-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

We have adopted Grant Thornton International's Horizon audit approach and Voyager software, a revolutionary paperless audit designed to achieve a consistent standard of audit service.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Our local experts

Our local experts

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

-

M&A, Restructuring & Forensics

Forensic

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

New research from Grant Thornton reveals that inflation is a key concern for businesses globally and in Malaysia. The research coincides with the release of Grant Thornton’s “Essential action plan for managing in inflationary times” and highlights that around three-quarters of businesses globally and in Malaysia have not taken the appropriate actions.

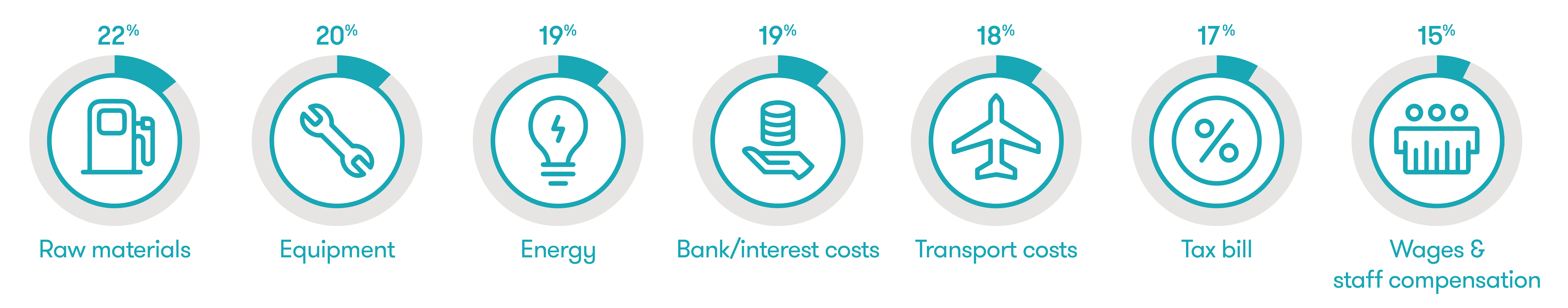

Percentage cost increase over 12 months. Source IBR Grant Thornton

The urgent need to act is plain for all to see. The research shows that key input costs of businesses in Malaysia are up nearly a fifth (19% on average) led by raw materials (up 22%), equipment (up 20%) and energy (up 19%). Bank/interest costs meanwhile have surged 19% and tax bills have risen by 17%.

Dato N.K. Jasani, Country Managing Partner of Grant Thornton Malaysia PLT says:

“The sentiment about inflation shifted rapidly at the start of 2022 from being a transitory, predominantly supply chain and release of pent-up demand issue, to one that has taken a firmer grip. The effects of inflation are strongly apparent and is a contributing factor to higher business costs.

“To cope with inflation, businesses are applying different pricing strategies. The research shows that 82% of Malaysian businesses have been increasing prices in response to inflation. 37% of businesses have increased prices in line with inflation, while 33% have increased prices above inflation. Only 12% of businesses have increased prices below their costs.

“To avoid losing customers, some businesses chose to absorb part if not majority of the cost, causing a dent in their profit margins. Businesses are also squeezed hard between rising prices and customer’s unwillingness to pay more and that could result them going out of business when they couldn’t hold the fort any longer.

“If prices still need to be increased, there are multiple factors to weigh up: existing contractual terms, timing of the increase, nature of historic increases, who the increases should apply to, whether you can link the increases to new features and customers’ willingness to pay.”

Companies need to take a range of different actions to deal with inflation and can’t simply price their way out of this problem. Grant Thornton experts have identified seven actions that businesses should be taking now to deal with the threat of inflation – or at least consider taking:

Action 1: Identify and mitigate the risks of inflation for your business

Work across your business to identify where you are most exposed to inflation. Having identified your key risks, draw on the expertise within your business on how best to mitigate them. Review the plan regularly and consider a wider range of outcomes and model these well.

Action 2: Take action to limit external cost increases

Actions here include locking in prices, bulk buying, renegotiating terms with suppliers or changing suppliers. In a high inflation environment these basic countermoves can really make a difference in limiting costs and protecting margins.

This can also impact inventory, working capital, storage space requirements, as well as important profit and tax implications when bulk buying through subsidiaries, which could lead to tax savings in addition to the mitigation of inflation.

Action 3: Outsource more activities to lower costs and ameliorate labour shortages

Outsourcing now offers more compelling benefits than ever for international companies looking to both lower costs and address the skills shortage, with many outsourcing partners having invested heavily in automation and developed new service models.

Businesses should also look at the current design of their processes and explore optimisation opportunities through a range of modern technological tools.

While relocating operations to lower-cost jurisdictions can help manage wage costs and inflation generally there can also be tax considerations will need to consider – especially for value-adding roles like R&D.

Action 4: Improve your understanding of the true cost to serve clients

Customer segmentation provides critical information to help protect profitability by actively managing a business’s customer base. It is important to be clear about what costs are included such as supply chain, sales and marketing and customer success and allocating them appropriately to individual customer segments.

Action 5: Change your pricing strategy so it is more in line with cost increases

The recent price increases have been supported by the particular combination of strong demand and supply shortages. These won’t last forever. Companies need to take a range of different actions to deal with inflation.

There are multiple factors to weigh up: existing contractual terms, timing of the increase, nature of historic increases, who the increases should apply to, whether you can link the increases to new features and customers’ willingness to pay.

How businesses engage with customers around price increases is also really important. Open communication is key, where you explain the pressures and try to work with customers to minimise the issues.

Action 6: Take action to improve capital structure

Companies need to optimise their costs of capital, and also look at scaling up or down the level of working capital to meet their needs. In the short-term, if businesses are healthy and have plenty of cash, then they can consider strategies like bulk buying to beat inflation. If the opposite applies, then they may need to look at sourcing additional capital and managing debt.

Banks will inevitably become more cautious about lending in this environment. Businesses may need to look at other providers and sources of capital and shop around.

Action 7: Take steps to improve internal efficiency and costs, and/or reduce waste

If you can do more with less, and cut down on the wastage, you may be able to offset the higher prices – and lower your environmental impact.

What really drives internal efficiency is technology. Automation, robotics and machine learning can all improve productivity by lowering output costs and allowing companies to deploy human capital more effectively.

Waste reduction is often a benefit of greater efficiency, but also deserves separate consideration. There are eight main types of waste including less obvious areas like underutilisation of skills, unnecessary movement of resources and time spent waiting. Some waste is unavoidable, but most are simply unnoticed or ignored. Addressing it can save businesses a lot of money.

Dato N.K. Jasani said:

“This isn’t a list of everything companies must do, but it is the essential starter actions with maximum impact. What is concerning is the fairly low proportion of companies that are taking the actions needed around inflation. Companies need to be pulling all these levers now.

These steps will help businesses get through this difficult inflationary period, and make them more resilient to any economic slowdowns, which is a real risk in the aftermath of inflation.”

Further enquiries, please contact:

Charmane Koh

Senior Manager, Corporate Affairs

Grant Thornton Malaysia PLT

T: +603 2692 4022

M: +017 3384563