. cold chain logistics.

C. warehouse with a minimum build-up area of 30,000 square meters;

D. adaptation of at least 3 IR4.0 elements; and

E. other specified conditions.

Effective date : Application received by MIDA from 1 January 2025 to 31 December 2027

Indirect Tax

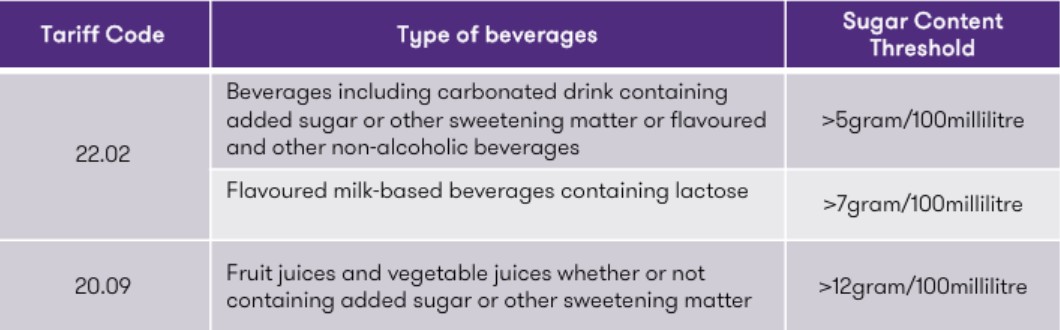

1. EXCISE DUTY ON SUGAR SWEETENED BEVERAGES

Effective from 1 January 2024, the excise duty on sugar sweetened beverages was increased from RM0.40 per litre to RM0.50 per litre based on the threshold of sugar content in the following beverages:

It is proposed that excise duty rate for the above sugar sweetened beverages be increased in phases at RM0.40 per litre. This is to improve health and well-being of the people especially to prevent diabetes and obesity.

Effective date : From 1 January 2025

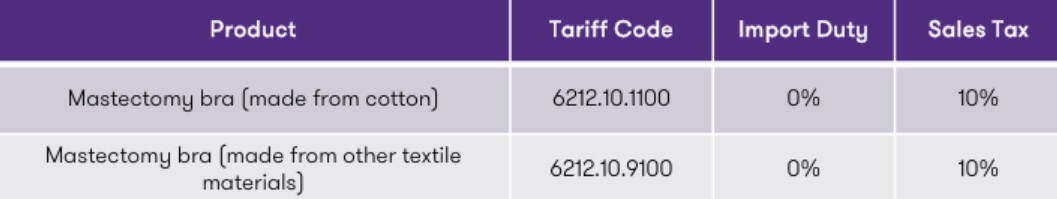

2. SALES TAX EXEMPTION ON MASTECTOMY BRAS FOR BREAST CANCER PATIENTS

Currently, mastectomy bras for cancer patients are subject to following duties/taxes:

It is proposed that sales tax exemption be given for the above mastectomy bras to be in line with the value of compassion and to ease the burden of breast cancer patients.

Effective date : Application received by the Ministry of Finance from 1 November 2024 to 31 December 2027

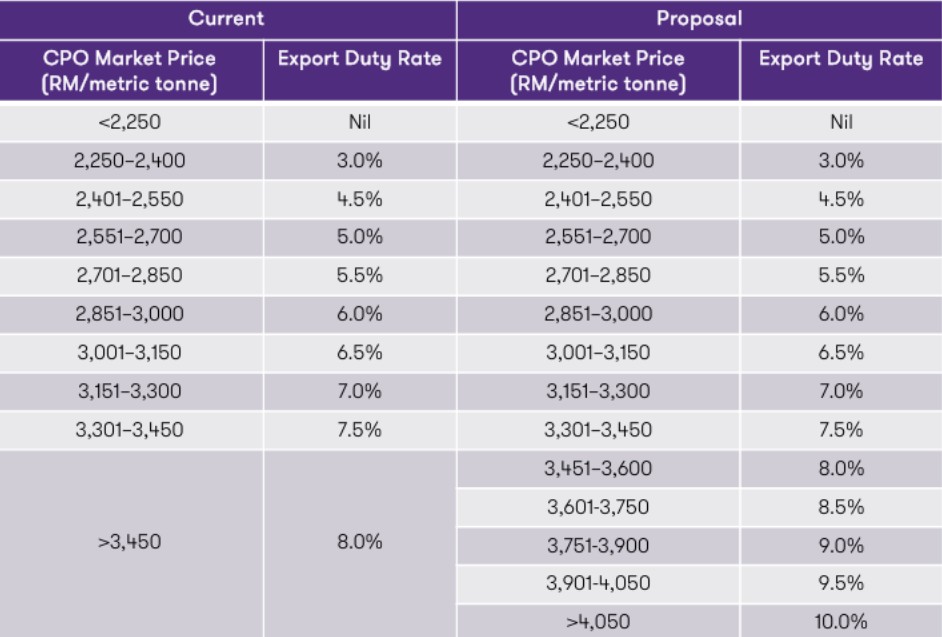

3.REVIEW OF EXPORT DUTY EXEMPTION ON CRUDE PALM OIL

The Customs Duties Order 2022 determines the export duty rate on crude palm oil (CPO) according to market price range of CPO. Effective 1 January 2020, the export duty for CPO was revised through a partial exemption.

It is proposed that the export duty for CPO, taking into accounts the partial exemption be revised to ensure sufficient supply of CPO in the domestic market as well as to encourage midstream and downstream processing activities for the production of value-added products such as biodiesel and oleochemicals as follows:

Effective date : 1 November 2024

4. REVIEW OF SALES TAX RATES AND EXPANSION OF SERVICE TAX SCOPE

Sales tax is imposed on taxable goods manufactured in Malaysia as well as taxable goods imported into Malaysia. Currently, sales tax rates are 5% or 10% depending on the type of goods and there are specific rates for petroleum related products. There are also goods that are exempted from sales tax.

Service tax is imposed on taxable services provided by service providers including digital services provided to consumers in Malaysia by foreign registered persons who are registered with the Royal Malaysian Customs Department. Service tax is also charged on importation of taxable services. The service tax rates are 6%, 8% or a specific rate depending on the type of taxable service provided.

It is proposed that sales tax rates and service tax scope be reviewed to strengthen the fiscal position as follows:

- i. sales tax exemption be maintained on basic food items consumed by the rakyat;

- ii. sales tax be increased on non-essential items such as imported premium goods (e.g. salmon and avocado); and

- iii. scope of service tax be expanded to include new services such as commercial service transactions between businesses (B2B).

- The Government will undertake industry consultation to provide balancing measures as well as finalising the scope and applicable tax rates.

Effective date : 1 May 2025

5. FURNISHING OF RETURNS AND PAYMENT OF SALES TAX AND SERVICE TAX DUE AND PAYABLE

Currently, a registered manufacturer and a service tax registered person whose taxable period has been varied is required to furnish a return not later than 30 days of the month following the end of the varied taxable period.

It is proposed to allow the registered manufacturer and the service tax registered person to furnish a return not later than the last day of the month following the end of the varied taxable period.

Effective date : Upon coming into operation of the Act

Stamp Duty

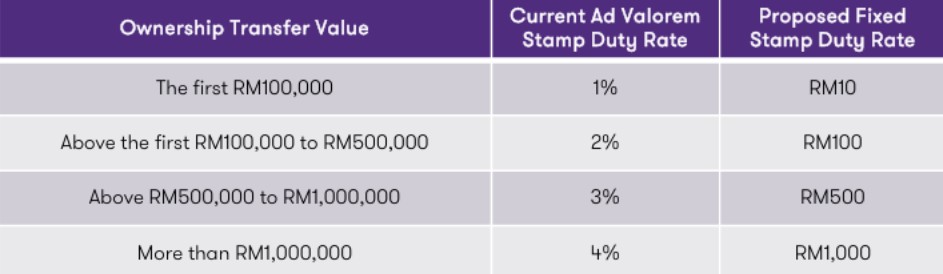

1. STAMP DUTY FOR DEED OF ASSIGNMENT FOR LIFE INSURANCE POLICY AND FAMILY TAKAFUL CERTIFICATE

Currently, stamp duty is charged on deed of assignment for life insurance policy and family takaful certificate pursuant to Item 32(a) of the First Schedule, Stamp Act 1949 at ad valorem rates in the table below.

In order to help reduce the deed of assignment costs and to promote insurance and takaful protection of family members, it is proposed that stamp duty be charged on deed of assignment for life insurance policy and family takaful certificate given by way of love and affection or through a trustee at fixed rates in the table below:

Effective date : Deed of assignment for life insurance policy and family takaful certificate executed from 1 January 2025

2. STAMP DUTY FOR LOAN/FINANCING AGREEMENTS BASED ON SHARIAH PRINCIPLES

Currently, ad valorem stamp duty at a rate of 0.5% is charged on loan/financing agreements for the purchase of goods other than hire purchase based on Shariah principles such as Murabahah and Tawarruq.

In order to streamline the stamp duty treatment on loan/financing agreements for the purchase of goods based on Shariah principles under the First Schedule, Hire Purchase Act 1967, it is proposed that stamp duty be imposed at a fixed rate of RM10 on the loan/financing agreements for the purchase of goods other than hire purchase based on Shariah principles.

Effective date : Loan/financing agreements based on Shariah principles executed from 1 January 2025

3. IMPLEMENTATION OF SELF-ASSESSMENT SYSTEM FOR STAMP DUTY

Currently, stamp duty information is entered into the Stamp Assessment and Payment System (STAMPS) by duty payers and the assessment of stamp duty remains the responsibility of the Inland Revenue Board of Malaysia (IRBM). The duty payers pay stamp duty according to the notice of assessment issued by the IRBM through STAMPS.

In order to ensure the stamping and self-payment system is more efficient and to further enhance compliance, it is proposed that Self-assessment Stamp Duty System (STSDS) be implemented in phases based on the types of instruments/agreements.

STSDS requires duty payers or appointed agents to upload information in STAMPS and undertake self-assessment of the value of stamp duties for the instruments/agreements and subsequently make payments based on the self-assessment within a specified timeframe.

Effective date :

4. STAMP DUTY EXEMPTION ON LOAN/FINANCING AGREEMENTS THROUGH THE INITIAL EXCHANGE OFFERING (IEO) PLATFORM FOR MICRO, SMALL AND MEDIUM ENTERPRISES (MSMEs)

Currently, stamp duty at a rate between 0.05% and 0.5% is charged on loan/financing agreements executed by MSMEs and investors through the IEO platforms pursuant to Item 27 of the First Schedule, Stamp Act 1949.

In order to facilitate the expansion of MSMEs’ access to raising business capital through alternative financing, it is proposed that the stamp duty on loan/financing agreements executed by MSMEs and investors though the IEO platforms registered with the Securities Commission Malaysia be exempted for 2 years.

Effective date : Loan/financing agreements executed from 1 January 2025 to 31 December 2026

5. STAMP DUTY EXEMPTION FOR LOAN/FINANCING AGREEMENTS UNDER MICRO FINANCING SCHEME (MFS)

Currently, stamp duty is exempted for loan/financing agreements between Micro, Small and Medium Enterprises (MSMEs) and financial institutions under the MFS approved by the National Small and Medium Enterprise Development Council for an amount not exceeding RM50,000. This exemption applies to loan/financing agreements executed on or after 1 January 2012.

In order to assist MSMEs in obtaining unsecured loans/financing, it is proposed that stamp duty exemption be given for loan/financing agreements under the MFS for an amount not exceeding RM100,000.

Effective date : Loan/financing agreement under the MFS executed from 1 January 2025

6. STAMP DUTY FOR INSTRUMENT OF CHEQUE

Currently, stamp duty is charged on instrument of cheque pursuant to Item 29 of the First Schedule, Stamp Act 1949 at a fixed rate of RM0.15.

It is proposed stamp duty be increased to RM1 on the instrument of cheque.

Effective date : 1 January 2025

7. STAMP DUTY FOR POWER OR LETTER OF ATTORNEY

Currently, stamp duty is charged on power or letter of attorney pursuant to Item 59 of the First Schedule, Stamp Act 1949 at a fixed rate of RM10.

It is proposed that ad valorem stamp duty be charged on instruments with conveyance features involving consideration while in any other case, stamp duty charged is remained at a fixed rate of RM10.

Effective date : 1 January 2025

8. FINE FOR FRAUD IN RELATION TO DUTY

Currently, fine of RM5,000 is imposed on any person who practices or is concerned in any fraudulent act, contrivance or device not specially provided for by law, with intent to defraud the Government of any duty pursuant to Section 74 of the Stamp Act 1949.

It is proposed that the fine for fraud in relation to duty be imposed at amount of not less than RM1,000 and not more than RM20,000.

Effective date : 1 January 2025

9. STAMP DUTY FOR LEASE OR AGREEMENT FOR LEASE

Currently, ad valorem stamp duty is charged on the lease or agreement for lease pursuant to Item 49(a) of the First Schedule, Stamp Act 1949 at the following rates:

It is proposed stamp duty be charged at the following rates:

Effective date : 1 January 2025

10. NEW MINIMUM DUTY

In order to streamline the minimum stamp duty treatment for all levels, it is proposed that the new minimum duty at the rate of RM10 be imposed on instruments with duty less than RM10. This is not applicable to instruments of cheque and contact notes.

Effective date : 1 January 2025

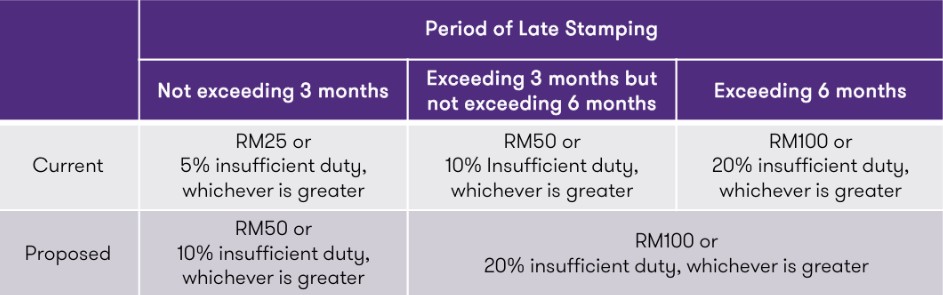

11. PENALTY FOR LATE STAMPING

Currently, the stamp duty penalty is imposed on late stamping pursuant to Section 47A of the Stamp Act 1949 based on the rates below.

It is proposed that stamp duty penalty for late stamping be imposed based on the rates below:

Effective date : 1 January 2025

12. STAMP DUTY FOR EXCHANGE OF PROPERTIES

Currently, ad valorem stamp duty is charged on the principal instrument concerning payment for the difference in sale value of the exchanged properties, while stamp duty at a fixed rate of RM10 is charged on other instruments completing the property.

It is proposed that the ad valorem stamp duty be expanded to include the transfer of property ownership, whether with or without consideration, treated as a sale transfer. Stamp duty at a fixed rate of RM10 will still apply to the following transfers:

- a. Transfers involving Ruler of a State, Government or State Government;

- b. Subdivision of land or partitioning of land where grantor and recipient are original co-owners; and

- c. Property transfers between husband and wife, parent and child, grandparent and grandchild or among siblings.

Effective date : 1 January 2025

Others

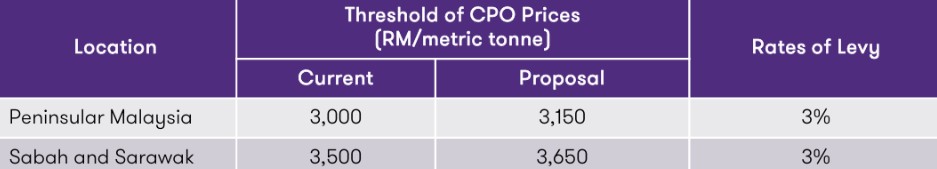

1. REVIEW OF THRESHOLD VALUE FOR WINDFALL PROFIT LEVY

The windfall profit levy is imposed on the production of fresh fruit bunches when the market price of crude palm oil (CPO) exceeds the threshold.

In order to continuously support the sustainability of the palm oil industry, it is proposed that the threshold of the windfall profit levy for Peninsular Malaysia, Sabah and Sarawak be revised as follows:

Effective date : 1 January 2025

2. CONSOLIDATION OF GOVERNMENT AGENCIES

To enhance operational efficiency, government agencies with similar roles have been consolidated. This includes the merging of:

- i. InvestKL Corporation and Malaysian Investment Development Authority (MIDA);

- ii. Razak School of Government (RSOG) and Institut Tadbiran Awam Negara (INTAN);

- iii. Halal Development Corporation (HDC) and Malaysia External Trade Development Corporation (MATRADE); and

- iv. Malaysian Aviation Commission (MAVCOM) and the Civil Aviation Authority of Malaysia (CAAM).

The above mergers will increase the efficiency of the above government agencies to be self sufficient without relying on government fundings.

3. ENVIROMENTAL, SOCIAL AND GOVERNANCE (ESG) BASED INVESTMENT FOR CARBON CAPTURE UTILISATION AND STORAGE (CCUS) ACTIVITIES

It is proposed that tax incentives in the form of investment tax allowance or income tax exemption be introduced for CCUS activities. Further details are expected to be released in due course.

4. NEW INVESTMENT INCENTIVE FRAMEWORK (NIIF)

A New Investment Incentive Framework (NIIF) will be introduced, which focuses on high-value activities as opposed to existing incentives based on specific products. With the implementation of NIIF, the government aims to reduce the economic gap between regions through economic spillover. One of the initiatives is to offer tax incentives at a special rate for investments in 21 economic sectors in states such as Perlis, Kedah, Kelantan, Terengganu, Sabah and Sarawak, resulting in economic spillover.

The framework also includes a strategic investment fund worth RM1 billion aimed at enhancing the capacity of local talent and encouraging high-value activities to be carried out in the country.

The NIFF is expected to be implemented in the 3rd quarter of 2025.

5. CARBON TAX ON IRON, STEEL AND ENERGY INDUSTRIES

In order to encourage the adoption of low-carbon technologies, it is proposed that carbon tax on iron, steel and energy industries be introduced by year 2026. Revenue collected from carbon tax will be used to fund green technology and research programmes.

Further details are expected to be released in due course

6. REVIEW ON IMPLEMENTATION OF GLOBAL MINIMUM TAX

The Government is committed in streamlining the existing tax incentives and introduce alternative non-tax based incentives in order to mitigate the impact of Global Minimum Tax and to maintain Malaysia’s competitiveness as a preferred investment destination.

The Finance Bill 2024 released on 19 November 2024 made changes and clarifications to some definitions and formulas to be aligned with the amendments to the GloBE Model Rules.

Effective date : Upon coming into operation of the Finance (No. 2) Act 2023

7. DEDUCTION FOR SUPPORTING EDUCATIONAL OPPORTUNITIES FOR UNDERPRIVILEGED STUDENTS

To improve the accessibility of education for students from underprivileged families, it is proposed that salary or wages paid to educators by education institutions and organisations approved under Section 44(6) of the Income Tax Act 1967 be treated as expenditure incurred for welfare purposes.

Further details are expected to be released in due course.

8. RELAXATION OF CONDITION IMPOSED ON APPROVED INSTITUTIONS OR ORGANISATIONS

Currently, services or benefits of approved institutions or organisations under Section 44(6) of the Income Tax Act 1967 (ITA) must be targeted to Malaysia citizens regardless of race, religion and heredity, in order for the approved institutions or organisations to enjoy income tax exemption.

To support efforts in raising aid funds under a shared responsibility, the Government proposed to expand the scope of tax exemptions for charitable organisations under Section 44(6) of ITA to include donations to non-citizens who are affected. It is expected that services or benefits of the approved institutions or organisations may be extended to non-Malaysia citizens.

This is in light of the Government’s initiative in bringing in Palestinians requiring medical treatment in Malaysia.

Further details are expected to be released in due course.

9. ACCESS TO TAX IDENTIFICATION NUMBER (TIN)

Currently, only registered taxpayers are allowed to access to TIN. It is proposed that to enable the public to access TIN, such information shall not be considered as confidential.

The Director General shall not be liable for any loss or damage suffered by taxpayers due to error or omission arising from enabling access to TIN to the public. It also prohibits the public to use TIN other than for income tax purposes.

Any abuse of TIN information shall be liable to a fine not exceeding RM4,000 or to imprisonment not exceeding 1 year, or both.

Effective date : 1 January 2025

10. ELECTRONIC SUBMISSION OF AMENDED TAX RETURNS

Currently a company, limited liability partnership, trust body and cooperative society which has furnished its tax return may make amendment to its tax return in a prescribed form on an electronic medium or by way of electronic transmission.

It is proposed that the obligation to furnish the amended tax return in a prescribed form on an electronic medium or by way of electronic transmission be expanded to resident individuals (with or without business income), partnerships, associations and estates.

Effective date : From year of assessment 2025

11. TAX DEDUCTION ON EXPENDITURE ON COMMUNITY PROJECTS

Currently, tax deduction is allowed for expenditure incurred by a person for the following:

- A. provision of services;

- B. public amenities;

- C. contributions to a charity or community project pertaining to education, health, housing, conservation or preservation of environment, enhancement of income of the poor, infrastructure, information and communication technology or maintenance of a building designated as a heritage site by the Commissioner of Heritage under the National Heritage Act 2005, approved by the Minister of Finance; and

- D. specifically for a company only, expenditure incurred on the provision of infrastructure in relation to its business which is available for public use, subject to the prior approval of the Minister of Finance.

To reduce the administrative burden of taxpayer to claim tax deduction for (C) above:

- i. For contributions of up to RM300,000, the contribution needs to be verified and the charity or community project needs to be approved by the relevant government authority

- ii. For contributions of more than RM300,000, the contribution needs to be verified by the relevant government authority, and the charity or community project needs to be approved by the Minister of Finance

As for (D) above:

- i. For expenditure of up to RM300,000, the expenditure and the provision of infrastructure only needs to be verified and approved by the relevant government authority

- ii. For expenditure of more than RM300,000, the expenditure shall be verified by the relevant government authority and the provision of infrastructure shall be approved by the Minister of Finance

Effective date : From 1 April 2025

12. TIME FRAME TO RECTIFY ERRORS OR MISTAKES IN E-INVOICE

Currently, if a person makes an error or mistake in the e-invoice, it can be rectified by issuing a substitute e-invoice within 3 days from the date of issuance of the defective e-invoice.

It is proposed that the timeframe to rectify the error or mistake be amended to 72 hours from the time of issuance of the defective e-invoice.

Effective date : From 1 January 2025

13. DETERMINATION OF ACQUISITION DATE AND PRICE OF RELEVANT COMPANY SHARES FOR CAPITAL GAINS TAX

With effect from 1 January 2024, Capital Gains Tax (“CGT”) applies to the gains or profits accruing to a company, limited liability partnership, trust body or co-operative society arising from:

- i. Disposal of unlisted shares for company incorporated in Malaysia;

- ii. Disposal of shares of a controlled company incorporated outside Malaysia deriving value from real property in Malaysia and/or another controlled company (“relevant company”) under Section 15C of the ITA (hereinafter referred to as “S15C shares”); and

- iii. Disposal of foreign capital asset.

As CGT comes into operation only on 1 January 2024, there was ambiguity as to whether the deemed acquisition date and price of real property company (“RPC”) shares stipulated in the Real Property Gains Tax Act 1976 (“RPGTA”) can be used for S15C shares acquired before 1 January 2024.

Some of the salient points/clarification in the Finance Bill 2024 are as follows:

- CGT applies to the gains or profits arising from the disposal of S15C shares acquired by a company, limited liability partnership, trust body or co-operative society;

- Definition of “another controlled company” and “value of its total tangible asset” is provided / updated;

- A relevant company ceases its relevant company status, where, at any date a relevant company disposes of the real property situated in Malaysia and/or another S15C shares, and with the disposal, the defined value of the real property situated in Malaysia and/or another S15C shares owned by the relevant company has reduced to less than 75% of the value of its total tangible assets;

- The basis of determining the acquisition date and price of S15C shares acquired before 1 January 2024 is deemed aligned with the basis of determining RPC shares under RPGTA;

- For acquisition of S15C shares where the relevant company (previously not a relevant company) becomes a relevant company after a subsequent acquisition, the basis of determining the acquisition date and price is deemed to be equal to the acquisition price determined according to the following formula:

Determination formula

A x C

B

A – the number of S15C disposed by a company, limited liability partnership, trust body or cooperative society

B – the total number of issued S15C shares at the subsequent acquisition date

C – the defined value of real property situated in Malaysia and/or another S15C shares owned by the relevant company at the subsequent acquisition date

Effective date : 1 January 2025

14. GROUNDS OF APPEAL IN A HEARING BY SPECIAL COMMISSIONERS OF INCOME TAX

Currently, the Special Commissioners of Income Tax (SCIT) shall adjourn the hearing for a reasonable period of time upon request by the Director General if the appellant does not give reasonable notice to the Director General in relation to reliance of grounds (other than those stated in the Form Q) and variation of any grounds of appeal.

It is proposed that the appellant may rely on other grounds of appeal (other than those stated in the Form Q) and vary any grounds of appeal if the appellant had provided a written notice in respect of the above to the SCIT and Director General within 6 months from the date the appellant received a notice from the Director General that the Form Q had been forwarded to the SCIT.

Effective date : 1 January 2025

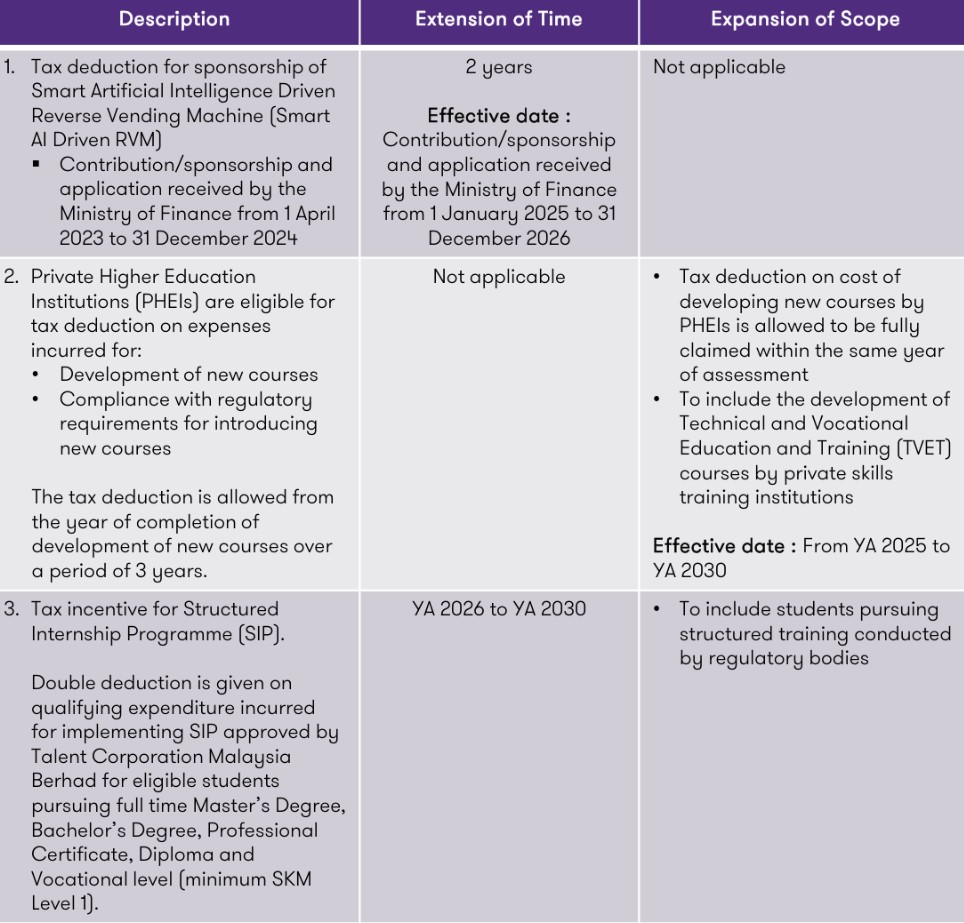

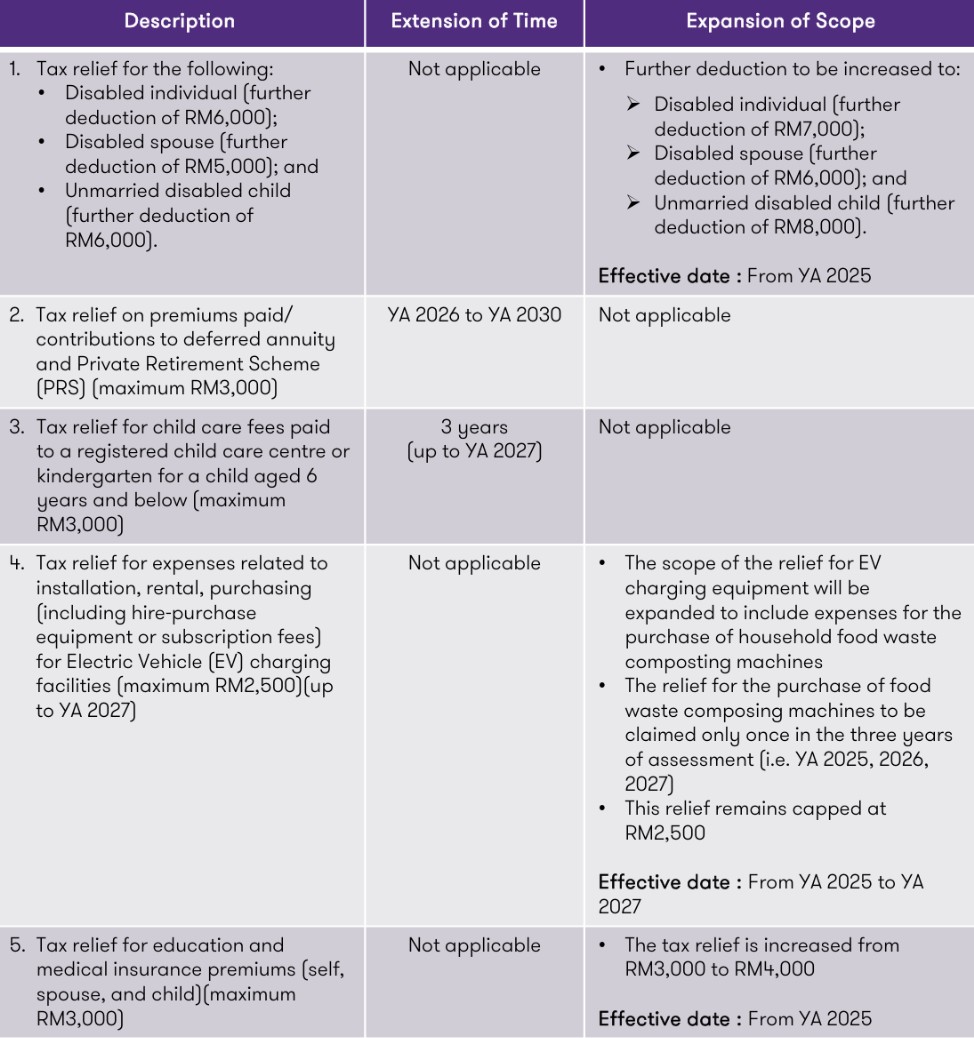

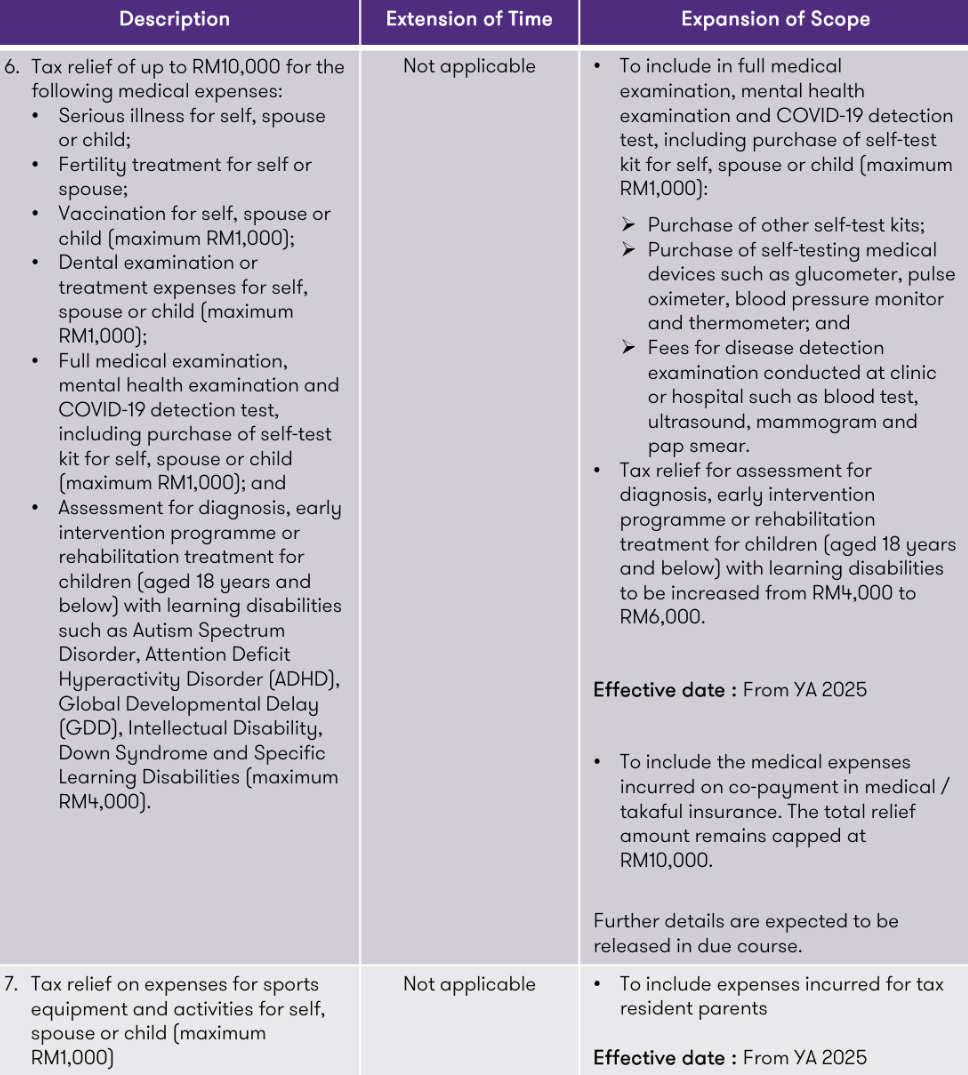

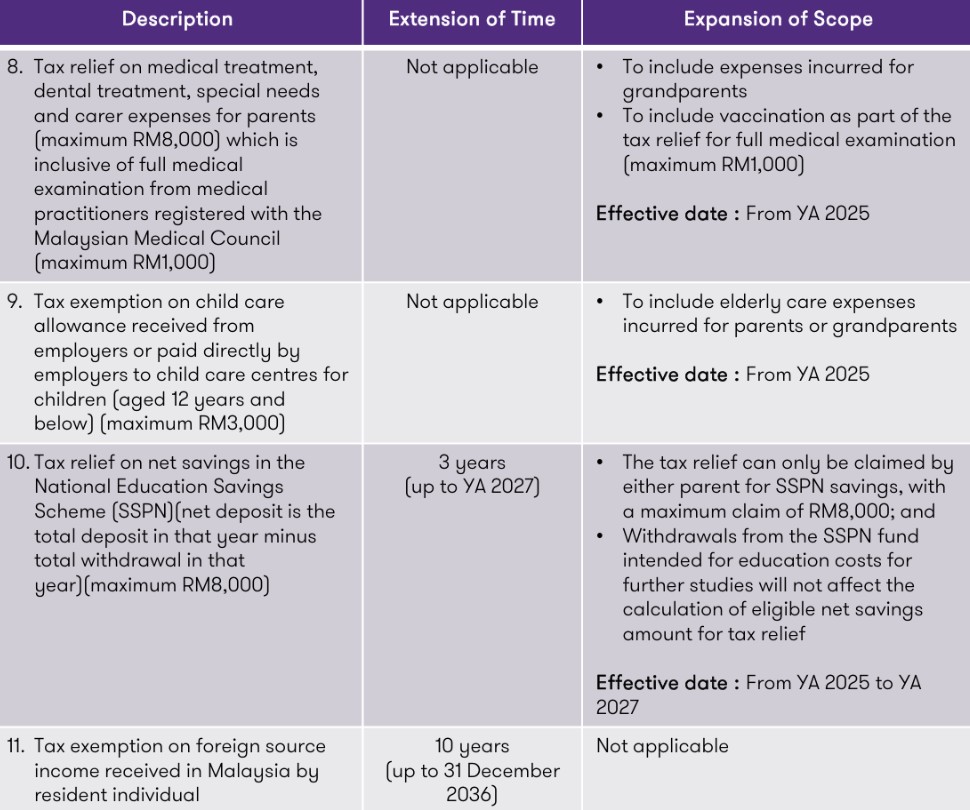

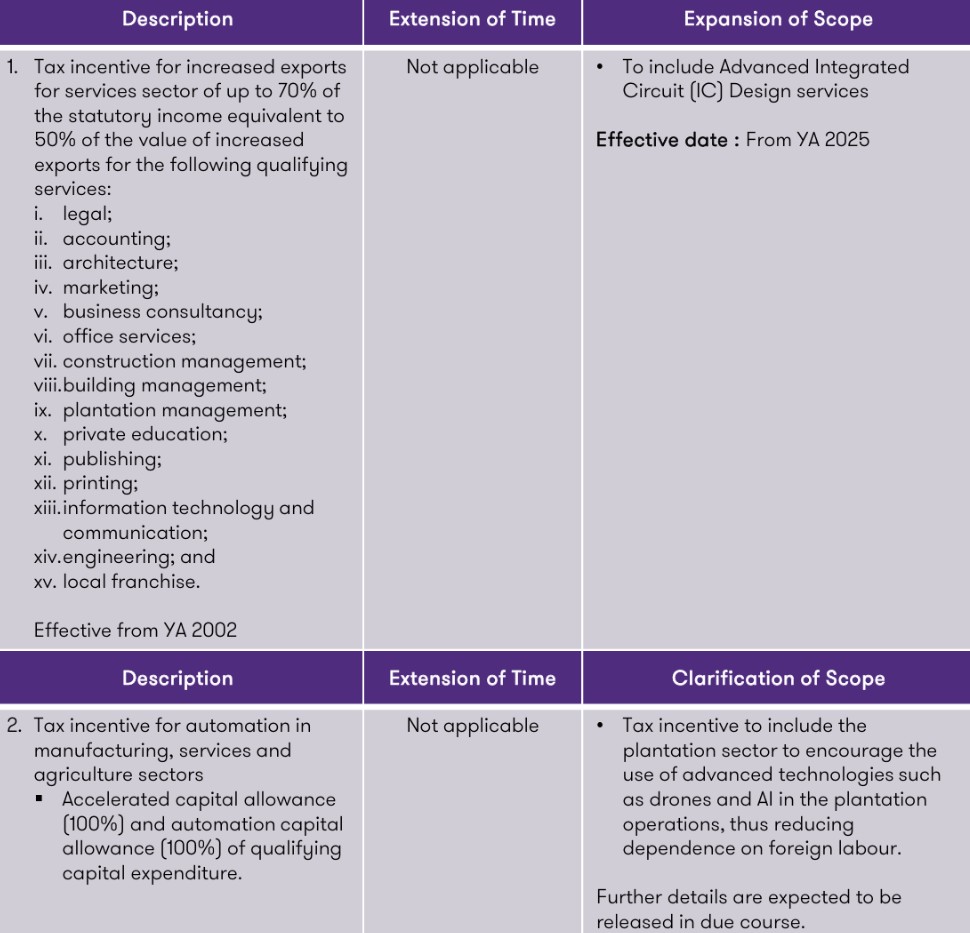

Summary of Extension of Time and Expansion of Scope

INDIVIDUAL TAX

TAX INCENTIVE

CORPORATE TAX