The 2019 Budget, the first budget under the new government will be tabled in the Parliament on 2nd November 2018. The budget has a tall order to meet, balancing the people’s expectations while being fiscally responsible. The budget will focus on trickling down the country’s economic growth to the people while providing proactive economic measures to manage inflation rates. Will we see a tax reform and new taxes in the coming budget? How will the budget impact us, businesses and our country?

Programme

2019 Budget Highlights

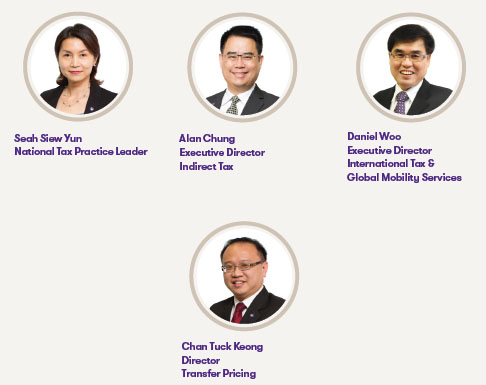

Alan Chung, Executive Director of Indirect Tax

Daniel Woo, Executive Director of International Tax & Global Mobility Services

Common Issues in a Tax Audit

Seah Siew Yun, National Tax Practice Leader

Corporate Tax & Indirect Tax Updates

Alan Chung, Executive Director of Indirect Tax

Daniel Woo, Executive Director of International Tax & Global Mobility Services

Transfer Pricing Audit & Updates

Chan Tuck Keong, Director of Transfer Pricing

Seminar fee

• RM 380 nett per participant (Grant Thornton clients/alumni) or

RM 430 nett per participant (non-clients) inclusive of 6% service tax.

• Fee includes seminar materials, refreshments and lunch.

• Certificate of attendance will be given to all participants for registration of CPE/CPD points with the relevant professional bodies.

Registration by 9 November 2018.

Ms Chong Siew Zi / Ms Rihana Binti Mohamed

Grant Thornton Malaysia (AF:0737)

Suite 28.01

28th Floor, Menara Zurich

No 15, Jalan Dato’ Abdullah Tahir

80300 Johor Bahru

T (607) 332 8335

F (607) 332 2268

E siewzi.chong@my.gt.com / rihana.mohamed@my.gt.com

- Orchid 3 Hall, Thistle Johor Bahru Hotel, Johor